Page 126 - 2021 Issue 2

P. 126

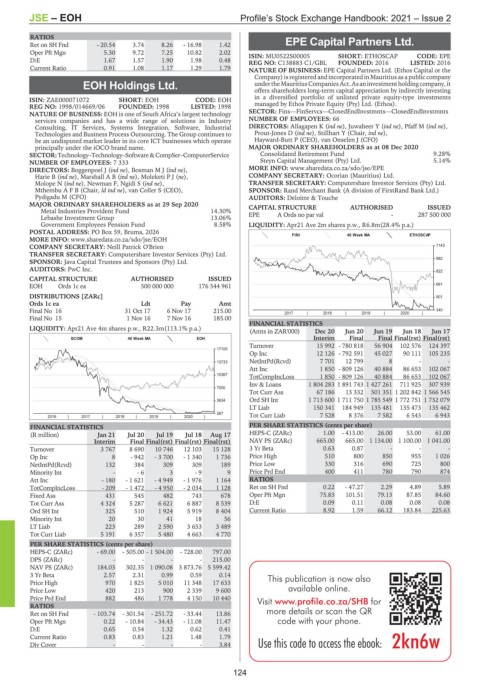

JSE – EOH Profile’s Stock Exchange Handbook: 2021 – Issue 2

RATIOS

Ret on SH Fnd - 20.54 3.74 8.26 - 16.98 1.42 EPE Capital Partners Ltd.

Oper Pft Mgn 5.30 9.72 7.25 10.82 2.02 ISIN: MU0522S00005 SHORT: ETHOSCAP CODE: EPE

EPE

D:E 1.67 1.57 1.90 1.98 0.48 REG NO: C138883 C1/GBL FOUNDED: 2016 LISTED: 2016

Current Ratio 0.91 1.08 1.17 1.29 1.79

NATURE OF BUSINESS: EPE Capital Partners Ltd. (Ethos Capital or the

Company) is registered and incorporated in Mauritius as a public company

EOH Holdings Ltd. undertheMauritiusCompaniesAct.Asaninvestmentholdingcompany,it

offers shareholders long-term capital appreciation by indirectly investing

EOH in a diversified portfolio of unlisted private equity-type investments

ISIN: ZAE000071072 SHORT: EOH CODE: EOH

REG NO: 1998/014669/06 FOUNDED: 1998 LISTED: 1998 managed by Ethos Private Equity (Pty) Ltd. (Ethos).

NATURE OF BUSINESS: EOH is one of South Africa’s largest technology SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

services companies and has a wide range of solutions in Industry NUMBER OF EMPLOYEES: 66

Consulting, IT Services, Systems Integration, Software, Industrial DIRECTORS: Allagapen K (ind ne), Juwaheer Y (ind ne), Pfaff M (ind ne),

Technologies and Business Process Outsourcing. The Group continues to Prout-Jones D (ind ne), Stillhart Y (Chair, ind ne),

be an undisputed market leader in its core ICT businesses which operate Hayward-Butt P (CEO), van Onselen J (CFO)

principally under the iOCO brand name. MAJOR ORDINARY SHAREHOLDERS as at 08 Dec 2020

SECTOR:Technology–Technology–Software&CompSer–ComputerService Consolidated Retirement Fund 9.28%

NUMBER OF EMPLOYEES: 7 333 Steyn Capital Management (Pty) Ltd. 5.14%

DIRECTORS: Boggenpoel J (ind ne), BosmanMJ(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/EPE

Harie B (ind ne), MarshallAB(ind ne), MoleketiPJ(ne), COMPANY SECRETARY: Ocorian (Mauritius) Ltd.

Molope N (ind ne), Newman F, Ngidi S (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MthembuAFB (Chair, ld ind ne), van Coller S (CEO), SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Pydigadu M (CFO) AUDITORS: Deloitte & Touche

MAJOR ORDINARY SHAREHOLDERS as at 29 Sep 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

Metal Industries Provident Fund 14.30%

Lebashe Investment Group 13.06% EPE A Ords no par val - 287 500 000

Government Employees Pension Fund 8.58% LIQUIDITY: Apr21 Ave 2m shares p.w., R6.8m(28.4% p.a.)

POSTAL ADDRESS: PO Box 59, Bruma, 2026

FINI 40 Week MA ETHOSCAP

MORE INFO: www.sharedata.co.za/sdo/jse/EOH

COMPANY SECRETARY: Neill Patrick O'Brien 1143

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

982

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

AUDITORS: PwC Inc. 822

CAPITAL STRUCTURE AUTHORISED ISSUED

EOH Ords 1c ea 500 000 000 176 544 961 661

DISTRIBUTIONS [ZARc] 501

Ords 1c ea Ldt Pay Amt

Final No 16 31 Oct 17 6 Nov 17 215.00 2017 | 2018 | 2019 | 2020 | 340

Final No 15 1 Nov 16 7 Nov 16 185.00

FINANCIAL STATISTICS

LIQUIDITY: Apr21 Ave 4m shares p.w., R22.3m(113.1% p.a.)

(Amts in ZAR'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

SCOM 40 Week MA EOH Interim Final Final Final(rst) Final(rst)

Turnover 15 992 - 780 818 56 904 102 576 124 397

17100

Op Inc 12 126 - 792 591 45 027 90 111 105 235

13733 NetIntPd(Rcvd) 7 701 12 799 8 - -

Att Inc 1 850 - 809 126 40 884 86 653 102 067

10367 TotCompIncLoss 1 850 - 809 126 40 884 86 653 102 067

Inv & Loans 1 804 283 1 891 743 1 427 261 711 925 307 939

7000

Tot Curr Ass 67 186 13 332 501 351 1 202 842 1 566 545

3634 Ord SH Int 1 713 600 1 711 750 1 785 549 1 772 751 1 732 079

LT Liab 150 341 184 949 135 481 135 473 135 462

267 Tot Curr Liab 7 528 8 376 7 582 6 543 6 943

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(R million) Jan 21 Jul 20 Jul 19 Jul 18 Aug 17 HEPS-C (ZARc) 1.00 - 413.00 26.00 53.00 61.00

Interim Final Final(rst) Final(rst) Final(rst) NAV PS (ZARc) 665.00 665.00 1 134.00 1 100.00 1 041.00

Turnover 3 767 8 690 10 746 12 103 15 128 3 Yr Beta 0.63 0.87 - - -

Op Inc 8 - 942 - 3 700 - 1 340 1 736 Price High 510 800 850 955 1 026

NetIntPd(Rcvd) 132 384 309 309 189 Price Low 330 316 690 725 800

Minority Int - - 6 3 - 9 9 Price Prd End 400 411 780 790 874

Att Inc - 180 - 1 621 - 4 949 - 1 976 1 164 RATIOS

TotCompIncLoss - 209 - 1 472 - 4 950 - 2 034 1 128 Ret on SH Fnd 0.22 - 47.27 2.29 4.89 5.89

Fixed Ass 431 545 482 743 678 Oper Pft Mgn 75.83 101.51 79.13 87.85 84.60

Tot Curr Ass 4 324 5 287 6 621 6 887 8 539 D:E 0.09 0.11 0.08 0.08 0.08

Ord SH Int 325 510 1 924 5 919 8 404 Current Ratio 8.92 1.59 66.12 183.84 225.63

Minority Int 20 30 41 18 56

LT Liab 223 289 2 590 3 653 3 489

Tot Curr Liab 5 191 6 357 5 480 4 663 4 770

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 69.00 - 505.00 - 1 504.00 - 728.00 797.00

DPS (ZARc) - - - - 215.00

NAV PS (ZARc) 184.03 302.35 1 090.08 3 873.76 5 599.42

3 Yr Beta 2.57 2.31 0.99 0.59 0.14 This publication is now also

Price High 970 1 825 5 010 11 348 17 633

Price Low 420 213 900 2 339 9 600 available online.

Price Prd End 882 486 1 778 4 150 10 440 Visit www.profile.co.za/SHB for

RATIOS

Ret on SH Fnd - 103.74 - 301.54 - 251.72 - 33.44 13.86 more details or scan the QR

Oper Pft Mgn 0.22 - 10.84 - 34.43 - 11.08 11.47 code with your phone.

D:E 0.65 0.54 1.32 0.62 0.41

Current Ratio 0.83 0.83 1.21 1.48 1.79

Div Cover - - - - 3.84 Usethiscodetoaccess theebook:

124