Page 115 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 115

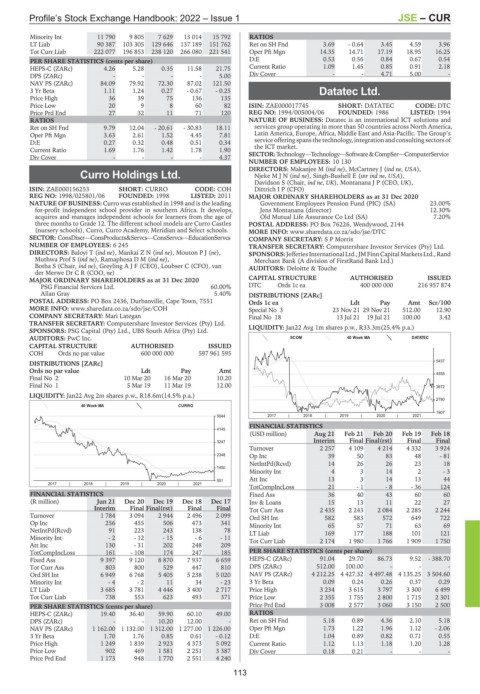

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – CUR

Minority Int 11 790 9 805 7 629 13 014 15 792 RATIOS

LT Liab 90 387 103 305 129 646 137 189 151 762 Ret on SH Fnd 3.69 - 0.64 3.45 4.59 3.96

Tot Curr Liab 222 077 196 853 238 120 266 080 221 541 Oper Pft Mgn 14.35 14.71 17.19 18.95 16.25

PER SHARE STATISTICS (cents per share) D:E 0.53 0.56 0.84 0.67 0.54

HEPS-C (ZARc) 4.26 5.28 0.35 11.58 21.75 Current Ratio 1.09 1.45 0.85 0.91 2.18

DPS (ZARc) - - - - 5.00 Div Cover - - 4.71 5.00 -

NAV PS (ZARc) 84.09 79.92 72.30 87.02 121.50

3 Yr Beta 1.11 1.24 0.27 - 0.67 - 0.25 Datatec Ltd.

Price High 36 39 75 136 135

DAT

Price Low 20 9 8 60 82 ISIN: ZAE000017745 SHORT: DATATEC CODE: DTC

Price Prd End 27 32 11 71 120 REG NO: 1994/005004/06 FOUNDED: 1986 LISTED: 1994

RATIOS NATURE OF BUSINESS: Datatec is an international ICT solutions and

Ret on SH Fnd 9.79 12.04 - 20.61 - 30.83 18.11 services group operating in more than 50 countries across North America,

Oper Pft Mgn 3.63 2.61 1.52 4.45 7.81 Latin America, Europe, Africa, Middle East and Asia-Pacific. The Group’s

D:E 0.27 0.32 0.48 0.51 0.34 service offering spansthe technology, integration andconsulting sectors of

the ICT market.

Current Ratio 1.69 1.76 1.42 1.78 1.90 SECTOR:Technology—Technology—Software&CompSer—ComputerService

Div Cover - - - - 4.37

NUMBER OF EMPLOYEES: 10 130

DIRECTORS: Makanjee M (ind ne), McCartney J (ind ne, USA),

Curro Holdings Ltd. NjekeMJN(ind ne), Singh-Bushell E (snr ind ne, USA),

Davidson S (Chair, ind ne, UK), Montanana J P (CEO, UK),

CUR

ISIN: ZAE000156253 SHORT: CURRO CODE: COH Dittrich I P (CFO)

REG NO: 1998/025801/06 FOUNDED: 1998 LISTED: 2011 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

NATURE OF BUSINESS: Curro was established in 1998 and is the leading Government Employees Pension Fund (PIC) (SA) 23.00%

for-profit independent school provider in southern Africa. It develops, Jens Montanana (director) 12.30%

acquires and manages independent schools for learners from the age of Old Mutual Life Assurance Co Ltd (SA) 7.20%

three months to Grade 12. The different school models are Curro Castles POSTAL ADDRESS: PO Box 76226, Wendywood, 2144

(nursery schools), Curro, Curro Academy, Meridian and Select schools. MORE INFO: www.sharedata.co.za/sdo/jse/DTC

SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—EducationServcs COMPANY SECRETARY: S P Morris

NUMBER OF EMPLOYEES: 6 245 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Baloyi T (ind ne), MankaiZN(ind ne), MoutonPJ(ne), SPONSORS:JefferiesInternationalLtd.,JMFinnCapitalMarketsLtd.,Rand

Muthwa Prof S (ind ne), RamaphosaDM(ind ne), Merchant Bank (A division of FirstRand Bank Ltd.)

Botha S (Chair, ind ne), GreylingAJF (CEO), Loubser C (CFO), van AUDITORS: Deloitte & Touche

der Merwe Dr C R (COO, ne)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

PSG Financial Services Ltd. 60.00% DTC Ords 1c ea 400 000 000 216 957 874

Allan Gray 5.40% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 2436, Durbanville, Cape Town, 7551 Ords 1c ea Ldt Pay Amt Scr/100

MORE INFO: www.sharedata.co.za/sdo/jse/COH Special No 3 23 Nov 21 29 Nov 21 512.00 12.90

COMPANY SECRETARY: Mari Lategan Final No 18 13 Jul 21 19 Jul 21 100.00 3.42

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan22 Avg 1m shares p.w., R33.3m(25.4% p.a.)

SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd.

AUDITORS: PwC Inc. SCOM 40 Week MA DATATEC

CAPITAL STRUCTURE AUTHORISED ISSUED

COH Ords no par value 600 000 000 597 961 595

5437

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 2 10 Mar 20 16 Mar 20 10.20 4555

Final No 1 5 Mar 19 11 Mar 19 12.00 3672

LIQUIDITY: Jan22 Avg 2m shares p.w., R18.6m(14.5% p.a.)

2790

40 Week MA CURRO

1907

5044 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

4145

(USD million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

Interim Final Final(rst) Final Final

3247

Turnover 2 257 4 109 4 214 4 332 3 924

2348 Op Inc 39 50 83 48 - 81

NetIntPd(Rcvd) 14 26 26 23 18

1450

Minority Int 4 3 14 2 - 3

Att Inc 13 3 14 13 44

551

2017 | 2018 | 2019 | 2020 | 2021

TotCompIncLoss 21 - 1 - 8 - 36 124

FINANCIAL STATISTICS Fixed Ass 36 40 43 60 60

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Inv & Loans 15 13 11 22 27

Interim Final Final(rst) Final Final Tot Curr Ass 2 435 2 243 2 084 2 285 2 244

Turnover 1 784 3 094 2 944 2 496 2 099 Ord SH Int 582 583 572 649 722

Op Inc 256 455 506 473 341 Minority Int 65 57 71 63 69

NetIntPd(Rcvd) 91 223 243 138 78 LT Liab 169 177 188 101 121

Minority Int - 2 - 12 - 15 - 6 - 11 Tot Curr Liab 2 174 1 980 1 766 1 909 1 750

Att Inc 130 - 31 202 248 209

TotCompIncLoss 161 - 108 174 247 185 PER SHARE STATISTICS (cents per share)

Fixed Ass 9 397 9 120 8 870 7 937 6 659 HEPS-C (ZARc) 91.04 29.70 86.73 9.52 - 388.70

Tot Curr Ass 803 800 529 447 810 DPS (ZARc) 512.00 100.00 - - -

Ord SH Int 6 949 6 768 5 405 5 238 5 020 NAV PS (ZARc) 4 212.25 4 427.32 4 497.48 4 135.25 3 504.60

Minority Int - 4 - 2 11 34 - 23 3 Yr Beta 0.09 0.24 0.26 0.37 0.29

LT Liab 3 685 3 781 4 446 3 400 2 717 Price High 3 234 3 615 3 797 3 300 6 499

Tot Curr Liab 738 553 623 493 371 Price Low 2 355 1 755 2 800 1 715 2 301

PER SHARE STATISTICS (cents per share) Price Prd End 3 008 2 577 3 060 3 150 2 500

HEPS-C (ZARc) 19.40 36.40 59.90 60.10 49.00 RATIOS

DPS (ZARc) - - 10.20 12.00 - Ret on SH Fnd 5.18 0.89 4.36 2.10 5.18

NAV PS (ZARc) 1 162.00 1 132.00 1 312.00 1 277.00 1 226.00 Oper Pft Mgn 1.73 1.22 1.96 1.12 - 2.06

3 Yr Beta 1.70 1.76 0.85 0.61 - 0.12 D:E 1.04 0.89 0.82 0.71 0.55

Price High 1 249 1 839 2 923 4 373 5 092 Current Ratio 1.12 1.13 1.18 1.20 1.28

Price Low 902 469 1 581 2 251 3 387 Div Cover 0.18 0.21 - - -

Price Prd End 1 173 948 1 770 2 551 4 240

113