Page 124 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 124

JSE – EPP Profile’s Stock Exchange Handbook: 2022 – Issue 1

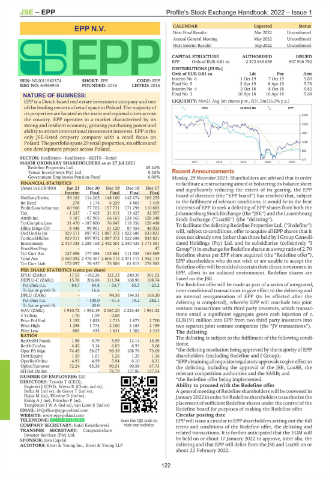

EPP N.V. CALENDAR Expected Status

Next Final Results Mar 2022 Unconfirmed

EPP

Annual General Meeting May 2022 Unconfirmed

Next Interim Results Sep 2022 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EPP Ords of EUR 0.81 ea 2 572 645 659 907 946 792

DISTRIBUTIONS [EURc]

Ords of EUR 0.81 ea Ldt Pay Amt

Interim No 6 1 Oct 19 7 Oct 19 5.80

ISIN: NL0011983374 SHORT: EPP CODE: EPP

REG NO: 64965945 FOUNDED: 2016 LISTED: 2016 Final No 5 2 Apr 19 8 Apr 19 5.78

Interim No 4 2 Oct 18 8 Oct 18 5.82

NATURE OF BUSINESS: Final No 3 10 Apr 18 16 Apr 18 5.68

EPP is a Dutch based real estate investment company and one LIQUIDITY: Nov21 Avg 3m shares p.w., R31.5m(16.3% p.a.)

of the leading owners of retail space in Poland. The majority of

its properties are located in the main and regional cities across

the country. EPP operates in a market characterised by its

strong and resilient economy, growing purchasing power and

ability to attract international investment interests. EPP is the

only JSE-listed property company with a retail focus on

Poland.The portfoliospans29retailproperties, sixofficesand

one development project across Poland.

SECTOR: RealEstate—RealEstate—REITS—Retail

MAJOR ORDINARY SHAREHOLDERS as at 27 Jul 2021

Redefine Properties Ltd. 45.44%

Tensai Investments Pty) Ltd. 8.26% Recent Announcements

Government Employees Pension Fund 6.00% Monday, 29 November 2021: Shareholders are advised that in order

FINANCIAL STATISTICS to facilitate a restructuring aimed at bolstering its balance sheet

(Amts in EUR’000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 and significantly reducing the extent of its gearing, the EPP

Interim Final Final Final Final

NetRent/InvInc 59 163 114 205 148 100 142 674 103 255 board of directors (the “EPP board”) has resolved that, subject

Int Recd 278 1 174 6 229 4 865 7 419 to the fulfilment of relevant conditions, it would be in the best

Profit/Loss before tax 60 968 77 705 157 731 171 298 110 883 interests of EPP to seek a delisting of EPP shares from both the

Tax - 1 237 - 7 405 21 615 13 427 32 557 Johannesburg Stock Exchange (the “JSE”) and the Luxembourg

Attrib Inc 9 187 - 87 905 66 165 124 165 128 348 Stock Exchange (“LuxSE”) (the “delisting”).

TotCompIncLoss 31 470 - 187 800 76 047 118 356 128 498 To facilitate the delisting Redefine Properties Ltd. (“Redefine”)

Hline Erngs-CO 8 446 99 961 61 120 87 454 46 053

Ord UntHs Int 929 511 897 972 1 087 372 1 022 688 833 821 will, subject to conditions, offer to acquire all EPP shares that it

TotStockHldInt 929 511 897 972 1 087 372 1 022 688 833 821 does not already own (other than those held by I Group Consoli-

Investments 2 410 338 2 288 168 2 492 501 2 340 435 1 771 581 dated Holdings (Pty) Ltd. and its subsidiaries (collectively “I

FixedAss/Prop - - - - 47 Group”)) in exchange for Redefine shares at a swap ratio of 2.70

Tot Curr Ass 127 696 177 484 105 661 111 355 154 569 Redefine shares per EPP share acquired (the “Redefine offer”).

Total Ass 2 550 092 2 476 367 2 606 715 2 471 715 1 952 114 EPP shareholders who do not wish or are unable to accept the

Tot Curr Liab 172 097 76 437 75 506 61 815 176 583

Redefineofferwillbeentitledtoretaintheirdirectinvestmentin

PER SHARE STATISTICS (cents per share)

EPLU (ZARc) 17.53 - 182.26 121.33 240.39 301.02 EPP, albeit in an unlisted environment. Redefine shares are

HEPLU-C (ZARc) 15.78 206.88 111.94 168.90 108.74 listed on the JSE.

Pct chng p.a. - 84.7 84.8 - 33.7 55.3 - 23.2 The Redefine offer will be made as part of a series of integrated,

Tr 5yr av grwth % - 16.6 - - - inter-conditional transactions to give effect to the delisting and

DPLU (ZARc) - - 94.36 194.51 163.20 an internal reorganisation of EPP (to be effected after the

Pct chng p.a. - - 100.0 - 51.5 19.2 282.1 delisting is completed), whereby EPP will conclude two joint

Tr 5yr av grwth % - 30.0 - - -

NAV (ZARc) 1 910.72 1 952.19 2 067.20 2 223.45 1 961.52 venture transactions with third party investors, which transac-

3 Yr Beta 1.76 1.59 - 0.08 - - tions entail a significant aggregate gross cash injection of c.

Price Prd End 1 135 1 035 1 715 1 875 1 700 EUR191 million into EPP from two third party investors into

Price High 1 298 1 774 2 100 2 183 2 199 two separate joint venture companies (the “JV transactions”).

Price Low 885 434 1 631 1 382 1 315 The delisting

RATIOS The delisting is subject to the fulfilment of the following condi-

RetOnSH Funds 1.98 - 9.79 5.99 12.14 15.39

RetOnTotAss 4.42 3.14 6.05 6.93 5.68 tions:

Oper Pft Mgn 74.45 58.07 96.39 108.76 73.09 *the delisting resolution being approved by the majority of EPP

Debt:Equity 1.59 1.61 1.26 1.29 1.16 shareholders (excluding Redefine and I Group);

OperRetOnInv 4.91 4.99 5.94 6.10 6.21 *EPPobtainingallrequisiteregulatoryapprovalstogiveeffectto

OpInc:Turnover 72.24 85.35 90.51 90.58 67.73 the delisting, including the approval of the JSE, LuxSE, the

SH Ret On Inv - - 78.79 157.86 137.54 relevant competition authorities and the SARB; and

NUMBER OF EMPLOYEES: 220 *the Redefine offer being implemented.

DIRECTORS: Trzoslo T (CEO),

Baginski J (CFO), Weisz R (Chair, ind ne), Ability to proceed with the Redefine offer

Belka M (ind ne), de Groot T (ind ne), A general meeting of Redefine shareholders will be convened in

Dyjas M (ne), Ellerine D (ind ne), January2022inorderforRedefineshareholders toauthorisethe

KonigAJ(ne), Prinsloo P (ne),

TempletonJWA(ind ne), van Loon S (ind ne) placement of sufficient Redefine shares under the control of the

EMAIL: HQoffice@epp-poland.com Redefine board for purposes of making the Redefine offer.

WEBSITE: www.epp-poland.com Circular posting date

TELEPHONE: 004822-221-7110 Scan the QR code to EPP will issue a circular to EPP shareholders setting out the full

COMPANY SECRETARY: Rafal Kwiatkowski visit our website terms and conditions of the Redefine offer, the delisting and

TRANSFER SECRETARY: Computershare related transactions. It is further anticipated that the EGM will

Investor Services (Pty) Ltd.

SPONSOR: Java Capital be held on or about 17 January 2022 to approve, inter alia, the

AUDITORS: Ernst & Young Inc., Ernst & Young LLP delisting and that EPP will delist from the JSE and LuxSE on or

about 22 February 2022.

122