Page 138 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 138

JSE – HYP Profile’s Stock Exchange Handbook: 2021 – Issue 3

experience of management; environmental considerations and

geographical location primarily in Sub-Saharan Africa. Hyprop Investments Ltd.

SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh HYP

NUMBER OF EMPLOYEES: 0 ISIN: ZAE000190724 SHORT: HYPROP CODE: HYP

DIRECTORS: BirkettPD(ind ne), HlatshwayoDR(ind ne), Kekana REG NO: 1987/005284/06 FOUNDED: 1987 LISTED: 1988

KN(ind ne), Schaaf H (ind ne, German), Dem M (Interim CEO), NATURE OF BUSINESS: Hyprop, Africa's leading specialist shopping

Mdoda P C (Chair, ind ne) centre Real Estate Investment Trust (REIT), operates an internally

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 managed portfolio of shopping centres in major metropolitan areas across

Government Employees Pension Fund 34.00% South Africa. Hyprop has a growing presence in sub-Saharan Africa,

through a joint venture with Attacq Ltd. and the Atterbury Group.

Eskom Pension and Provident Fund 11.00%

Alexander Forbes Investments 5.00% SECTOR: RealEstate—RealEstate—REITS—Retail

POSTAL ADDRESS: PO Box 784583, Sandton, 2146 NUMBER OF EMPLOYEES: 270

MORE INFO: www.sharedata.co.za/sdo/jse/HUL DIRECTORS: DallamoreAA(ind ne), Ellerine K (ne), Jasper Z (ind ne),

COMPANY SECRETARY: Rilapax (Pty) Ltd. Mandindi N (ind ne), MokgatlhaTV(ind ne), Noussis S (ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Shaw-Taylor S (ind ne), Tipper G R (Chair, ind ne), Nauta A W (CIO),

Wilken M C (CEO), Till B C (CFO)

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: BDO South Africa Inc.

MAJOR ORDINARY SHAREHOLDERS as at 04 Jun 2021

CAPITAL STRUCTURE AUTHORISED ISSUED Government Employees Pension Fund (SA) 12.13%

HUL Ords no par val 1 000 000 000 50 000 020 Ninety One 6.05%

Sanlam 5.32%

DISTRIBUTIONS [ZARc] POSTAL ADDRESS: PO Box 52509, Saxonwold, 2132

Ords no par val Ldt Pay Amt MORE INFO: www.sharedata.co.za/sdo/jse/HYP

Final No 1 8 Jun 21 14 Jun 21 6.00

COMPANY SECRETARY: Statucor (Pty) Ltd.

LIQUIDITY: Jul21 Ave 66 907 shares p.w., R122 567.7(7.0% p.a.) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd.

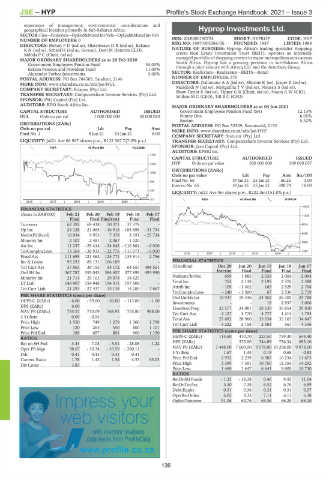

FINA 40 Week MA HULISANI

AUDITORS: KPMG Inc.

1764

CAPITAL STRUCTURE AUTHORISED ISSUED

1432 HYP Ords no par value 500 000 000 309 070 057

DISTRIBUTIONS [ZARc]

1099

Ords no par value Ldt Pay Amt Scr/100

Final No 66 19 Jan 21 25 Jan 21 66.26 3.00

766

Interim No 65 19 Jan 21 25 Jan 21 308.74 16.00

434

LIQUIDITY: Jul21 Ave 9m shares p.w., R222.0m(151.0% p.a.)

101 REIV 40 Week MA HYPROP

2016 | 2017 | 2018 | 2019 | 2020 |

14045

FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 11529

Final Final Final(rst) Final Final

Turnover 62 392 69 438 50 371 37 378 - 9014

Op Inc 24 128 - 21 065 - 16 918 - 104 698 - 31 734

6498

NetIntPd(Rcvd) 10 834 9 953 7 378 2 191 - 25 724

Minority Int 2 107 2 481 2 067 1 020 -

3983

Att Inc 11 257 - 29 414 - 24 842 - 116 864 - 6 010

TotCompIncLoss 13 364 - 26 933 - 22 776 - 115 071 - 6 010 1467

2016 | 2017 | 2018 | 2019 | 2020 |

Fixed Ass 111 695 121 462 125 771 133 914 2 756

Inv & Loans 95 293 89 131 106 189 - - FINANCIAL STATISTICS

Tot Curr Ass 37 863 39 155 54 172 64 657 498 551 (R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Ord SH Int 367 787 355 043 384 457 377 899 493 990 Interim Final Final Final Final

Minority Int 21 714 25 103 29 078 34 625 - NetRent/InvInc 659 1 885 2 039 2 064 2 094

LT Liab 146 907 154 948 154 311 157 506 - Total Inc 762 2 138 2 195 2 376 2 388

Tot Curr Liab 21 293 27 437 35 138 14 285 7 667 Attrib Inc - 109 - 3 402 165 2 529 2 768

TotCompIncLoss - 240 - 3 500 67 2 536 2 719

PER SHARE STATISTICS (cents per share) Ord UntHs Int 18 937 19 346 24 452 26 305 24 788

HEPS-C (ZARc) - 6.00 - 59.00 - 50.00 - 113.00 - 1.00 Investments - - 19 2 937 3 006

DPS (ZARc) 6.00 - - - - FixedAss/Prop 22 577 24 081 28 639 30 854 29 830

NAV PS (ZARc) 735.57 710.09 768.91 755.80 988.00

Tot Curr Ass 4 127 3 770 4 777 1 214 1 793

3 Yr Beta 0.09 - 0.54 - - - Total Ass 27 682 28 960 33 654 35 165 34 647

Price High 1 550 749 1 279 1 300 1 799 Tot Curr Liab 3 222 5 158 2 583 567 4 336

Price Low 120 263 550 800 1 101

Price Prd End 189 697 801 900 1 150 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 114.60 410.70 223.50 759.30 644.40

DPS (ZARc) - 375.00 744.89 756.54 695.10

Ret on SH Fnd 3.43 - 7.08 - 5.51 - 28.08 - 1.22

Oper Pft Mgn 38.67 - 30.34 - 33.59 - 280.11 - NAV PS (ZARc) 7 448.00 7 609.00 9 578.00 10 298.00 9 978.00

D:E 0.41 0.45 0.41 0.41 - 3 Yr Beta 1.67 1.45 0.19 0.68 0.83

Current Ratio 1.78 1.43 1.54 4.53 65.03 Price Prd End 2 952 2 239 6 987 10 234 11 675

Div Cover 3.83 - - - - Price High 3 399 7 391 10 750 12 354 14 292

Price Low 1 460 1 447 6 641 9 800 10 730

RATIOS

RetOnSH Funds - 1.23 - 18.28 0.46 9.55 11.04

RetOnTotAss 5.50 7.38 6.52 6.76 6.89

Debt:Equity 0.31 0.36 0.31 0.31 0.37

6.11

6.38

8.33

7.11

6.02

Impress your OperRetOnInv 51.06 60.76 63.36 66.28 66.10

OpInc:Turnover

web visitors

with investor relations

data feeds from ProfileData

www.profile.co.za

136