Page 144 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 144

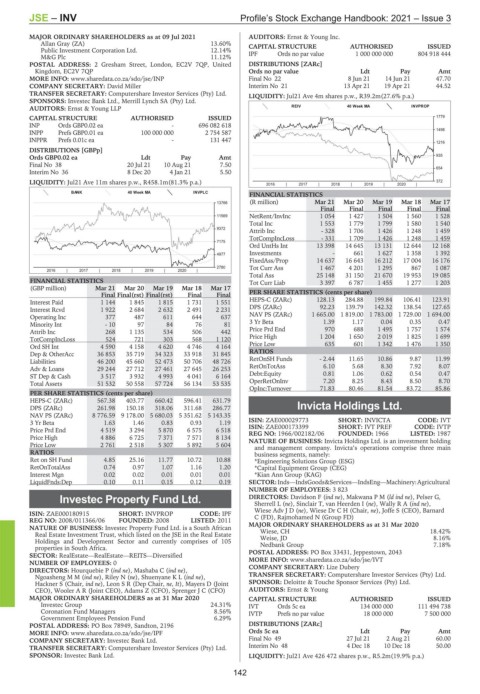

JSE – INV Profile’s Stock Exchange Handbook: 2021 – Issue 3

MAJOR ORDINARY SHAREHOLDERS as at 09 Jul 2021 AUDITORS: Ernst & Young Inc.

Allan Gray (ZA) 13.60% CAPITAL STRUCTURE AUTHORISED ISSUED

Public Investment Corporation Ltd. 12.14%

M&G Plc 11.12% IPF Ords no par value 1 000 000 000 804 918 444

POSTAL ADDRESS: 2 Gresham Street, London, EC2V 7QP, United DISTRIBUTIONS [ZARc]

Kingdom, EC2V 7QP Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/INP Final No 22 8 Jun 21 14 Jun 21 47.70

COMPANY SECRETARY: David Miller Interim No 21 13 Apr 21 19 Apr 21 44.52

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul21 Ave 4m shares p.w., R39.2m(27.6% p.a.)

SPONSORS: Investec Bank Ltd., Merrill Lynch SA (Pty) Ltd.

AUDITORS: Ernst & Young LLP REIV 40 Week MA INVPROP

CAPITAL STRUCTURE AUTHORISED ISSUED 1779

INP Ords GBP0.02 ea - 696 082 618

INPP Prefs GBP0.01 ea 100 000 000 2 754 587 1498

INPPR Prefs 0.01c ea - 131 447

1216

DISTRIBUTIONS [GBPp]

935

Ords GBP0.02 ea Ldt Pay Amt

Final No 38 20 Jul 21 10 Aug 21 7.50

654

Interim No 36 8 Dec 20 4 Jan 21 5.50

LIQUIDITY: Jul21 Ave 11m shares p.w., R458.1m(81.3% p.a.) 372

2016 | 2017 | 2018 | 2019 | 2020 |

BANK 40 Week MA INVPLC

FINANCIAL STATISTICS

13766 (R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Final Final Final Final Final

11569 NetRent/InvInc 1 054 1 427 1 504 1 560 1 528

Total Inc 1 553 1 779 1 799 1 580 1 540

9372

Attrib Inc - 328 1 706 1 426 1 248 1 459

TotCompIncLoss - 331 1 709 1 426 1 248 1 459

7175

Ord UntHs Int 13 398 14 645 13 131 12 644 12 168

4977 Investments - 661 1 627 1 358 1 392

FixedAss/Prop 14 637 16 643 16 212 17 004 16 176

2780 Tot Curr Ass 1 467 4 201 1 295 867 1 087

2016 | 2017 | 2018 | 2019 | 2020 |

Total Ass 25 148 31 150 21 670 19 953 19 085

FINANCIAL STATISTICS Tot Curr Liab 3 397 6 787 1 455 1 277 1 203

(GBP million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Final Final(rst) Final(rst) Final Final PER SHARE STATISTICS (cents per share)

Interest Paid 1 144 1 845 1 815 1 731 1 551 HEPS-C (ZARc) 128.13 284.88 199.84 106.41 123.91

Interest Rcvd 1 922 2 684 2 632 2 491 2 231 DPS (ZARc) 92.23 139.79 142.32 138.54 127.65

Operating Inc 377 487 611 644 637 NAV PS (ZARc) 1 665.00 1 819.00 1 783.00 1 729.00 1 694.00

Minority Int - 10 97 84 76 81 3 Yr Beta 1.39 1.17 0.04 0.35 0.47

Attrib Inc 268 1 135 534 506 442 Price Prd End 970 688 1 495 1 757 1 574

TotCompIncLoss 524 721 303 568 1 120 Price High 1 204 1 650 2 019 1 825 1 699

Ord SH Int 4 590 4 158 4 620 4 746 4 164 Price Low 635 601 1 342 1 476 1 350

Dep & OtherAcc 36 853 35 719 34 323 33 918 31 845 RATIOS

Liabilities 46 200 45 660 52 473 50 706 48 726 RetOnSH Funds - 2.44 11.65 10.86 9.87 11.99

Adv & Loans 29 244 27 712 27 461 27 645 26 253 RetOnTotAss 6.10 5.68 8.30 7.92 8.07

ST Dep & Cash 3 517 3 932 4 993 4 041 6 164 Debt:Equity 0.81 1.06 0.62 0.54 0.47

Total Assets 51 532 50 558 57 724 56 134 53 535 OperRetOnInv 7.20 8.25 8.43 8.50 8.70

OpInc:Turnover 71.83 80.46 81.54 83.72 85.86

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 567.38 403.77 660.42 596.41 631.79

DPS (ZARc) 261.98 150.18 318.06 311.68 286.77 Invicta Holdings Ltd.

NAV PS (ZARc) 8 776.59 9 178.00 5 680.03 5 351.62 5 143.35 INV

3 Yr Beta 1.63 1.46 0.83 0.93 1.19 ISIN: ZAE000029773 SHORT: INVICTA CODE: IVT

CODE: IVTP

Price Prd End 4 519 3 294 5 870 6 575 6 518 ISIN: ZAE000173399 SHORT: IVT PREF LISTED: 1987

FOUNDED: 1966

REG NO: 1966/002182/06

Price High 4 886 6 725 7 371 7 571 8 134 NATURE OF BUSINESS: Invicta Holdings Ltd. is an investment holding

Price Low 2 761 2 518 5 307 5 892 5 604 and management company. Invicta’s operations comprise three main

RATIOS business segments, namely:

Ret on SH Fund 4.85 25.16 11.77 10.72 10.88 *Engineering Solutions Group (ESG)

RetOnTotalAss 0.74 0.97 1.07 1.16 1.20 *Capital Equipment Group (CEG)

Interest Mgn 0.02 0.02 0.01 0.01 0.01 *Kian Ann Group (KAG)

LiquidFnds:Dep 0.10 0.11 0.15 0.12 0.19 SECTOR:Inds—IndsGoods&Services—IndsEng—Machinery:Agricultural

NUMBER OF EMPLOYEES: 3 823

Investec Property Fund Ltd. DIRECTORS: Davidson F (ind ne), MakwanaPM(ld ind ne), Pelser G,

Sherrell L (ne), Sinclair T, van Heerden I (ne), WallyRA(ind ne),

INV Wiese AdvJD(ne), Wiese Dr C H (Chair, ne), Joffe S (CEO), Barnard

ISIN: ZAE000180915 SHORT: INVPROP CODE: IPF

REG NO: 2008/011366/06 FOUNDED: 2008 LISTED: 2011 C (FD), Rajmohamed N (Group FD)

NATURE OF BUSINESS: Investec Property Fund Ltd. is a South African MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Real Estate Investment Trust, which listed on the JSE in the Real Estate Wiese, CH 18.42%

8.16%

Weise, JD

Holdings and Development Sector and currently comprises of 105

properties in South Africa. Nedbank Group 7.18%

SECTOR: RealEstate—RealEstate—REITS—Diversified POSTAL ADDRESS: PO Box 33431, Jeppestown, 2043

MORE INFO: www.sharedata.co.za/sdo/jse/IVT

NUMBER OF EMPLOYEES: 0

DIRECTORS: Hourquebie P (ind ne), Mashaba C (ind ne), COMPANY SECRETARY: Lize Dubery

NgoashengMM(ind ne), Riley N (ne), ShuenyaneKL(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Hackner S (Chair, ind ne), Leon S R (Dep Chair, ne, It), Mayers D (Joint SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

CEO), Wooler A R (Joint CEO), Adams Z (CFO), Sprenger J C (CFO) AUDITORS: Ernst & Young

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

Investec Group 24.31% IVT Ords 5c ea 134 000 000 111 494 738

Coronation Fund Managers 8.56% IVTP Prefs no par value 18 000 000 7 500 000

Government Employees Pension Fund 6.29%

POSTAL ADDRESS: PO Box 78949, Sandton, 2196 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/IPF Ords 5c ea Ldt Pay Amt

COMPANY SECRETARY: Investec Bank Ltd. Final No 49 27 Jul 21 2 Aug 21 60.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 48 4 Dec 18 10 Dec 18 50.00

SPONSOR: Investec Bank Ltd. LIQUIDITY: Jul21 Ave 426 472 shares p.w., R5.2m(19.9% p.a.)

142