Page 247 - Stock Exchange Handbook 2020 - Issue 3

P. 247

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – WOO

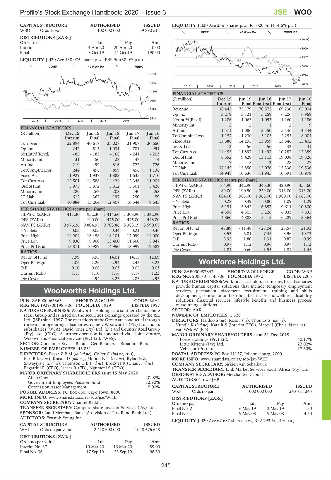

LIQUIDITY: Jul20 Ave 23m shares p.w., R1 020.3m(114.6% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

WBO Ords 1c ea 100 000 000 59 890 514

GERE 40 Week MA WOOLIES

10490

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Interim 14 Apr 20 20 Apr 20 0.00 8929

Final 8 Oct 19 14 Oct 19 190.00

7367

LIQUIDITY: Jul20 Ave 438 075 shares p.w., R49.9m(38.0% p.a.)

CONM 40 Week MA WBHO 5806

17320

4244

14559 2683

2015 | 2016 | 2017 | 2018 | 2019 |

11797

FINANCIAL STATISTICS

(R million)

9036 Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final(rst) Final(rst) Final

6275 Revenue 38 442 75 179 70 572 69 230 65 004

Op Inc 3 279 5 121 5 259 6 206 6 969

3513 NetIntPd(Rcvd) 1 286 1 063 1 053 1 160 1 186

2015 | 2016 | 2017 | 2018 | 2019 |

Minority Int 2 2 1 2 9

Att Inc 1 571 - 1 086 - 3 550 5 446 4 344

FINANCIAL STATISTICS

(R million)

TotCompIncLoss 1 157 - 1 230 - 3 103 2 253 8 004

Jun 17

Jun 18

Jun 19

Jun 16

Dec 19

Fixed Ass 13 688 14 295 13 959 13 846 15 402

Interim Final Final Final Final

Turnover 22 894 40 617 35 028 31 907 30 650

Op Inc 242 513 1 031 781 991 Inv & Loans 73 56 56 42 41

NetIntPd(Rcvd) - 85 - 183 - 168 - 241 - 203 Tot Curr Ass 14 455 11 897 11 497 10 287 12 389

Minority Int 31 50 28 47 - 4 Ord SH Int 6 552 9 428 13 113 19 038 19 826

Att Inc 219 499 816 722 726 Minority Int 17 15 13 28 27

TotCompIncLoss 244 496 859 456 1 136 LT Liab 37 145 15 850 15 076 15 336 19 536

Fixed Ass 1 929 1 937 1 883 1 635 1 710 Tot Curr Liab 14 948 10 636 11 945 10 591 10 978

Tot Curr Ass 12 501 14 588 14 424 12 346 11 904 PER SHARE STATISTICS (cents per share)

Ord SH Int 5 975 5 872 5 812 5 301 5 428 HEPS-C (ZARc) 164.90 342.90 346.30 420.90 455.60

Minority Int 280 262 208 140 258 DPS (ZARc) 89.00 190.50 239.00 313.00 313.00

LT Liab 612 367 197 250 59 NAV PS (ZARc) 684.00 985.00 1 365.00 1 980.00 2 065.00

Tot Curr Liab 10 884 13 264 12 407 10 544 9 645 3 Yr Beta 0.28 0.49 0.80 1.09 1.29

Price High 6 151 5 842 6 857 9 614 10 800

PER SHARE STATISTICS (cents per share) Price Low 4 598 4 305 5 226 6 033 7 835

HEPS-C (ZARc) 411.30 932.30 1 414.60 1 308.90 1 342.90

DPS (ZARc) - 190.00 475.00 475.00 448.00 Price Prd End 4 860 4 888 5 415 6 289 8 364

NAV PS (ZARc) 9 976.26 9 804.95 9 703.86 8 388.19 8 590.65 RATIOS

3 Yr Beta - 0.05 - 0.05 0.34 0.21 0.36 Ret on SH Fnd 47.89 - 11.48 - 27.04 28.57 21.93

Oper Pft Mgn

8.96

10.72

7.45

8.53

6.81

Price High 14 904 16 458 18 101 17 099 14 000

Price Low 9 830 9 900 13 400 11 500 8 947 D:E 5.92 1.80 1.31 0.87 0.99

Price Prd End 13 811 10 989 14 950 13 999 12 582 Current Ratio 0.97 1.12 0.96 0.97 1.13

Div Cover 1.84 - 0.60 - 1.55 1.81 1.45

RATIOS

Ret on SH Fnd 7.99 8.95 14.01 14.15 12.69

Oper Pft Mgn 1.06 1.26 2.94 2.45 3.23 Workforce Holdings Ltd.

D:E 0.10 0.06 0.03 0.05 0.03 WOR

Current Ratio 1.15 1.10 1.16 1.17 1.23 ISIN: ZAE000087847 SHORT: WORKFORCE CODE: WKF

Div Cover - 4.94 3.23 2.83 2.95 REG NO: 2006/018145/06 FOUNDED: 1972 LISTED: 2006

NATURE OF BUSINESS: Workforce is a holding company. Its subsidiaries

provide human capital solutions that include temporary employment

Woolworths Holdings Ltd. services, permanent placement recruitment, training and skills

development, contractor on-boarding, healthcare and wellness, disability

WOO

ISIN: ZAE000063863 SHORT: WOOLIES CODE: WHL solutions, financial services, lifestyle benefits and business process

REG NO: 1929/001986/06 FOUNDED: 1929 LISTED: 1997 outsourcing solutions.

NATURE OF BUSINESS: Woolworths Holdings is a southern hemisphere SECTOR: AltX

retail Group and is listed on the securities exchange operated by the JSE NUMBER OF EMPLOYEES: 1 328

Ltd. (JSE) since 1997. The operations of the Group are conducted through DIRECTORS: Naidoo S (ne), Ross I (ne), Thomas S (ind ne),

three major operating subsidiaries, namely Woolworths (Pty) Ltd. and its Vundla K (ind ne), Katz R S (Interim CEO), Macey J (Chair, ld ind ne),

subsidiaries (WSA), David Jones (Pty) Ltd. (DJ) and Country Road Group van Wyk W (FD)

(Pty) Ltd. (CRG). A further operation is conducted via a joint venture,

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Woolworths Financial Services (Pty) Ltd. (WFS). Force Holdings (Pty) Ltd. 40.17%

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets Little Kittens (Pty) Ltd. 27.02%

NUMBER OF EMPLOYEES: 46 831 Vebicept (Pty) Ltd. 17.60%

DIRECTORS: BassaZBM(ld ind ne), Colfer C (ind ne, Aus), POSTAL ADDRESS: PO Box 11137, Johannesburg, 2000

Earl B (ind ne), Kneale D (ind ne), MoholiNT(ind ne), Rylands Z, MORE INFO: www.sharedata.co.za/sdo/jse/WKF

Skweyiya T (ind ne), ThomsonCB(ind ne), Brody H R (Chair, ind ne), COMPANY SECRETARY: Sirkien van Schalkwyk

Bagattini R (CEO), Isaacs R (FD), Ngumeni S (COO) TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

DESIGNATED ADVISOR: Merchantec Capital

MAJOR ORDINARY SHAREHOLDERS as at 15 May 2020

Allan Gray 20.02% AUDITORS: Crowe JHB

Government Employees Pension Fund 12.90%

Coronation Asset Management 5.00% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 680, Cape Town, 8000 WKF Ords no par 1 000 000 000 243 731 343

MORE INFO: www.sharedata.co.za/sdo/jse/WHL

DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Chantel Reddiar

Ords no par Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 2 6 May 19 13 May 19 1.50

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Final No 1 9 May 08 19 May 08 4.50

AUDITORS: Ernst & Young Inc.

LIQUIDITY: Jul20 Ave 67 687 shares p.w., R92 793.5(1.4% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

WHL Ords no par value 2 410 600 000 1 048 576 648

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Interim No 37 10 Mar 20 16 Mar 20 89.00

Final No 36 17 Sep 19 23 Sep 19 98.50

245