Page 245 - Stock Exchange Handbook 2020 - Issue 3

P. 245

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – VUK

Fixed Ass 59 277 43 989 40 529 40 181 39 744 Price High 2 153 2 300 2 283 2 000 2 015

Tot Curr Ass 47 828 39 746 34 822 29 011 27 618 Price Low 585 1 869 1 767 1 565 1 350

Ord SH Int 91 656 77 992 64 468 24 063 24 158 RATIOS

Minority Int 8 414 8 396 6 184 - 1 067 - 1 134 RetOnSH Funds - 0.20 9.30 15.22 11.65 13.15

LT Liab 53 403 29 084 28 130 31 423 29 909 RetOnTotAss 7.29 6.56 7.45 7.61 9.11

Tot Curr Liab 36 750 38 171 32 583 26 719 25 770 Debt:Equity 1.01 0.64 0.44 0.30 0.43

OperRetOnInv 6.65 6.21 6.51 7.47 11.44

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 945.00 868.00 923.00 923.00 883.00 OpInc:Turnover 67.75 67.12 65.06 60.18 66.64

DPS (ZARc) 845.00 795.00 815.00 830.00 795.00

NAV PS (ZARc) 4 992.52 4 248.24 3 745.06 1 545.00 1 547.00 Vunani Ltd.

3 Yr Beta 0.06 0.17 0.83 0.92 1.04 VUN

Price High 13 729 16 029 18 699 17 234 16 179 ISIN: ZAE000163382 SHORT: VUNANI CODE: VUN

Price Low 9 070 10 940 13 496 13 852 12 700 REG NO: 1997/020641/06 FOUNDED: 1997 LISTED: 2007

Price Prd End 11 701 11 143 15 307 15 200 16 053 NATURE OF BUSINESS: Vunani is an independent black-owned and

managed diversified financial services group with a unique positioning in

RATIOS the South African financial services sector. Owner-managed by

Ret on SH Fnd 16.63 17.98 22.03 55.70 55.90

Oper Pft Mgn 30.54 28.27 28.08 26.76 26.30 professionals who also have a passion for entrepreneurship, Vunani has

D:E 0.58 0.46 0.51 1.53 1.41 become known as one of the country’s leading boutique providers.

Current Ratio 1.30 1.04 1.07 1.09 1.07 SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs

Div Cover 1.11 1.10 1.16 1.10 1.11 NUMBER OF EMPLOYEES: 105

DIRECTORS: Anderson N M, GoldingMJA(ne), Guma DrXP(ind ne),

Macey J (ind ne), Mazwi N (ind ne), Mthethwa S (ne), Nzalo G (ind ne),

Vukile Property Fund Ltd. Jacobs L I (Chair, ind ne), Dube E G (Dep Chair), Khoza B M (CEO),

Mika T (CFO)

VUK

ISIN: ZAE000180865 SHORT: VUKILE CODE: VKE MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

REG NO: 2002/027194/06 FOUNDED: 2004 LISTED: 2004 Bambelela Capital (Pty) Ltd. 49.20%

NATURE OF BUSINESS: Vukile is a property holding and investment Geomer Investments (Pty) Ltd. 18.60%

company through the direct and indirect ownership of immovable Baleine Capital (Pty) Ltd. 6.20%

property. The group holds a portfolio of direct property assets as well as POSTAL ADDRESS: PO Box 652419, Benmore, 2010

strategic shareholdings in listed REITs. The company is listed on the JSE MORE INFO: www.sharedata.co.za/sdo/jse/VUN

and the NSX in Namibia under the retail REITs sector. COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

SECTOR: Fins—Rest—Inv—Ret TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 30 SPONSOR: Grindrod Bank Ltd.

DIRECTORS: Booysen DrSF(ind ne), Mokate DrRD(ld ind ne), AUDITORS: KPMG Inc.

Moseneke Dr G S, Mothibeli I, MoyangaPS(ind ne), Ngonyama B

(ind ne), Ntene H (ind ne), SerebroHM(ind ne), Payne N G CAPITAL STRUCTURE AUTHORISED ISSUED

(Chair, ind ne), Rapp L (CEO), Cohen L (CFO) VUN Ords no par value 500 000 000 161 155 915

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

DISTRIBUTIONS [ZARc]

Government Employees Pension Fund 10.70%

Encha Properties Equity Investments 7.00% Ords no par value 23 Jul 19 29 Jul 19 Amt

Ldt

Pay

7.40

Final No 6

Old Mutual 6.78% Final No 5 24 Jul 18 30 Jul 18 6.20

POSTAL ADDRESS: PO Box 522779, Saxonworld, 2132

MORE INFO: www.sharedata.co.za/sdo/jse/VKE LIQUIDITY: Jul20 Ave 39 279 shares p.w., R86 087.8(1.3% p.a.)

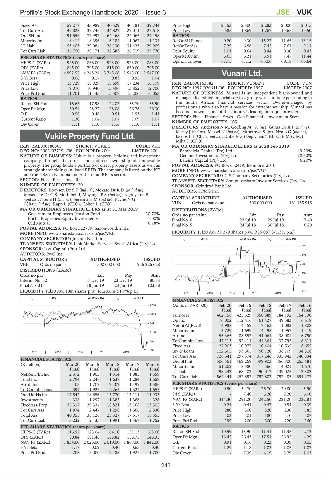

COMPANY SECRETARY: Johann Neethling ALSH 40 Week MA VUNANI

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

320

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: PwC Inc. 279

CAPITAL STRUCTURE AUTHORISED ISSUED

VKE Ords no par 1 500 000 000 956 226 628 238

DISTRIBUTIONS [ZARc]

197

Ords no par Ldt Pay Amt

Interim No 32 17 Dec 19 23 Dec 19 80.84

156

Final No 31 18 Jun 19 24 Jun 19 103.38

LIQUIDITY: Jul20 Ave 10m shares p.w., R128.6m(51.7% p.a.) 115

2015 | 2016 | 2017 | 2018 | 2019 |

SAPY 40 Week MA VUKILE

FINANCIAL STATISTICS

2230 (Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final Final Final Final

1885 Turnover 462 156 425 329 350 889 184 192 154 190

Op Inc 76 002 112 416 61 427 49 583 6 618

1541

NetIntPd(Rcvd) 4 988 4 459 7 463 1 082 - 1 808

Minority Int 3 729 1 699 4 495 1 957 1 419

1196

Att Inc 55 365 88 553 41 061 38 081 6 750

TotCompIncLoss 47 113 92 411 44 364 37 795 8 311

852

Fixed Ass 27 903 10 977 10 404 10 535 8 655

507 Inv & Loans 112 305 93 565 50 720 38 109 34 318

2015 | 2016 | 2017 | 2018 | 2019 |

Tot Curr Ass 726 341 297 574 817 246 835 942 740 834

Ord SH Int 506 561 469 269 399 903 356 800 255 481

FINANCIAL STATISTICS

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 Minority Int 51 202 8 380 - 566 - 4 021 1 670

LT Liab 498 242 68 402 90 017 139 025 12 302

Final Final Final Final Final

NetRent/InvInc 2 372 1 903 1 314 1 085 1 559 Tot Curr Liab 564 441 252 893 792 802 792 485 694 277

Total Inc 2 794 2 248 1 638 1 284 1 658

Attrib Inc - 103 1 709 2 402 1 499 1 586 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 397 1 925 2 265 1 324 1 655 HEPS-C (ZARc) 0.50 54.70 26.70 20.80 5.90

Ord UntHs Int 17 542 18 656 15 770 13 111 11 933 DPS (ZARc) - 7.40 6.20 5.20 6.00

Investments 338 1 297 1 385 1 366 328 NAV PS (ZARc) 314.30 291.20 242.50 221.20 222.81

FixedAss/Prop 35 317 29 334 18 821 13 168 13 302 3 Yr Beta - 0.21 - 0.41 0.47 0.54 0.39

Tot Curr Ass 1 874 2 447 1 298 1 666 2 830 Price High 280 300 320 230 185

Total Ass 40 055 35 126 23 327 17 517 18 355 Price Low 103 101 180 70 107

Tot Curr Liab 3 232 2 135 1 991 1 367 1 752 Price Prd End 199 200 300 220 160

RATIOS

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 116.92 123.04 164.10 151.13 168.00 Ret on SH Fnd 10.59 18.90 11.41 11.35 2.72

DPS (ZARc) 80.84 181.48 168.82 156.75 146.35 Oper Pft Mgn 16.45 26.43 17.51 26.92 4.29

NAV PS (ZARc) 1 834.00 2 026.00 2 010.00 1 868.00 1 842.00 D:E 0.91 0.16 0.23 0.39 0.05

3 Yr Beta 1.17 - 0.09 0.40 0.65 0.40 Current Ratio 1.29 1.18 1.03 1.05 1.07

Price Prd End 708 2 000 2 188 1 925 1 700 Div Cover - 7.39 4.19 5.79 1.03

243