Page 189 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 189

Fact Sheet Tips

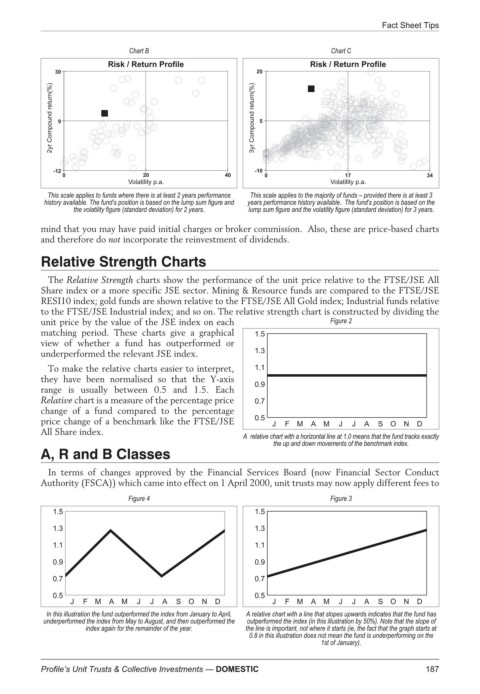

Chart B Chart C

30 20

9 5

-12 -10

20 40 17 34

This scale applies to funds where there is at least 2 years performance This scale applies to the majority of funds – provided there is at least 3

history available. The fund’s position is based on the lump sum figure and years performance history available. The fund’s position is based on the

the volatility figure (standard deviation) for 2 years. lump sum figure and the volatility figure (standard deviation) for 3 years.

mind that you may have paid initial charges or broker commission. Also, these are price-based charts

and therefore do not incorporate the reinvestment of dividends.

Relative Strength Charts

The Relative Strength charts show the performance of the unit price relative to the FTSE/JSE All

Share index or a more specific JSE sector. Mining & Resource funds are compared to the FTSE/JSE

RESI10 index; gold funds are shown relative to the FTSE/JSE All Gold index; Industrial funds relative

to the FTSE/JSE Industrial index; and so on. The relative strength chart is constructed by dividing the

unit price by the value of the JSE index on each Figure 2

matching period. These charts give a graphical

view of whether a fund has outperformed or

underperformed the relevant JSE index.

To make the relative charts easier to interpret,

they have been normalised so that the Y-axis

range is usually between 0.5 and 1.5. Each

Relative chart is a measure of the percentage price

change of a fund compared to the percentage

price change of a benchmark like the FTSE/JSE

All Share index.

A relative chart with a horizontal line at 1.0 means that the fund tracks exactly

the up and down movements of the benchmark index.

A, R and B Classes

In terms of changes approved by the Financial Services Board (now Financial Sector Conduct

Authority (FSCA)) which came into effect on 1 April 2000, unit trusts may now apply different fees to

Figure 4 Figure 3

In this illustration the fund outperformed the index from January to April, A relative chart with a line that slopes upwards indicates that the fund has

underperformed the index from May to August, and then outperformed the outperformed the index (in this illustration by 50%). Note that the slope of

index again for the remainder of the year. the line is important, not where it starts (ie, the fact that the graph starts at

0.8 in this illustration does not mean the fund is underperforming on the

1st of January).

187

Profile’s Unit Trusts & Collective Investments — DOMESTIC