Page 116 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 116

JSE – DEL Profile’s Stock Exchange Handbook: 2022 – Issue 1

DIRECTORS: Ahmed M H (ld ind ne), Govender T G (ne), Jappie N (ind ne),

Delta Property Fund Ltd. Mahloma F K (ind ne), Shaik Y (ne), Copelyn J A (Chair, ne), Queen S A

(CEO), Duncan D (COO), Wege G (FD)

DEL

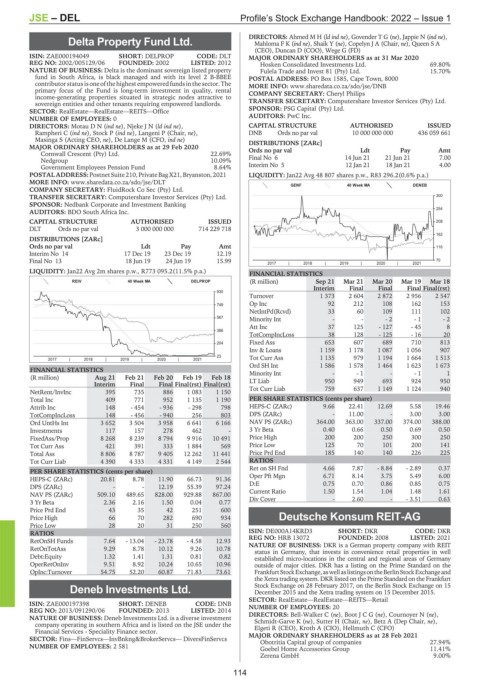

ISIN: ZAE000194049 SHORT: DELPROP CODE: DLT MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

REG NO: 2002/005129/06 FOUNDED: 2002 LISTED: 2012 Hosken Consolidated Investments Ltd. 69.80%

NATURE OF BUSINESS: Delta is the dominant sovereign listed property Fulela Trade and Invest 81 (Pty) Ltd. 15.70%

fund in South Africa, is black managed and with its level 2 B-BBEE POSTAL ADDRESS: PO Box 1585, Cape Town, 8000

contributor statusisoneofthe highest empoweredfundsinthe sector.The MORE INFO: www.sharedata.co.za/sdo/jse/DNB

primary focus of the Fund is long-term investment in quality, rental COMPANY SECRETARY: Cheryl Philips

income-generating properties situated in strategic nodes attractive to

sovereign entities and other tenants requiring empowered landlords. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SECTOR: RealEstate—RealEstate—REITS—Office SPONSOR: PSG Capital (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 AUDITORS: PwC Inc.

DIRECTORS: MotauDN(ind ne), NjekeJN(ld ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Rampheri C (ind ne), Stock P (ind ne), Langeni P (Chair, ne), DNB Ords no par val 10 000 000 000 436 059 661

Masinga S (Acting CEO, ne), De Lange M (CFO, ind ne) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Cornwall Crescent (Pty) Ltd. 22.69% Ords no par val Ldt Pay Amt

Nedgroup 10.09% Final No 6 14 Jun 21 21 Jun 21 7.00

Government Employees Pension Fund 8.64% Interim No 5 12 Jan 21 18 Jan 21 4.00

POSTAL ADDRESS:PostnetSuite210, PrivateBagX21,Bryanston,2021 LIQUIDITY: Jan22 Avg 48 807 shares p.w., R83 296.2(0.6% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/DLT

GENF 40 Week MA DENEB

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 300

SPONSOR: Nedbank Corporate and Investment Banking

254

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 208

DLT Ords no par val 3 000 000 000 714 229 718

162

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt 116

Interim No 14 17 Dec 19 23 Dec 19 12.19

Final No 13 18 Jun 19 24 Jun 19 15.99 2017 | 2018 | 2019 | 2020 | 2021 70

LIQUIDITY: Jan22 Avg 2m shares p.w., R773 095.2(11.5% p.a.) FINANCIAL STATISTICS

REIV 40 Week MA DELPROP (R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18

Interim Final Final Final Final(rst)

930

Turnover 1 373 2 604 2 872 2 956 2 547

749 Op Inc 92 212 108 162 153

NetIntPd(Rcvd) 33 60 109 111 102

Minority Int - - - 2 - 1 - 2

567

Att Inc 37 125 - 127 - 45 8

386

TotCompIncLoss 38 128 - 125 - 16 20

204 Fixed Ass 653 607 689 710 813

Inv & Loans 1 159 1 178 1 087 1 056 907

23 Tot Curr Ass 1 135 979 1 194 1 664 1 513

2017 | 2018 | 2019 | 2020 | 2021

Ord SH Int 1 586 1 578 1 464 1 623 1 673

FINANCIAL STATISTICS Minority Int - - 1 - - 1 1

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 LT Liab 950 949 693 924 950

Interim Final Final Final(rst) Final(rst)

NetRent/InvInc 395 735 886 1 083 1 150 Tot Curr Liab 759 637 1 149 1 124 940

Total Inc 409 771 952 1 135 1 190 PER SHARE STATISTICS (cents per share)

Attrib Inc 148 - 454 - 936 - 298 798 HEPS-C (ZARc) 9.66 22.41 12.69 5.58 19.46

TotCompIncLoss 148 - 456 - 940 256 803 DPS (ZARc) - 11.00 - 3.00 3.00

Ord UntHs Int 3 652 3 504 3 958 6 641 6 166 NAV PS (ZARc) 364.00 363.00 337.00 374.00 388.00

Investments 117 157 278 462 - 3 Yr Beta 0.40 0.66 0.50 0.69 0.50

FixedAss/Prop 8 268 8 239 8 794 9 916 10 491 Price High 200 200 250 300 250

Tot Curr Ass 421 391 333 1 884 569 Price Low 125 70 101 200 141

Total Ass 8 806 8 787 9 405 12 262 11 441 Price Prd End 185 140 140 226 225

Tot Curr Liab 4 390 4 333 4 331 4 149 2 544 RATIOS

Ret on SH Fnd 4.66 7.87 - 8.84 - 2.89 0.37

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 20.81 8.78 11.90 66.73 91.36 Oper Pft Mgn 6.71 8.14 3.75 5.49 6.00

DPS (ZARc) - - 12.19 55.39 97.24 D:E 0.75 0.70 0.86 0.85 0.75

NAV PS (ZARc) 509.10 489.65 828.00 929.88 867.00 Current Ratio 1.50 1.54 1.04 1.48 1.61

3 Yr Beta 2.36 2.16 1.50 0.04 0.77 Div Cover - 2.60 - - 3.51 0.63

Price Prd End 43 35 42 251 600

Price High 66 70 282 690 934 Deutsche Konsum REIT-AG

Price Low 28 20 31 250 560 DEU

RATIOS ISIN: DE000A14KRD3 SHORT: DKR CODE: DKR

RetOnSH Funds 7.64 - 13.04 - 23.78 - 4.58 12.93 REG NO: HRB 13072 FOUNDED: 2008 LISTED: 2021

NATURE OF BUSINESS: DKR is a German property company with REIT

RetOnTotAss 9.29 8.78 10.12 9.26 10.78 status in Germany, that invests in convenience retail properties in well

Debt:Equity 1.32 1.41 1.31 0.81 0.82 established micro-locations in the central and regional areas of Germany

OperRetOnInv 9.51 8.92 10.24 10.65 10.96 outside of major cities. DKR has a listing on the Prime Standard on the

OpInc:Turnover 54.75 52.20 60.87 71.83 73.61 FrankfurtStockExchange,aswellaslistingsontheBerlinStockExchangeand

the Xetra trading system. DKR listed on the Prime Standard on the Frankfurt

Deneb Investments Ltd. Stock Exchange on 28 February 2017, on the Berlin Stock Exchange on 15

December 2015 and the Xetra trading system on 15 December 2015.

DEN SECTOR: RealEstate—RealEstate—REITS—Retail

ISIN: ZAE000197398 SHORT: DENEB CODE: DNB NUMBER OF EMPLOYEES: 20

REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014 DIRECTORS: Bell-Walker C (ne), BootJCG(ne), Cournoyer N (ne),

NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment Schmidt-Garve K (ne), Sutter H (Chair, ne), Betz A (Dep Chair, ne),

company operating in southern Africa and is listed on the JSE under the Elgeti R (CEO), Kroth A (CIO), Hellmuth C (CFO)

Financial Services - Speciality Finance sector.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 27.94%

Obotritia Capital group of companies

NUMBER OF EMPLOYEES: 2 581 Goebel Home Accessories Group 11.41%

Zerena GmbH 9.00%

114