Page 127 - 2021 Issue 2

P. 127

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – EPP

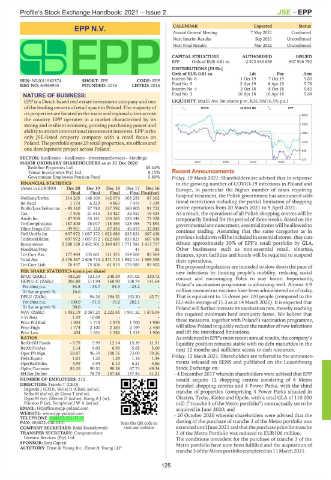

EPP N.V. CALENDAR Expected Status

Annual General Meeting 7 May 2021 Confirmed

EPP

Next Interim Results Sep 2021 Unconfirmed

Next Final Results Mar 2022 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EPP Ords of EUR 0.81 ea 2 572 645 659 907 946 792

DISTRIBUTIONS [EURc]

Ords of EUR 0.81 ea Ldt Pay Amt

Interim No 6 1 Oct 19 7 Oct 19 5.80

ISIN: NL0011983374 SHORT: EPP CODE: EPP

REG NO: 64965945 FOUNDED: 2016 LISTED: 2016 Final No 5 2 Apr 19 8 Apr 19 5.78

Interim No 4 2 Oct 18 8 Oct 18 5.82

NATURE OF BUSINESS: Final No 3 10 Apr 18 16 Apr 18 5.68

EPP is a Dutch based real estate investment company and one LIQUIDITY: Mar21 Ave 3m shares p.w., R26.7m(16.5% p.a.)

of the leading owners of retail space in Poland. The majority of REDS 40 Week MA EPP

its properties are located in the main and regional cities across 2822

the country. EPP operates in a market characterised by its

strong and resilient economy, growing purchasing power and 2353

ability to attract international investment interests. EPP is the

1884

only JSE-listed property company with a retail focus on

Poland.The portfoliospans 29retailproperties, six officesand 1415

one development project across Poland.

946

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 2017 | 2018 | 2019 | 2020 | 477

Redefine Properties Ltd. 45.44%

Tensai Investments Pty) Ltd. 8.15% Recent Announcements

Government Employees Pension Fund 5.89% Friday, 19 March 2021: Shareholders are advised that in response

FINANCIAL STATISTICS to the growing number of COVID-19 infections in Poland and

(Amts in EUR’000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Europe, in particular the higher number of cases requiring

Final Final Final Final Final(rst)

NetRent/InvInc 114 205 148 100 142 674 103 255 67 302 hospital treatment, the Polish government has announced addi-

Int Recd 1 174 6 229 4 865 7 419 7 339 tional restrictions including the partial limitation of shopping

Profit/Loss before tax - 95 310 87 780 137 592 160 905 91 752 centre operations from 20 March 2021 to 9 April 2021.

Tax - 7 405 21 615 13 427 32 557 19 424 As a result, the operations of all Polish shopping centres will be

Attrib Inc - 87 905 65 181 124 165 128 348 72 328 temporarily limited for the period of three weeks. Based on the

TotCompIncLoss - 187 800 76 047 118 356 128 498 71 894 governmentalannouncement,essentialstoreswillbeallowedto

Hline Erngs-CO 99 961 61 120 87 454 46 053 32 045 continue trading. Assuming that the same categories as in

Ord UntHs Int 897 972 1 087 372 1 022 688 833 821 607 438

TotStockHldInt 897 972 1 087 372 1 022 688 833 821 607 438 previous lockdown will be included in essential stores, they con-

Investments 2 288 168 2 492 501 2 340 435 1 771 581 1 413 717 stitute approximately 30% of EPP’s retail portfolio by GLA.

FixedAss/Prop - - - 47 85 Other businesses such as non-essential retail, cinemas,

Tot Curr Ass 177 484 105 661 111 355 154 569 85 564 theatres, sport facilities and hotels will be required to suspend

Total Ass 2 476 367 2 606 715 2 471 715 1 952 114 1 509 398 their operations.

Tot Curr Liab 76 437 75 506 61 815 176 583 83 502

The proposed regulations are intended to slow down the pace of

PER SHARE STATISTICS (cents per share) new infections by limiting people’s mobility, reducing social

EPLU (ZARc) - 182.26 121.33 240.39 301.02 320.72 contact and encouraging Poles to stay home. Importantly,

HEPLU-C (ZARc) 206.88 111.94 168.90 108.74 141.64

Pct chng p.a. 84.8 - 33.7 55.3 - 23.2 - Poland’s vaccination programme is advancing well. Almost 4.9

Tr 5yr av grwth % 16.6 - - - - million coronavirus vaccines have been administered as of today.

DPLU (ZARc) - 94.36 194.51 163.20 42.71 That is equivalent to 13 doses per 100 people (compared to the

Pct chng p.a. - 100.0 - 51.5 19.2 282.1 - EU-wide average of 11.3 as at 14 March 2021). It is expected that

Tr 5yr av grwth % 30.0 - - - - Poland will further increase its vaccination rate, thereby reaching

NAV (ZARc) 1 952.19 2 067.20 2 223.45 1 961.52 1 675.04 the required minimum herd immunity faster. We believe that

3 Yr Beta 1.59 - 0.08 - - -

Price Prd End 1 035 1 715 1 875 1 700 1 950 these measures, together with Poland’s vaccination programme,

Price High 1 774 2 100 2 183 2 199 2 450 will allow Poland to quickly reduce the number of new infections

Price Low 434 1 631 1 382 1 315 1 900 and lift the introduced limitations.

RATIOS As evidenced in EPP’s most recent annual results, the company’s

RetOnSH Funds - 9.79 5.99 12.14 15.39 11.91 liquidity position remains stable with no debt maturities in the

RetOnTotAss 3.14 6.05 6.93 5.68 5.00 next 12 months and sufficient access to cash resources.

Oper Pft Mgn 58.07 96.39 108.76 73.09 79.26

Debt:Equity 1.61 1.26 1.29 1.16 1.34 Friday, 12 March 2021: Shareholders are referred to the announce-

OperRetOnInv 4.99 5.94 6.10 6.21 4.86 ments released on SENS and published on the Luxembourg

OpInc:Turnover 85.35 90.51 90.58 67.73 69.34 Stock Exchange on:

SH Ret On Inv - 78.79 157.86 137.54 41.21 - 4 December 2017 wherein shareholders were advised that EPP

NUMBER OF EMPLOYEES: 212 would acquire 12 shopping centres consisting of 8 Metro

DIRECTORS: Trzoslo T (CEO), branded shopping centres and 4 Power Parks, with the third

Baginski J (CFO), Weisz R (Chair, ind ne), tranche of properties (comprising 4 Power Parks situated in

Belka M (ind ne), de Groot T (ind ne),

Dyjas M (ne), Ellerine D (ind ne), Konig AJ(ne), Olsztyn, Tychy, Kielce and Opole, with a total GLA of 110 000

Prinsloo P (ne), Templeton J W A (ind ne) m2) (“tranche 3 of the Metro portfolio”) contractually set to be

EMAIL: HQoffice@epp-poland.com acquired in June 2020; and

WEBSITE: www.epp-poland.com - 20 October 2020 wherein shareholders were advised that the

TELEPHONE: 004822-221-7110

FAX: 004822-430-0301 Scan the QR code to closing of the purchase of tranche 3 of the Metro portfolio was

COMPANY SECRETARY: Rafal Kwiatkowski visit our website extended until June 2021 andthat the purchase price fortranche

TRANSFER SECRETARY: Computershare 3 of the Metro Portfolio was reduced to EUR106 million.

Investor Services (Pty) Ltd. The conditions precedent for the purchase of tranche 3 of the

SPONSOR: Java Capital Metro portfolio have now been fulfilled and the acquisition of

AUDITORS: Ernst & Young Inc., Ernst & Young LLP

tranche3oftheMetroportfoliocompletedon11March2021.

125