Page 120 - 2021 Issue 2

P. 120

JSE – DEN Profile’s Stock Exchange Handbook: 2021 – Issue 2

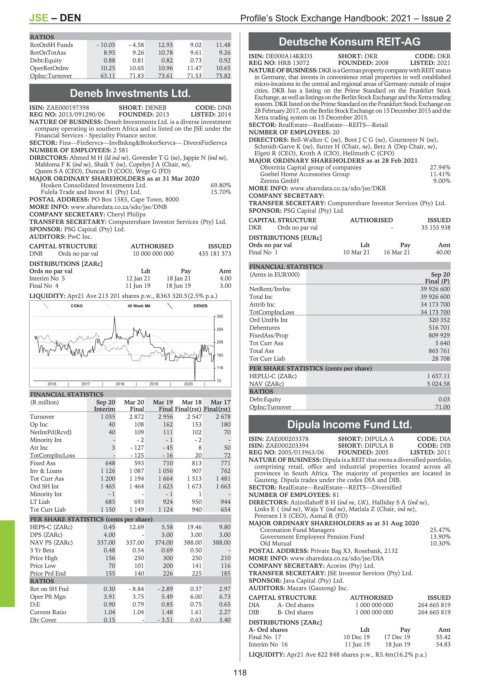

RATIOS

RetOnSH Funds - 10.05 - 4.58 12.93 9.02 11.48 Deutsche Konsum REIT-AG

DEU

RetOnTotAss 8.95 9.26 10.78 9.61 9.26 ISIN: DE000A14KRD3 SHORT: DKR CODE: DKR

Debt:Equity 0.88 0.81 0.82 0.73 0.92 REG NO: HRB 13072 FOUNDED: 2008 LISTED: 2021

OperRetOnInv 10.25 10.65 10.96 11.47 10.65 NATUREOFBUSINESS:DKRisaGermanpropertycompanywithREITstatus

OpInc:Turnover 63.11 71.83 73.61 71.53 75.82 in Germany, that invests in convenience retail properties in well established

micro-locations in the central and regional areas of Germany outside of major

Deneb Investments Ltd. cities. DKR has a listing on the Prime Standard on the Frankfurt Stock

Exchange,aswellaslistingsontheBerlinStockExchangeandtheXetratrading

DEN system. DKR listed onthe Prime Standard onthe Frankfurt Stock Exchange on

ISIN: ZAE000197398 SHORT: DENEB CODE: DNB 28 February 2017,ontheBerlinStock Exchangeon15 December2015 andthe

REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014 Xetra trading system on 15 December 2015.

NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment SECTOR: RealEstate—RealEstate—REITS—Retail

company operating in southern Africa and is listed on the JSE under the

Financial Services - Speciality Finance sector. NUMBER OF EMPLOYEES: 20

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs DIRECTORS: Bell-Walker C (ne), BootJCG(ne), Cournoyer N (ne),

NUMBER OF EMPLOYEES: 2 581 Schmidt-Garve K (ne), Sutter H (Chair, ne), Betz A (Dep Chair, ne),

Elgeti R (CEO), Kroth A (CIO), Hellmuth C (CFO)

DIRECTORS: Ahmed M H (ld ind ne), Govender T G (ne), Jappie N (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

Mahloma F K (ind ne), Shaik Y (ne), Copelyn J A (Chair, ne), Obotritia Capital group of companies 27.94%

Queen S A (CEO), Duncan D (COO), Wege G (FD) Goebel Home Accessories Group 11.41%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 Zerena GmbH 9.00%

Hosken Consolidated Investments Ltd. 69.80% MORE INFO: www.sharedata.co.za/sdo/jse/DKR

Fulela Trade and Invest 81 (Pty) Ltd. 15.70%

POSTAL ADDRESS: PO Box 1585, Cape Town, 8000 COMPANY SECRETARY:

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/DNB

COMPANY SECRETARY: Cheryl Philips SPONSOR: PSG Capital (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: PSG Capital (Pty) Ltd. DKR Ords no par val - 35 155 938

AUDITORS: PwC Inc. DISTRIBUTIONS [EURc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords no par val Ldt Pay Amt

DNB Ords no par val 10 000 000 000 435 181 373 Final No 1 10 Mar 21 16 Mar 21 40.00

DISTRIBUTIONS [ZARc] FINANCIAL STATISTICS

Ords no par val Ldt Pay Amt (Amts in EUR'000) Sep 20

Interim No 5 12 Jan 21 18 Jan 21 4.00 Final (P)

Final No 4 11 Jun 19 18 Jun 19 3.00

NetRent/InvInc 39 926 600

LIQUIDITY: Apr21 Ave 213 201 shares p.w., R363 320.5(2.5% p.a.) Total Inc 39 926 600

CONG 40 Week MA DENEB Attrib Inc 34 173 700

TotCompIncLoss 34 173 700

300

Ord UntHs Int 320 352

254 Debentures 516 701

FixedAss/Prop 809 929

208 Tot Curr Ass 5 640

Total Ass 865 761

162

Tot Curr Liab 28 708

116 PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) 1 657.11

70

2016 | 2017 | 2018 | 2019 | 2020 | NAV (ZARc) 5 024.58

RATIOS

FINANCIAL STATISTICS

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Debt:Equity 0.03

Interim Final Final Final(rst) Final(rst) OpInc:Turnover 71.00

Turnover 1 035 2 872 2 956 2 547 2 678

Op Inc 40 108 162 153 180 Dipula Income Fund Ltd.

NetIntPd(Rcvd) 40 109 111 102 70 DIP

Minority Int - - 2 - 1 - 2 - ISIN: ZAE000203378 SHORT: DIPULA A CODE: DIA

Att Inc 3 - 127 - 45 8 50 ISIN: ZAE000203394 SHORT: DIPULA B CODE: DIB

TotCompIncLoss - - 125 - 16 20 72 REG NO: 2005/013963/06 FOUNDED: 2005 LISTED: 2011

NATURE OF BUSINESS: Dipula is a REIT that owns a diversified portfolio,

Fixed Ass 648 593 710 813 771 comprising retail, office and industrial properties located across all

Inv & Loans 1 126 1 087 1 056 907 762 provinces in South Africa. The majority of properties are located in

Tot Curr Ass 1 200 1 194 1 664 1 513 1 481 Gauteng. Dipula trades under the codes DIA and DIB.

Ord SH Int 1 465 1 464 1 623 1 673 1 663 SECTOR: RealEstate—RealEstate—REITS—Diversified

Minority Int - 1 - - 1 1 - NUMBER OF EMPLOYEES: 81

LT Liab 685 693 924 950 944 DIRECTORS: AzizollahoffBH(ind ne, UK), HallidaySA(ind ne),

Tot Curr Liab 1 150 1 149 1 124 940 654 LinksE((ind ne), Waja Y (ind ne), Matlala Z (Chair, ind ne),

Petersen I S (CEO), Asmal R (FD)

PER SHARE STATISTICS (cents per share) MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

HEPS-C (ZARc) 0.45 12.69 5.58 19.46 9.80 Coronation Fund Managers 25.47%

DPS (ZARc) 4.00 - 3.00 3.00 3.00 Government Employees Pension Fund 13.90%

NAV PS (ZARc) 337.00 337.00 374.00 388.00 388.00 Old Mutual 10.30%

3 Yr Beta 0.48 0.54 0.69 0.50 - POSTAL ADDRESS: Private Bag X3, Rosebank, 2132

Price High 156 250 300 250 210 MORE INFO: www.sharedata.co.za/sdo/jse/DIA

Price Low 70 101 200 141 116 COMPANY SECRETARY: Acorim (Pty) Ltd.

Price Prd End 155 140 226 225 185 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

RATIOS SPONSOR: Java Capital (Pty) Ltd.

Ret on SH Fnd 0.30 - 8.84 - 2.89 0.37 2.97 AUDITORS: Mazars (Gauteng) Inc.

Oper Pft Mgn 3.91 3.75 5.49 6.00 6.73 CAPITAL STRUCTURE AUTHORISED ISSUED

D:E 0.90 0.79 0.85 0.75 0.65 DIA A- Ord shares 1 000 000 000 264 665 819

Current Ratio 1.04 1.04 1.48 1.61 2.27 DIB B- Ord shares 1 000 000 000 264 665 819

Div Cover 0.15 - - 3.51 0.63 3.40 DISTRIBUTIONS [ZARc]

A- Ord shares Ldt Pay Amt

Final No 17 10 Dec 19 17 Dec 19 55.42

Interim No 16 11 Jun 19 18 Jun 19 54.83

LIQUIDITY: Apr21 Ave 822 848 shares p.w., R5.4m(16.2% p.a.)

118