Page 188 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 188

Fact Sheet Tips

Distributions and calculated yields are gross (ie, before deduction of DWT). After April 2012, the

actual historical yield enjoyed by an individual investor subject to DWT will therefore be slightly lower

than the yield shown in the fact sheet.

Note that a different methodology is used in the Distribution Tables in fact sheets for Money Market

funds. See the previous page for more information.

Risk/Return Profile

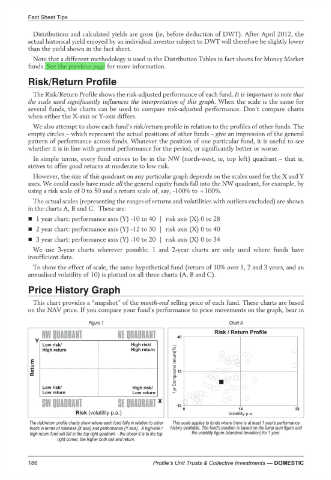

The Risk/Return Profile shows the risk-adjusted performance of each fund. It is important to note that

the scale used significantly influences the interpretation of this graph. When the scale is the same for

several funds, the charts can be used to compare risk-adjusted performance. Don’t compare charts

when either the X-axis or Y-axis differs.

We also attempt to show each fund’s risk/return profile in relation to the profiles of other funds. The

empty circles – which represent the actual positions of other funds – give an impression of the general

pattern of performance across funds. Whatever the position of one particular fund, it is useful to see

whether it is in line with general performance for the period, or significantly better or worse.

In simple terms, every fund strives to be in the NW (north-west, ie, top left) quadrant – that is,

strives to offer good returns at moderate to low risk.

However, the size of this quadrant on any particular graph depends on the scales used for the X and Y

axes. We could easily have made all the general equity funds fall into the NW quadrant, for example, by

using a risk scale of 0 to 50 and a return scale of, say, -100% to +100%.

The actual scales (representing the ranges of returns and volatilities with outliers excluded) are shown

in the charts A, B and C. These are:

1 year chart: performance axis (Y) -10 to 40 | risk axis (X) 0 to 28

2 year chart: performance axis (Y) -12 to 30 | risk axis (X) 0 to 40

3 year chart: performance axis (Y) -10 to 20 | risk axis (X) 0 to 34

We use 3-year charts wherever possible; 1 and 2-year charts are only used where funds have

insufficient data.

To show the effect of scale, the same hypothetical fund (return of 10% over 1, 2 and 3 years, and an

annualised volatility of 10) is plotted on all three charts (A, B and C).

Price History Graph

This chart provides a “snapshot” of the month-end selling price of each fund. These charts are based

on the NAV price. If you compare your fund’s performance to price movements on the graph, bear in

Figure 1 Chart A

40

15

-10

14 28

The risk/return profile charts show where each fund falls in relation to other This scale applies to funds where there is at least 1 year’s performance

funds in terms of riskiness (X axis) and performance (Y axis). A high-risk / history available. The fund’s position is based on the lump sum figure and

high return fund will fall in the top right quadrant – the closer it is to the top the volatility figure (standard deviation) for 1 year.

right corner, the higher both risk and return.

186 Profile’s Unit Trusts & Collective Investments — DOMESTIC