Page 119 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 119

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – DIS

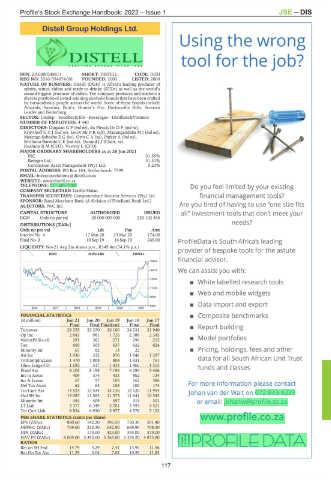

Distell Group Holdings Ltd.

DIS

ISIN: ZAE000248811 SHORT: DISTELL CODE: DGH

REG NO: 2016/394974/06 FOUNDED: 2000 LISTED: 2000

NATURE OF BUSINESS: Distell (DGH) is Africa’s leading producer of

spirits, wines, ciders and ready-to-drinks (RTDs) as well as the world’s

second biggest producer of ciders. The company produces and markets a

diverse portfolio of award-winning alcoholic brands that have been crafted

by extraordinary people across the world. Some of these brands include

Amarula, Savanna, Bain’s, Hunter’s Dry, Durbanville Hills, Scottish

Leader and Nederburg.

SECTOR: CnsStp—FoodBev&Tob—Beverages—Distillers&Vintners

NUMBER OF EMPLOYEES: 4 440

DIRECTORS: DingaanGP(ind ne), du Plessis DrDP(ind ne),

KruythoffGCJ(ind ne), Louw MrPR(alt), MadungandabaMJ(ind ne),

Matenge-SebeshoEG(ne), OttoCA(ne), Parker A (ind ne),

Sevillano-BarredoCE(ind ne), Durand J J (Chair, ne),

Rushton R M (CEO), Verwey L (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 26 Jun 2021

PIC 31.55%

Remgro Ltd. 31.31%

Coronation Asset Management (Pty) Ltd. 5.23%

POSTAL ADDRESS: PO Box 184, Stellenbosch, 7599

EMAIL: investor.relations@distell.co.za

WEBSITE: www.distell.co.za

TELEPHONE: 021-809-7000

COMPANY SECRETARY: Lizelle Malan

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DGH Ords no par val 20 000 000 000 223 102 356

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Interim No 4 17 Mar 20 23 Mar 20 174.00

Final No 3 10 Sep 19 16 Sep 19 249.00

LIQUIDITY: Nov21 Avg 2m shares p.w., R349.4m(54.1% p.a.)

BEVR 40 Week MA DISTELL

18900

16412

13924

11436

8948

6460

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final Final

Turnover 28 255 22 370 26 180 24 231 21 940

Op Inc 2 843 981 1 726 2 388 2 345

NetIntPd(Rcvd) 291 381 271 296 215

Tax 669 305 637 632 624

Minority Int 67 82 13 22 -

Att Inc 1 936 312 870 1 646 1 297

TotCompIncLoss 1 470 1 008 804 1 931 761

Hline Erngs-CO 1 692 517 1 433 1 466 1 553

Fixed Ass 8 103 8 198 7 196 6 290 5 466

Inv in Assoc 409 374 433 862 134

Inv & Loans 67 57 105 162 386

Def Tax Asset 62 63 108 100 174

Tot Curr Ass 14 523 13 534 13 136 12 120 11 994

Ord SH Int 13 087 11 583 11 573 11 641 10 542

Minority Int 454 409 357 315 301

LT Liab 3 377 6 349 5 701 5 593 4 521

Tot Curr Liab 8 834 6 930 5 977 4 578 5 122

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 880.60 142.20 396.50 750.30 591.40

HEPS-C (ZARc) 769.60 235.30 652.90 669.90 708.30

DPS (ZARc) - 174.00 423.00 395.00 379.00

NAV PS (ZARc) 6 069.00 5 393.00 5 365.00 5 376.20 4 875.90

RATIOS

Ret on SH Fnd 14.79 3.29 7.41 13.95 11.96

Ret On Tot Ass 11.29 3.04 7.02 10.59 11.83

117