Page 185 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 185

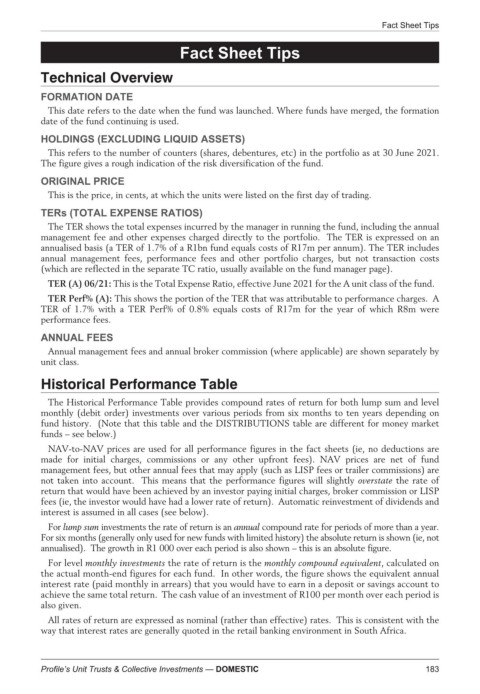

Fact Sheet Tips

Fact Sheet Tips

Fact Sheet Tips

Technical Overview

FORMATION DATE

This date refers to the date when the fund was launched. Where funds have merged, the formation

date of the fund continuing is used.

HOLDINGS (EXCLUDING LIQUID ASSETS)

This refers to the number of counters (shares, debentures, etc) in the portfolio as at 30 June 2021.

The figure gives a rough indication of the risk diversification of the fund.

ORIGINAL PRICE

This is the price, in cents, at which the units were listed on the first day of trading.

TERs (TOTAL EXPENSE RATIOS)

The TER shows the total expenses incurred by the manager in running the fund, including the annual

management fee and other expenses charged directly to the portfolio. The TER is expressed on an

annualised basis (a TER of 1.7% of a R1bn fund equals costs of R17m per annum). The TER includes

annual management fees, performance fees and other portfolio charges, but not transaction costs

(which are reflected in the separate TC ratio, usually available on the fund manager page).

TER (A) 06/21: This is the Total Expense Ratio, effective June 2021 for the A unit class of the fund.

TER Perf% (A): This shows the portion of the TER that was attributable to performance charges. A

TER of 1.7% with a TER Perf% of 0.8% equals costs of R17m for the year of which R8m were

performance fees.

ANNUAL FEES

Annual management fees and annual broker commission (where applicable) are shown separately by

unit class.

Historical Performance Table

The Historical Performance Table provides compound rates of return for both lump sum and level

monthly (debit order) investments over various periods from six months to ten years depending on

fund history. (Note that this table and the DISTRIBUTIONS table are different for money market

funds – see below.)

NAV-to-NAV prices are used for all performance figures in the fact sheets (ie, no deductions are

made for initial charges, commissions or any other upfront fees). NAV prices are net of fund

management fees, but other annual fees that may apply (such as LISP fees or trailer commissions) are

not taken into account. This means that the performance figures will slightly overstate the rate of

return that would have been achieved by an investor paying initial charges, broker commission or LISP

fees (ie, the investor would have had a lower rate of return). Automatic reinvestment of dividends and

interest is assumed in all cases (see below).

For lump sum investments the rate of return is an annual compound rate for periods of more than a year.

For six months (generally only used for new funds with limited history) the absolute return is shown (ie, not

annualised). The growth in R1 000 over each period is also shown – this is an absolute figure.

For level monthly investments therateofreturnisthe monthly compound equivalent, calculated on

the actual month-end figures for each fund. In other words, the figure shows the equivalent annual

interest rate (paid monthly in arrears) that you would have to earn in a deposit or savings account to

achieve the same total return. The cash value of an investment of R100 per month over each period is

also given.

All rates of return are expressed as nominal (rather than effective) rates. This is consistent with the

way that interest rates are generally quoted in the retail banking environment in South Africa.

183

Profile’s Unit Trusts & Collective Investments — DOMESTIC