Page 237 - Stock Exchange Handbook 2020 - Issue 3

P. 237

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – TOW

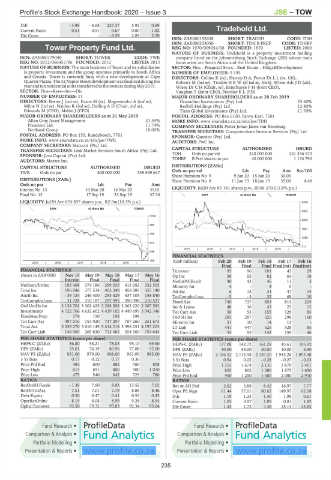

D:E - 3.98 - 4.68 227.37 5.92 0.69

Current Ratio 0.51 0.51 0.67 0.80 1.82 Tradehold Ltd.

Div Cover - - - 6.59 2.85 2.70 TRA

ISIN: ZAE000152658 SHORT: TRADEH CODE: TDH

ISIN: ZAE000253050 SHORT: TDH B PREF CODE: TDHBP

Tower Property Fund Ltd. REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

NATURE OF BUSINESS: Tradehold is a property investment holding

TOW

ISIN: ZAE000179040 SHORT: TOWER CODE: TWR company listed on the Johannesburg Stock Exchange (JSE) whose main

REG NO: 2012/066457/06 FOUNDED: 2012 LISTED: 2013 focus areas are South Africa and the United Kingdom.

NATURE OF BUSINESS: The main business of Tower and its subsidiaries SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

is property investment and the group operates primarily in South Africa NUMBER OF EMPLOYEES: 5 195

and Croatia. Tower is currently busy with a new development at Cape DIRECTORS: Collins K (ne), Harrop D A, Porter DrLL(ne, UK),

Quarter Piazza. The 32 Napier Street developmentwasfinalisedduring the Roberts M (ind ne), TroskieHRW(ld ind ne, Neth), Wiese AdvJD(alt),

yearandtenresidentialunitstransferredtotheownersduringMay2019. Wiese Dr C H (Chair, ne), Esterhuyse F H (Joint CEO),

SECTOR: Fins—Rest—Inv—Div Vaughan T (Joint CEO), Nordier K L (FD)

NUMBER OF EMPLOYEES: 11

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

DIRECTORS: Bester J (ind ne), Evans M (ne), Magwentshu A (ind ne), Granadino Investments (Pty) Ltd. 33.60%

Milne N (ind ne), Naidoo R (ind ne), Dalling A D (Chair, ind ne), Redbill Holdings (Pty) Ltd. 12.80%

Edwards M (CEO), Mabin J (CFO) Titan Global Investments (Pty) Ltd. 11.70%

POSTAL ADDRESS: PO Box 6100, Parow East, 7501

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2019

Allan Gray Asset Management 21.59% MORE INFO: www.sharedata.co.za/sdo/jse/TDH

Prescient Ltd. 11.74% COMPANY SECRETARY: Pieter Johan Janse van Rensburg

Nedbank Group 10.00% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 155, Rondebosch, 7701 SPONSOR: Questco (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/TWR AUDITORS: PwC Inc.

COMPANY SECRETARY: Statucor (Pty) Ltd.

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Java Capital (Pty) Ltd. TDH Ords no par val 310 000 000 261 346 570

AUDITORS: Mazars Inc. TDHBP B Pref shares no par 40 000 000 1 134 790

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

TWR Ords no par 500 000 000 339 549 647 Ords no par val Ldt Pay Amt Scr/100

Share Premium No 9 9 Jun 20 15 Jun 20 30.00 -

DISTRIBUTIONS [ZARc] Share Premium No 8 11 Jun 19 18 Jun 19 55.00 4.48

Ords no par Ldt Pay Amt LIQUIDITY: Jul20 Ave 89 181 shares p.w., R956 370.0(1.8% p.a.)

Interim No 13 10 Mar 20 16 Mar 20 35.01

Final No 12 17 Sep 19 23 Sep 19 37.36 SAPY 40 Week MA TRADEH

LIQUIDITY: Jul20 Ave 674 897 shares p.w., R2.9m(10.3% p.a.) 3450

SAPY 40 Week MA TOWER

2902

1064

2355

885

1807

706

1259

527

711

2015 | 2016 | 2017 | 2018 | 2019 |

348

FINANCIAL STATISTICS

169 (GBP million)

2015 | 2016 | 2017 | 2018 | 2019 | Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final Final Final(rst) Final(rst)

Turnover 95 96 101 43 29

FINANCIAL STATISTICS

(Amts in ZAR’000) Nov 19 May 19 May 18 May 17 May 16 Op Inc 58 55 82 64 18

NetIntPd(Rcvd) 40 43 46 11 3

Interim Final Final Final Final

NetRent/InvInc 193 468 374 186 399 035 413 082 352 505 Minority Int 4 - 4 5 -

Total Inc 196 046 377 534 403 349 458 089 355 140 Att Inc 6 13 31 47 14

Attrib Inc - 35 124 246 400 293 429 437 103 158 840 TotCompIncLoss - 5 - 5 32 68 10

TotCompIncLoss 31 328 310 187 297 495 390 398 210 527 Fixed Ass 740 737 853 814 205

Ord UntHs Int 3 138 701 3 302 425 3 288 508 3 263 220 2 367 583 Inv & Loans 48 36 43 25 15

Investments 4 722 766 4 632 602 4 439 102 4 449 699 3 942 346 Tot Curr Ass 58 53 155 129 83

FixedAss/Prop 174 150 193 198 - Ord SH Int 283 287 325 298 160

Tot Curr Ass 497 016 753 920 737 297 707 260 251 673 Minority Int 51 10 14 13 -

Total Ass 5 339 270 5 610 149 5 414 218 5 398 251 4 197 203 LT Liab 441 447 525 528 85

Tot Curr Liab 146 969 269 830 713 465 354 569 754 644 Tot Curr Liab 55 55 142 159 46

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 36.80 58.21 78.03 95.10 69.50 HEPS-C (ZARc) 177.08 142.72 161.28 43.61 105.92

DPS (ZARc) 35.01 74.19 80.96 77.08 92.00 DPS (ZARc) 30.00 55.00 50.00 10.00 6.50

NAV PS (ZARc) 931.00 979.00 968.00 961.00 985.00 NAV PS (ZARc) 2 186.52 2 114.98 2 139.20 1 945.28 1 893.48

3 Yr Beta 0.17 0.12 0.17 0.36 - 3 Yr Beta 0.54 0.02 - 0.28 - 0.27 - 0.03

Price Prd End 492 600 682 760 808 Price High 1 315 1 674 2 135 3 870 3 401

Price High 615 691 800 900 1 010 Price Low 825 802 1 380 1 875 1 650

Price Low 475 540 642 725 780 Price Prd End 950 1 250 1 600 2 080 2 910

RATIOS

RATIOS

RetOnSH Funds - 1.39 7.60 8.93 13.52 7.02 Ret on SH Fnd 2.62 3.88 8.42 16.97 7.77

RetOnTotAss 7.51 7.01 7.79 8.88 8.46 Oper Pft Mgn 61.44 57.01 80.62 149.97 62.08

Debt:Equity 0.50 0.47 0.41 0.53 0.43 D:E 1.19 1.33 1.40 1.98 0.61

OperRetOnInv 8.19 8.08 8.99 9.28 8.94 Current Ratio 1.05 0.97 1.09 0.81 1.82

OpInc:Turnover 93.50 79.32 95.83 92.34 93.64 Div Cover 1.43 1.72 4.38 45.13 23.82

235