Page 232 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 232

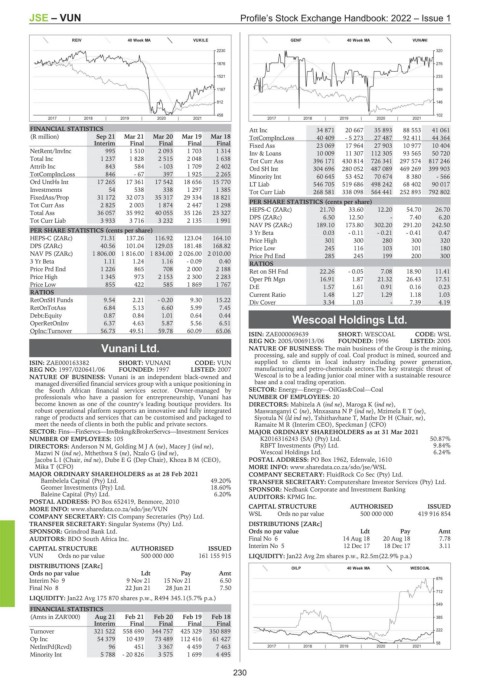

JSE – VUN Profile’s Stock Exchange Handbook: 2022 – Issue 1

REIV 40 Week MA VUKILE GENF 40 Week MA VUNANI

2230 320

1876 276

1521 233

1167 189

812 146

458 102

2017 | 2018 | 2019 | 2020 | 2021 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS Att Inc 34 871 20 667 35 893 88 553 41 061

(R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 TotCompIncLoss 40 409 - 5 273 27 487 92 411 44 364

Interim Final Final Final Final Fixed Ass 23 069 17 964 27 903 10 977 10 404

NetRent/InvInc 995 1 510 2 093 1 703 1 314 Inv & Loans 10 009 11 307 112 305 93 565 50 720

Total Inc 1 237 1 828 2 515 2 048 1 638 Tot Curr Ass 396 171 430 814 726 341 297 574 817 246

Attrib Inc 843 584 - 103 1 709 2 402 Ord SH Int 304 696 280 052 487 089 469 269 399 903

TotCompIncLoss 846 - 67 397 1 925 2 265 Minority Int 60 645 53 452 70 674 8 380 - 566

Ord UntHs Int 17 265 17 361 17 542 18 656 15 770 LT Liab 546 705 519 686 498 242 68 402 90 017

Investments 54 538 338 1 297 1 385 Tot Curr Liab 268 581 338 098 564 441 252 893 792 802

FixedAss/Prop 31 172 32 073 35 317 29 334 18 821

Tot Curr Ass 2 825 2 003 1 874 2 447 1 298 PER SHARE STATISTICS (cents per share)

Total Ass 36 057 35 992 40 055 35 126 23 327 HEPS-C (ZARc) 21.70 33.60 12.20 - 54.70 26.70

DPS (ZARc)

7.40

6.50

12.50

6.20

Tot Curr Liab 3 933 3 716 3 232 2 135 1 991

NAV PS (ZARc) 189.10 173.80 302.20 291.20 242.50

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.03 - 0.11 - 0.21 - 0.41 0.47

HEPS-C (ZARc) 71.31 137.26 116.92 123.04 164.10 Price High 301 300 280 300 320

DPS (ZARc) 40.56 101.04 129.03 181.48 168.82 Price Low 245 116 103 101 180

NAV PS (ZARc) 1 806.00 1 816.00 1 834.00 2 026.00 2 010.00

Price Prd End 285 245 199 200 300

3 Yr Beta 1.11 1.24 1.16 - 0.09 0.40 RATIOS

Price Prd End 1 226 865 708 2 000 2 188 Ret on SH Fnd 22.26 - 0.05 7.08 18.90 11.41

Price High 1 345 973 2 153 2 300 2 283 Oper Pft Mgn 16.91 1.87 21.32 26.43 17.51

Price Low 855 422 585 1 869 1 767 D:E 1.57 1.61 0.91 0.16 0.23

RATIOS Current Ratio 1.48 1.27 1.29 1.18 1.03

RetOnSH Funds 9.54 2.21 - 0.20 9.30 15.22 Div Cover 3.34 1.03 - 7.39 4.19

RetOnTotAss 6.84 5.13 6.60 5.99 7.45

Debt:Equity 0.87 0.84 1.01 0.64 0.44

OperRetOnInv 6.37 4.63 5.87 5.56 6.51 Wescoal Holdings Ltd.

OpInc:Turnover 56.73 49.51 59.78 60.09 65.06 WES

ISIN: ZAE000069639 SHORT: WESCOAL CODE: WSL

REG NO: 2005/006913/06 FOUNDED: 1996 LISTED: 2005

Vunani Ltd. NATURE OF BUSINESS: The main business of the Group is the mining,

processing, sale and supply of coal. Coal product is mined, sourced and

VUN

ISIN: ZAE000163382 SHORT: VUNANI CODE: VUN supplied to clients in local industry including power generation,

REG NO: 1997/020641/06 FOUNDED: 1997 LISTED: 2007 manufacturing and petro-chemicals sectors.The key strategic thrust of

NATURE OF BUSINESS: Vunani is an independent black-owned and Wescoal is to be a leading junior coal miner with a sustainable resource

managed diversified financial services group with a unique positioning in base and a coal trading operation.

the South African financial services sector. Owner-managed by SECTOR: Energy—Energy—OilGas&Coal—Coal

professionals who have a passion for entrepreneurship, Vunani has NUMBER OF EMPLOYEES: 20

become known as one of the country’s leading boutique providers. Its DIRECTORS: Mabizela A (ind ne), Maroga K (ind ne),

robust operational platform supports an innovative and fully integrated Maswanganyi C (ne), MnxasanaNP(ind ne), MzimelaET(ne),

range of products and services that can be customised and packaged to Siyotula N (ld ind ne), Tshithavhane T, Mathe Dr H (Chair, ne),

meet the needs of clients in both the public and private sectors. Ramaite M R (Interim CEO), Speckman J (CFO)

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

NUMBER OF EMPLOYEES: 105 K2016316243 (SA) (Pty) Ltd. 50.87%

DIRECTORS: Anderson N M, GoldingMJA(ne), Macey J (ind ne), RBFT Investments (Pty) Ltd. 9.84%

Mazwi N (ind ne), Mthethwa S (ne), Nzalo G (ind ne), Wescoal Holdings Ltd. 6.24%

Jacobs L I (Chair, ind ne), Dube E G (Dep Chair), Khoza B M (CEO), POSTAL ADDRESS: PO Box 1962, Edenvale, 1610

Mika T (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/WSL

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

Bambelela Capital (Pty) Ltd. 49.20% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Geomer Investments (Pty) Ltd. 18.60% SPONSOR: Nedbank Corporate and Investment Banking

Baleine Capital (Pty) Ltd. 6.20% AUDITORS: KPMG Inc.

POSTAL ADDRESS: PO Box 652419, Benmore, 2010

MORE INFO: www.sharedata.co.za/sdo/jse/VUN CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. WSL Ords no par value 500 000 000 419 916 854

TRANSFER SECRETARY: Singular Systems (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Grindrod Bank Ltd. Ords no par value Ldt Pay Amt

AUDITORS: BDO South Africa Inc. Final No 6 14 Aug 18 20 Aug 18 7.78

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 5 12 Dec 17 18 Dec 17 3.11

VUN Ords no par value 500 000 000 161 155 915 LIQUIDITY: Jan22 Avg 2m shares p.w., R2.5m(22.9% p.a.)

DISTRIBUTIONS [ZARc]

OILP 40 Week MA WESCOAL

Ords no par value Ldt Pay Amt

Interim No 9 9 Nov 21 15 Nov 21 6.50 876

Final No 8 22 Jun 21 28 Jun 21 7.50

712

LIQUIDITY: Jan22 Avg 175 870 shares p.w., R494 345.1(5.7% p.a.)

549

FINANCIAL STATISTICS

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 385

Interim Final Final Final Final

Turnover 321 522 558 690 344 757 425 329 350 889 222

Op Inc 54 379 10 439 73 489 112 416 61 427

58

NetIntPd(Rcvd) 96 451 3 367 4 459 7 463 2017 | 2018 | 2019 | 2020 | 2021

Minority Int 5 788 - 20 826 3 575 1 699 4 495

230