Page 111 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 111

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – CLI

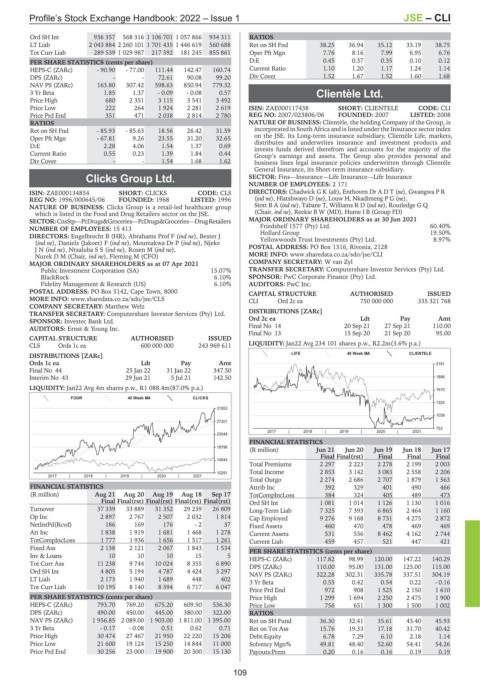

Ord SH Int 936 357 568 316 1 106 701 1 057 866 934 311 RATIOS

LT Liab 2 043 884 2 260 101 1 701 435 1 446 619 560 688 Ret on SH Fnd 38.25 36.94 35.12 33.19 38.75

Tot Curr Liab 289 539 1 029 987 217 592 181 245 855 861 Oper Pft Mgn 7.76 8.16 7.99 6.95 6.76

PER SHARE STATISTICS (cents per share) D:E 0.45 0.37 0.35 0.10 0.12

HEPS-C (ZARc) - 90.90 - 77.00 111.44 142.47 160.74 Current Ratio 1.10 1.20 1.17 1.24 1.14

DPS (ZARc) - - 72.61 90.08 99.20 Div Cover 1.52 1.67 1.52 1.60 1.68

NAV PS (ZARc) 163.80 307.42 598.63 850.94 779.32

3 Yr Beta 1.85 1.37 - 0.09 - 0.08 0.57 Clientèle Ltd.

Price High 680 2 351 3 115 3 541 3 492

CLI

Price Low 222 264 1 924 2 281 2 619 ISIN: ZAE000117438 SHORT: CLIENTELE CODE: CLI

Price Prd End 351 471 2 038 2 814 2 780 REG NO: 2007/023806/06 FOUNDED: 2007 LISTED: 2008

RATIOS NATURE OF BUSINESS: Clientèle, the holding Company of the Group, is

Ret on SH Fnd - 85.93 - 85.63 18.56 26.42 31.59 incorporated in South Africa and is listed under the Insurance sector index

Oper Pft Mgn - 67.81 9.26 23.55 31.20 32.65 on the JSE. Its Long-term insurance subsidiary, Clientèle Life, markets,

D:E 2.28 4.06 1.54 1.37 0.69 distributes and underwrites insurance and investment products and

invests funds derived therefrom and accounts for the majority of the

Current Ratio 0.55 0.23 1.39 1.84 0.44 Group’s earnings and assets. The Group also provides personal and

Div Cover - - 1.54 1.68 1.62 business lines legal insurance policies underwritten through Clientèle

General Insurance, its Short-term insurance subsidiary.

Clicks Group Ltd. SECTOR: Fins—Insurance—Life Insurance—Life Insurance

NUMBER OF EMPLOYEES: 2 171

CLI

ISIN: ZAE000134854 SHORT: CLICKS CODE: CLS DIRECTORS: Chadwick G K (alt), Enthoven Dr A D T (ne), Gwangwa P R

REG NO: 1996/000645/06 FOUNDED: 1968 LISTED: 1996 (ind ne), Hlatshwayo D (ne), Louw H, Nkadimeng P G (ne),

NATURE OF BUSINESS: Clicks Group is a retail-led healthcare group Stott B A (ind ne), Tabane T, Williams R D (ind ne), Routledge G Q

which is listed in the Food and Drug Retailers sector on the JSE. (Chair, ind ne), Reekie B W (MD), Hume I B (Group FD)

SECTOR:CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—DrugRetailers MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

NUMBER OF EMPLOYEES: 15 413 Friedshelf 1577 (Pty) Ltd. 60.40%

19.50%

Hollard Group

DIRECTORS: Engelbrecht B (HR), Abrahams Prof F (ind ne), Bester J Yellowwoods Trust Investments (Pty) Ltd. 8.97%

(ind ne), Daniels (Jakoet) F (ind ne), Moumakwa Dr P (ind ne), Njeke

JN(ind ne), NtsalubaSS(ind ne), Rosen M (ind ne), POSTAL ADDRESS: PO Box 1316, Rivonia, 2128

Nurek D M (Chair, ind ne), Fleming M (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/CLI

MAJOR ORDINARY SHAREHOLDERS as at 07 Apr 2021 COMPANY SECRETARY: W van Zyl

Public Investment Corporation (SA) 15.07% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

BlackRock 6.10% SPONSOR: PwC Corporate Finance (Pty) Ltd.

Fidelity Management & Research (US) 6.10% AUDITORS: PwC Inc.

POSTAL ADDRESS: PO Box 5142, Cape Town, 8000 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/CLS CLI Ord 2c ea 750 000 000 335 321 768

COMPANY SECRETARY: Matthew Welz

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Investec Bank Ltd. Ord2cea Ldt Pay Amt

AUDITORS: Ernst & Young Inc. Final No 14 20 Sep 21 27 Sep 21 110.00

Final No 13 15 Sep 20 21 Sep 20 95.00

CAPITAL STRUCTURE AUTHORISED ISSUED

CLS Ords 1c ea 600 000 000 243 969 611 LIQUIDITY: Jan22 Avg 234 101 shares p.w., R2.2m(3.6% p.a.)

DISTRIBUTIONS [ZARc] LIFE 40 Week MA CLIENTELE

Ords 1c ea Ldt Pay Amt 2181

Final No 44 25 Jan 22 31 Jan 22 347.50

Interim No 43 29 Jun 21 5 Jul 21 142.50 1896

LIQUIDITY: Jan22 Avg 4m shares p.w., R1 088.4m(87.0% p.a.) 1610

FOOR 40 Week MA CLICKS

1324

31553

1039

27301

753

2017 | 2018 | 2019 | 2020 | 2021

23048

FINANCIAL STATISTICS

18796

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final(rst) Final Final Final

14544

Total Premiums 2 297 2 223 2 278 2 199 2 003

10291 Total Income 2 853 3 142 3 083 2 558 2 206

2017 | 2018 | 2019 | 2020 | 2021

Total Outgo 2 274 2 686 2 707 1 879 1 563

FINANCIAL STATISTICS Attrib Inc 392 329 401 490 466

(R million) Aug 21 Aug 20 Aug 19 Aug 18 Sep 17 TotCompIncLoss 384 324 405 489 473

Final Final(rst) Final(rst) Final(rst) Final(rst) Ord SH Int 1 081 1 014 1 126 1 130 1 016

Turnover 37 339 33 889 31 352 29 239 26 809 Long-Term Liab 7 325 7 393 6 865 2 464 1 160

Op Inc 2 897 2 767 2 507 2 032 1 814 Cap Employed 9 276 9 168 8 731 4 275 2 872

NetIntPd(Rcvd) 186 169 176 - 2 37 Fixed Assets 460 470 478 469 469

Att Inc 1 838 1 919 1 681 1 468 1 278 Current Assets 531 536 8 462 4 162 2 744

TotCompIncLoss 1 777 1 936 1 656 1 517 1 261 Current Liab 459 457 521 447 421

Fixed Ass 2 138 2 121 2 067 1 843 1 534

PER SHARE STATISTICS (cents per share)

Inv & Loans 10 10 10 15 5 HEPS-C (ZARc) 117.82 98.99 120.00 147.22 140.29

Tot Curr Ass 11 238 9 744 10 024 8 355 6 890 DPS (ZARc) 110.00 95.00 131.00 125.00 115.00

Ord SH Int 4 805 5 194 4 787 4 424 3 297

NAV PS (ZARc) 322.28 302.31 335.78 337.51 304.19

LT Liab 2 173 1 940 1 689 448 402 3 Yr Beta 0.55 0.42 0.54 0.22 - 0.16

Tot Curr Liab 10 195 8 140 8 594 6 717 6 047

Price Prd End 972 908 1 525 2 150 1 610

PER SHARE STATISTICS (cents per share) Price High 1 299 1 694 2 250 2 475 1 900

HEPS-C (ZARc) 793.70 769.20 675.20 609.50 536.30 Price Low 756 651 1 300 1 500 1 002

DPS (ZARc) 490.00 450.00 445.00 380.00 322.00 RATIOS

NAV PS (ZARc) 1 956.85 2 089.00 1 903.00 1 811.00 1 395.00 Ret on SH Fund 36.30 32.41 35.61 43.40 45.93

3 Yr Beta - 0.17 - 0.08 0.51 0.62 0.71 Ret on Tot Ass 15.76 19.33 17.18 31.70 40.42

Price High 30 474 27 467 21 950 22 220 15 206 Debt:Equity 6.78 7.29 6.10 2.18 1.14

Price Low 21 600 19 124 15 250 14 844 11 000 Solvency Mgn% 49.81 48.40 52.60 54.41 54.26

Price Prd End 30 256 23 000 19 900 20 300 15 130 Payouts:Prem 0.20 0.16 0.16 0.19 0.19

109