Page 242 - Stock Exchange Handbook 2020 - Issue 3

P. 242

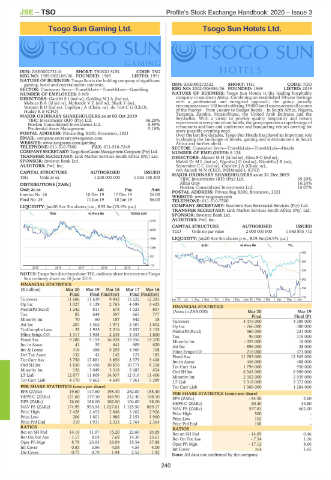

JSE – TSO Profile’s Stock Exchange Handbook: 2020 – Issue 3

Tsogo Sun Gaming Ltd. Tsogo Sun Hotels Ltd.

TSO TSO

ISIN: ZAE000273116 SHORT: TSOGO SUN CODE: TSG

REG NO: 1989/002108/06 FOUNDED: 1989 LISTED: 1991

NATURE OF BUSINESS: Tsogo Sun is the holding company of significant

gaming, hotel and entertainment interests. ISIN: ZAE000272522 SHORT: THL CODE: TGO

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Gambling REG NO: 2002/006356/06 FOUNDED: 1969 LISTED: 2019

NUMBER OF EMPLOYEES: 8 969 NATURE OF BUSINESS: Tsogo Sun Hotels is the leading hospitality

DIRECTORS: GaniMSI(ind ne), GoldingMJA(ind ne), company in southern Africa. Combining an established 50-year heritage

MabuzaBA(ld ind ne), MphandeVE(ind ne), Shaik Y (ne), with a professional and energised approach, the group proudly

WatsonRD(ind ne), Copelyn J A (Chair, ne), du Toit C G (CEO), encompassesover 100 hotels offering 19 000 hotel rooms across all sectors

Huddy R B (CFO) of the market – from Luxury to Budget hotels – in South Africa, Nigeria,

Tanzania, Zambia, Mozambique, the United Arab Emirates and the

MAJOR ORDINARY SHAREHOLDERS as at 03 Oct 2019 Seychelles. With a vision to provide quality hospitality and leisure

TIHC Investments (RF) (Pty) Ltd. 36.28% experiences at every one of our hotels, the group operates a superb range of

Hosken Consolidated Investments Ltd. 8.89% restaurants and bars and conference and banqueting venues catering for

Prudential Asset Management 5.18%

POSTAL ADDRESS: Private Bag X200, Bryanston, 2021 every possible eventing need.

Over the last five decades, Tsogo Sun Hotels has played an important role

EMAIL: company.secretary@tsogosun.com in shaping the landscape of hotels, gaming and entertainment in South

WEBSITE: www.tsogosun.com/gaming Africa and further afield.

TELEPHONE: 011-510-7800 FAX: 011-510-7249 SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Hotels

COMPANYSECRETARY:TsogoSunCasinoManagementCompany(Pty)Ltd. NUMBER OF EMPLOYEES: 8 128

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. DIRECTORS: AhmedMH(ld ind ne), GinaSC(ind ne),

SPONSOR: Investec Bank Ltd. Molefi DrML(ind ne), NgcoboJG(ind ne), NicolellaJR(ne),

AUDITORS: PwC Inc. SeptemberCC(ind ne), Copelyn J A (Chair, ne),

von Aulock M N (CEO), McDonald L (CFO)

CAPITAL STRUCTURE AUTHORISED ISSUED

TSG Ords 2c ea 1 200 000 000 1 050 188 300 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

TIHC Investments (RF) (Pty) Ltd. 39.20%

Allan Gray 16.24%

DISTRIBUTIONS [ZARc]

Hosken Consolidated Investments Ltd. 10.07%

Ords 2c ea Ldt Pay Amt POSTAL ADDRESS: Private Bag X200, Bryanston, 2021

Interim No 26 10 Dec 19 17 Dec 19 26.00 WEBSITE: www.tsogosun.com

Final No 25 11 Jun 19 18 Jun 19 56.00 TELEPHONE: 011-510-7500

LIQUIDITY: Jun20 Ave 5m shares p.w., R55.6m(25.6% p.a.) COMPANY SECRETARY: Southern Sun Secretarial Services (Pty) Ltd.

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

TRAV 40 Week MA TSOGO SUN

SPONSOR: Investec Bank Ltd.

3215 AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

2606

TGO Ords no par value 2 000 000 000 1 060 895 712

LIQUIDITY: Jun20 Ave 5m shares p.w., R19.5m(26.9% p.a.)

1998

ALSH 40 Week MA THL

1389

460

781

394

172

2015 | 2016 | 2017 | 2018 | 2019 |

328

NOTES: Tsogo Sun distributed one THL ordinary share for every one Tsogo

Sun ordinary share on 18 June 2019. 262

FINANCIAL STATISTICS

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 196

Final Final Final(rst) Final Final(rst)

130

Turnover 11 686 11 619 9 842 13 222 12 283 Jun 19 | Jul | Aug | Sep | Oct | Nov | Dec |Jan 20 | Feb | Mar | Apr | May | Jun

Op Inc 1 027 3 129 2 765 4 699 3 425

NetIntPd(Rcvd) 1 242 811 678 1 023 857 FINANCIAL STATISTICS

(Amts in ZAR’000)

Tax 82 644 597 665 777 Mar 20 Mar 19

Final (P)

Final

Minority Int 70 60 187 542 18 Turnover 4 475 000 4 389 000

Att Inc 207 1 562 1 971 2 507 1 802 Op Inc - 766 000 380 000

TotCompIncLoss - 35 1 935 2 016 2 857 2 155 NetIntPd(Rcvd) 360 000 231 000

Hline Erngs-CO 1 317 1 928 2 238 2 033 1 800 Tax 96 000 118 000

Fixed Ass 9 280 9 154 16 038 15 556 14 370 Minority Int - 329 000 18 000

Inv in Assoc 41 35 641 609 620 Att Inc - 896 000 28 000

Inv & Loans 416 486 5 255 4 969 108 Hline Erngs-CO 216 000 371 000

Def Tax Asset 132 43 142 121 185 Fixed Ass 11 703 000 12 565 000

Tot Curr Ass 3 750 17 881 3 856 3 379 3 408 Inv in Assoc 446 000 488 000

Ord SH Int 1 830 10 496 10 876 10 771 8 318 Tot Curr Ass 1 796 000 950 000

Minority Int 126 3 049 3 318 2 685 654 Ord SH Int 6 343 000 6 990 000

LT Liab 12 877 11 869 14 937 12 016 11 406 Minority Int 2 352 000 2 939 000

Tot Curr Liab 4 170 9 663 4 649 7 061 5 289 LT Liab 5 318 000 3 373 000

Tot Curr Liab 1 369 000 1 284 000

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 19.60 147.60 198.30 262.00 188.30

HEPS-C (ZARc) 121.60 157.10 164.90 212.40 188.10 PER SHARE STATISTICS (cents per share) 2.60

EPS (ZARc)

- 84.50

DPS (ZARc) 26.00 188.00 102.00 104.00 98.00 HEPS-C (ZARc) 20.40 34.80

NAV PS (ZARc) 174.95 993.94 1 027.01 1 125.50 869.17 NAV PS (ZARc) 597.83 662.00

Price High 2 428 2 453 2 848 3 262 2 926 Price High 500 -

Price Low 206 1 801 1 986 2 151 1 960 Price Low 102 -

Price Prd End 310 1 931 2 333 2 764 2 364

Price Prd End 158 -

RATIOS

Ret on SH Fnd 14.16 11.97 15.20 22.66 20.29 RATIOS - 14.09 0.46

Ret on SH Fnd

Ret On Tot Ass - 1.17 8.04 7.68 14.30 13.61 Ret On Tot Ass - 7.54 1.16

Oper Pft Mgn 8.79 26.93 28.09 35.54 27.88 Oper Pft Mgn - 17.12 8.66

Int Cover 0.83 3.86 4.08 4.59 4.00 Int Cover n/a 1.65

Div Cover 0.75 0.79 1.94 2.52 1.92

Note: All data not confirmed by the company

240