Page 125 - 2021 Issue 2

P. 125

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – ENX

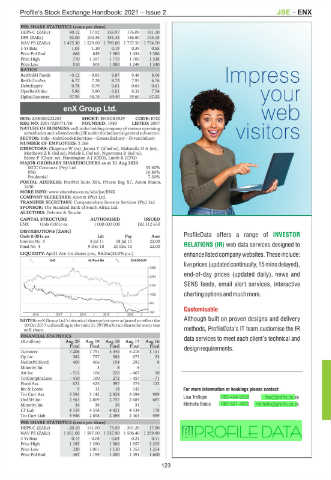

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 80.12 17.92 158.97 176.09 101.10

DPS (ZARc) 52.00 104.36 151.34 146.80 143.18

NAV PS (ZARc) 1 475.30 1 529.60 1 790.80 1 757.50 1 734.70

3 Yr Beta 1.03 1.10 0.19 0.39 0.55

Price Prd End 666 649 1 380 1 434 1 386

Price High 770 1 397 1 719 1 700 1 538

Price Low 510 505 1 000 1 249 1 330

RATIOS

RetOnSH Funds - 0.12 - 9.83 9.87 9.46 8.06

RetOnTotAss 6.77 7.38 8.73 7.93 6.76

Debt:Equity 0.78 0.79 0.61 0.64 0.61

OperRetOnInv 5.86 5.80 6.61 8.32 7.54

OpInc:Turnover 47.95 48.78 54.40 59.60 57.23

enX Group Ltd.

ENX

ISIN: ZAE000222253 SHORT: ENXGROUP CODE: ENX

REG NO: 2001/029771/06 FOUNDED: 1980 LISTED: 2007

NATURE OF BUSINESS: enX is the holding company of various operating

subsidiariesandislistedontheJSEundertheIndustrialgeneralsub-sector.

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

NUMBER OF EMPLOYEES: 2 268

DIRECTORS: Chapman W (ne), Jarana V (ld ind ne), MabandlaOA(ne),

MatthewsZK(ind ne), Molefe L (ind ne), Ngonyama B (ind ne),

Baloyi P (Chair, ne), Hannington A J (CEO), Lumb R (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

MCC Contracts (Pty) Ltd. 33.60%

PSG 10.80%

Prudential 7.30%

POSTAL ADDRESS: PostNet Suite X86, Private Bag X7, Aston Manor,

1630

MORE INFO: www.sharedata.co.za/sdo/jse/ENX

COMPANY SECRETARY: Acorim (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: The Standard Bank of South Africa Ltd.

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED

ENX Ords 0.001c ea 1 000 000 000 182 312 650

DISTRIBUTIONS [ZARc]

Ords 0.001c ea Ldt Pay Amt

Interim No 5 8 Jul 11 18 Jul 11 22.00

Final No 4 9 Dec 10 20 Dec 10 22.00

LIQUIDITY: Apr21 Ave 1m shares p.w., R6.2m(38.0% p.a.)

IIND 40 Week MA ENXGROUP

3355

2754

2153

1552

951

350

2016 | 2017 | 2018 | 2019 | 2020 |

NOTES: enX Group Ltd.'s historical share prices were adjusted to reflect the

10 Oct 2017 unbundling in the ratio 21.39799 eXtract shares for every one

enX share.

FINANCIAL STATISTICS

(R million) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16

Final Final Final Final Final

Turnover 7 206 7 791 5 345 6 218 1 151

Op Inc 382 757 388 673 23

NetIntPd(Rcvd) 409 406 194 292 8

Minority Int - 3 5 6 -

Att Inc - 512 106 226 - 467 10

TotCompIncLoss - 410 100 272 - 457 - 71

Fixed Ass 621 425 397 374 122

Inv & Loans 9 13 18 143 -

Tot Curr Ass 3 593 3 142 2 928 3 094 999

Ord SH Int 2 463 2 869 2 757 2 684 687

Minority Int 34 36 36 31 -

LT Liab 4 159 4 558 4 421 4 534 178

Tot Curr Liab 3 956 2 898 2 496 2 401 559

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 20.10 141.00 73.50 - 301.20 17.90

NAV PS (ZARc) 1 361.00 1 597.00 1 537.90 1 506.40 1 259.90

3 Yr Beta 0.14 - 0.08 - 0.04 0.21 0.11

Price High 1 185 1 350 1 566 1 957 2 205

Price Low 320 1 001 1 130 1 352 1 254

Price Prd End 467 1 199 1 250 1 491 1 600

123