Page 240 - Stock Exchange Handbook 2020 - Issue 3

P. 240

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – TRE

LIQUIDITY: Jul20 Ave 365 079 shares p.w., R1.2m(18.9% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Ceppawu Iinvestments (Pty) Ltd. 20.26%

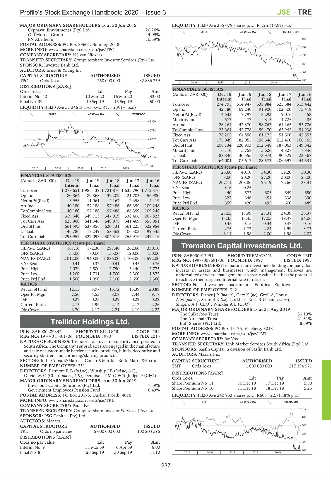

Old Mutual Group 14.09% ALSH 40 Week MA TRELLIDOR

PN Abelheim 10.69% 651

POSTAL ADDRESS: PO Box 39601, Bramley, 2018

552

MORE INFO: www.sharedata.co.za/sdo/jse/TPC

COMPANY SECRETARY: H J van Niekerk 453

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. 354

AUDITORS: Ernst & Young Inc.

254

CAPITAL STRUCTURE AUTHORISED ISSUED

TPC Ords 1c ea 250 000 000 32 886 359 155

| 2016 | 2017 | 2018 | 2019 |

DISTRIBUTIONS [ZARc]

FINANCIAL STATISTICS

Ords 1c ea Ldt Pay Amt (Amts in ZAR’000)

Interim No 40 10 Mar 20 16 Mar 20 33.00 Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Final No 39 10 Sep 19 16 Sep 19 50.00 Turnover Interim 514 947 538 984 525 384 313 442

Final

Final

Final

Final

274 795

LIQUIDITY: Jul20 Ave 57 246 shares p.w., R1.1m(9.1% p.a.)

Op Inc 42 180 69 240 91 900 102 300 75 418

SUPS 40 Week MA TRNPACO NetIntPd(Rcvd) 4 543 7 797 8 293 9 076 - 458

Minority Int 572 172 815 1 725 485

3300

Att Inc 26 261 42 870 58 763 64 265 53 706

2774 TotCompIncLoss 25 361 42 778 59 470 65 942 54 938

Fixed Ass 78 205 64 856 61 175 51 500 42 553

2247 Tot Curr Ass 175 949 182 055 198 646 212 400 166 165

Ord SH Int 208 134 220 903 212 548 187 063 149 842

1721

Minority Int 6 110 5 758 5 626 4 827 - 846

LT Liab 88 846 30 555 73 974 90 529 23 367

1195

Tot Curr Liab 64 001 105 613 88 573 106 597 44 531

668

2015 | 2016 | 2017 | 2018 | 2019 | PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 25.60 40.10 54.30 59.20 50.30

FINANCIAL STATISTICS DPS (ZARc) 8.00 20.20 27.20 30.00 25.00

(Amts in ZAR’000)

NAV PS (ZARc) 207.71 208.86 196.19 172.66 138.31

Jun 18

Jun 16

Jun 17

Dec 19

Jun 19

Interim Final Final Final Final 3 Yr Beta - 0.16 - 0.25 - - -

Turnover 1 078 651 1 985 139 1 721 876 1 635 790 1 712 376 Price High 440 573 605 649 650

Op Inc 80 864 89 868 139 209 121 703 156 980 Price Low 327 346 451 338 390

NetIntPd(Rcvd) 6 956 11 061 4 167 2 358 4 419 Price Prd End 359 420 495 600 489

Att Inc 40 180 57 188 97 486 86 359 109 248

TotCompIncLoss 40 180 57 188 97 486 86 359 109 248 RATIOS 25.05 18.99 27.31 34.39 36.37

Ret on SH Fnd

Fixed Ass 319 640 349 713 347 019 338 406 267 823 Oper Pft Mgn 15.35 13.45 17.05 19.47 24.06

Tot Curr Ass 625 960 641 346 649 978 541 469 558 051 D:E 0.45 0.15 0.34 0.47 0.16

Ord SH Int 661 593 637 856 620 131 561 225 522 954 Current Ratio 2.75 1.72 2.24 1.99 3.73

LT Liab 146 786 117 249 158 362 106 303 99 345 Div Cover 3.14 1.98 2.00 1.98 2.03

Tot Curr Liab 293 957 322 093 304 316 255 976 247 416

PER SHARE STATISTICS (cents per share) Trematon Capital Investments Ltd.

HEPS-C (ZARc) 161.10 172.30 297.40 262.60 330.10

DPS (ZARc) 33.00 80.00 135.00 120.00 150.00 ISIN: ZAE000013991 SHORT: TREMATON CODE: TMT

TRE

NAV PS (ZARc) 2 012.00 1 940.00 1 886.00 1 708.00 1 592.00 REG NO: 1997/008691/06 FOUNDED: 1997 LISTED: 1997

3 Yr Beta 0.41 0.32 - 0.41 - 0.45 - 0.76 NATURE OF BUSINESS:Trematonis aninvestmentholding company that

Price High 2 079 2 500 2 750 3 440 2 775 invests in assets and businesses which management believes are

Price Low 1 200 1 731 1 700 2 300 1 875 undervalued or where management can create value that has the potential

Price Prd End 1 500 1 950 2 100 2 650 2 360 to achieve their targeted internal rate of return.

SECTOR: Fins—Investment Instruments—Equities—Equities

RATIOS

Ret on SH Fnd 12.15 8.97 15.72 15.39 20.89 NUMBER OF EMPLOYEES: 342

Oper Pft Mgn 7.50 4.53 8.08 7.44 9.17 DIRECTORS: FisherJP(ind ne), Getz K (ne), Groll A, Louw

D:E 0.27 0.25 0.29 0.22 0.22 AM(ind ne), Stumpf R (ne), Lockhart-Ross R (Chair, ind ne),

Current Ratio 2.13 1.99 2.14 2.12 2.26 Shapiro A J (CEO), Winkler A L (CFO)

Div Cover 3.70 2.17 2.21 2.19 2.22 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

The Suikerbos Trust 30.19%

The Armchair Trust 21.61%

Trellidor Holdings Ltd. Buff-Shares (Pty) Ltd. 8.69%

TRE POSTAL ADDRESS: PO Box 15176, Vlaeberg, 8018

ISIN: ZAE000209342 SHORT: TRELLIDOR CODE: TRL MORE INFO: www.sharedata.co.za/sdo/jse/TMT

REG NO: 1970/015401/06 FOUNDED: 1970 LISTED: 2015

NATURE OF BUSINESS: Trellidor is an investment entity incorporated in COMPANY SECRETARY: Jac Vos

South Africa. The Company’s subsidiaries are engaged in the manufacture TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

and sale of custom-made barrier security products, blinds, decorative and SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

security shutters and cornicing/skirting products. AUDITORS: Mazars Inc.

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs

CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 351 TMT Ords 1c ea 1 000 000 000 217 194 571

DIRECTORS: PatmoreRB(ind ne), WinshipJB(ind ne, UK),

Olivier M C (Chair, ind ne, UK), Dennison T M (CEO), Judge D (CFO) DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 Share Premium No 11 10 Dec 19 17 Dec 19 5.50

Envisionit Capital Solutions (Pty) Ltd. 7.59%

Government Employees Pension Fund 6.49% Share Premium No 10 11 Dec 18 18 Dec 18 5.25

POSTAL ADDRESS: PO Box 20173, Durban North, 4016 LIQUIDITY: Jul20 Ave 240 953 shares p.w., R603 722.7(5.8% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/TRL

EQII 40 Week MA TREMATON

COMPANY SECRETARY: Paula Nel

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 470

SPONSOR: PSG Capital (Pty) Ltd. 409

AUDITORS: Mazars

348

CAPITAL STRUCTURE AUTHORISED ISSUED

TRL Ords no par value 5 000 000 000 100 203 596

287

DISTRIBUTIONS [ZARc]

226

Ords no par value Ldt Pay Amt

Interim No 9 31 Mar 69 6 Apr 69 8.00

165

Final No 8 23 Sep 19 30 Sep 19 11.10 2015 | 2016 | 2017 | 2018 | 2019 |

237