Page 246 - Stock Exchange Handbook 2020 - Issue 3

P. 246

JSE – WES Profile’s Stock Exchange Handbook: 2020 – Issue 3

The Group’s main strategic project is to build and operate South Africa’s

Wescoal Holdings Ltd. next platinum group metals mine at its Bakubung Minerals (Pty) Ltd.

(“Bakubung”) operation also known as Bakubung Platinum Mine

WES

ISIN: ZAE000069639 SHORT: WESCOAL CODE: WSL (“BPM”), which is owned by Wesizwe, firmly positioning the Group as a

REG NO: 2005/006913/06 FOUNDED: 1996 LISTED: 2005 significant mid-tier precious metals producer.

NATURE OF BUSINESS: The main business of the Group is the mining, SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals

processing, sale and supply of coal. Coal product is mined, sourced and NUMBER OF EMPLOYEES: 180

supplied to clients in local industry including power generation, DIRECTORS: GuoH(ne), MabuzaVT(ind ne), Ngculu J (ind ne),

manufacturing and petro-chemicals sectors.The key strategic thrust of Pengfei L (ne), Pingan S (ne), MokhoboDNM (Chair, ind ne),

Wescoal is to be a leading junior coal miner with a sustainable resource Li Z (CEO), Liu J (FD)

base and a coal trading operation.

SECTOR: Basic Materials—Basic Resrcs—Mining—Coal MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 45.00%

China-Africa Jinchuan Inv Ltd.

NUMBER OF EMPLOYEES: 155 Rustenburg Platinum Mines Ltd. 13.01%

DIRECTORS: Mabizela A (ind ne), Maroga K (ind ne), Micawber 809 (Pty) Ltd. 5.98%

Maswanganyi C (ne), MnxasanaNP(ind ne), MzimelaET(ne), POSTAL ADDRESS: Private Bag X16, Northlands, 2116

RamaiteMR(ne), Siyotula N (ld ind ne), Tshithavhane T, MORE INFO: www.sharedata.co.za/sdo/jse/WEZ

Mathe Dr H (Chair), Demana R L (CEO), van der Walt I (CFO)

COMPANY SECRETARY: Vasta Mhlongo

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

K2016316243 (SA) (Pty) Ltd. 47.70% SPONSOR: PSG Capital (Pty) Ltd.

UBS (Custodian) 5.26%

Rutendo Holdings (Pty) Ltd. 4.51% AUDITORS: SizweNtsalubaGobodo Inc.

POSTAL ADDRESS: PO Box 1962, Edenvale, 1610 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/WSL WEZ Ords no par 2 000 000 000 1 627 827 058

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd. LIQUIDITY: Jul20 Ave 1m shares p.w., R581 233.0(4.2% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

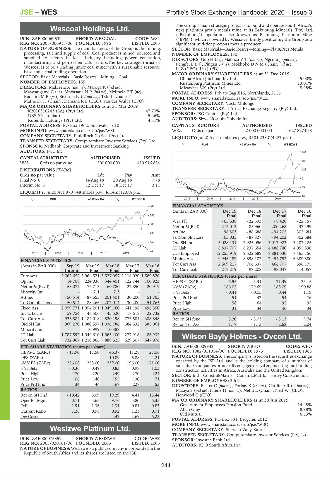

SPONSOR: Nedbank Corporate and Investment Banking PLAT 40 Week MA WESIZWE

AUDITORS: PwC Inc. 186

CAPITAL STRUCTURE AUTHORISED ISSUED 154

WSL Ords no par value 500 000 000 419 916 854

123

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

91

Final No 6 14 Aug 18 20 Aug 18 7.78

Interim No 5 12 Dec 17 18 Dec 17 3.11

59

LIQUIDITY: Jul20 Ave 970 748 shares p.w., R1.4m(12.0% p.a.)

28

MINI 40 Week MA WESCOAL 2015 | 2016 | 2017 | 2018 | 2019 |

464 FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Dec 18 Dec 17 Dec 16

386

Final Final Final Final

Wrk Pft - 65 638 - 22 593 - 8 420 - 22 157

308

NetIntPd(Rcd) - 212 013 85 960 200 268 132 199

Att Inc 96 803 - 88 688 - 94 202 302 684

230

TotCompIncLoss 103 035 - 87 827 - 94 202 302 684

152 Ord SH Int 3 028 131 2 925 096 3 012 923 3 107 125

LT Liab 8 837 707 6 237 654 4 488 740 4 055 896

74

2015 | 2016 | 2017 | 2018 | 2019 | Cap Employed 12 255 919 9 522 689 7 881 530 7 465 156

Mining Ass 9 946 189 8 858 102 7 454 753 6 389 880

FINANCIAL STATISTICS

(Amts in ZAR’000) Tot Curr Ass 2 509 217 706 637 466 707 596 175

Tot Curr Liab 217 279 97 208 98 047 114 057

Sep 19

Mar 16

Mar 17

Mar 19

Mar 18

Interim Final Final Final Final

Turnover 2 062 652 3 964 571 3 527 057 2 118 020 1 589 870 PER SHARE STATISTICS (cents per share)

Op Inc 14 708 224 036 344 401 122 744 100 923 HEPS-C (ZARc) 5.95 - 5.31 21.39 25.15

NetIntPd(Rcvd) 58 077 76 713 60 780 22 850 20 919 NAV (ZARc) 186.02 179.69 185.09 190.88

Minority Int - 611 613 - - 3 Yr Beta - 0.41 - 0.05 0.44 1.19

Att Inc - 50 514 87 655 201 401 30 200 51 765 Price Prd End 51 42 54 76

TotCompIncLoss - 50 514 88 266 202 014 30 200 51 765 Price High 58 64 95 95

Fixed Ass 2 059 771 1 954 201 1 949 160 641 198 496 350 Price Low 31 34 46 34

Inv & Loans 59 754 48 506 43 520 18 618 22 732

RATIOS

Tot Curr Ass 926 884 1 184 018 820 198 773 584 388 848 Ret on SH fund 3.20 - 3.03 - 3.13 9.74

Ord SH Int 969 270 1 080 597 1 036 786 684 632 385 061 Ret on Tot Ass 1.17 - 1.13 - 2.62 - 2.04

Minority Int - 10 999 10 388 - -

LT Liab 1 787 592 1 049 610 1 063 400 277 918 86 932 Wilson Bayly Holmes - Ovcon Ltd.

Tot Curr Liab 732 967 1 210 866 889 625 629 307 547 976

WIL

ISIN: ZAE000009932 SHORT: WBHO CODE: WBO

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 11.90 17.50 46.37 11.28 27.06 REG NO: 1982/011014/06 FOUNDED: 1975 LISTED: 1988

DPS (ZARc) - - 10.89 6.88 4.21 NATURE OF BUSINESS: The company is listed on the securities exchange

NAV PS (ZARc) 226.08 253.00 239.00 196.00 171.00 operated by the JSE Ltd. and is the holding company of a number of

3 Yr Beta - 0.36 - 0.49 0.83 0.98 1.03 subsidiary companies principally engaged in civil engineering andbuilding

construction activities in Africa, Australia and the United Kingdom.

Price High 170 220 249 270 224 SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction

Price Low 106 140 155 130 71 NUMBER OF EMPLOYEES: 3 616

Price Prd End 134 144 167 228 153 DIRECTORS: Bester C (ind ne), Forbay K (ind ne), Gardiner R (ld ind ne),

Maziya S (ind ne), Ntene H (ind ne), Nel E L (Chair), Neff W (CEO),

RATIOS

Ret on SH Fnd - 10.42 8.09 19.29 4.41 13.44 Henwood C (CFO)

Oper Pft Mgn 0.71 5.65 9.76 5.80 6.35 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

D:E 1.91 1.36 1.31 0.81 0.83 Government Employees Pension Fund 14.48%

Current Ratio 1.26 0.98 0.92 1.23 0.71 Allan Gray 8.98%

Old Mutual

6.53%

Div Cover - - 4.42 1.69 6.23

POSTAL ADDRESS: PO Box 531, Bergvlei, 2012

MORE INFO: www.sharedata.co.za/sdo/jse/WBO

Wesizwe Platinum Ltd. COMPANY SECRETARY: Shereen Vally-Kara

WES TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000075859 SHORT: WESIZWE CODE: WEZ SPONSOR: Investec Bank Ltd.

REG NO: 2003/020161/06 FOUNDED: 2003 LISTED: 2005 AUDITORS: BDO South Africa Inc.

NATURE OF BUSINESS:Wesizwe is a public company incorporated in the

Republic of South Africa and its shares are listed on the JSE.

244