Page 112 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 112

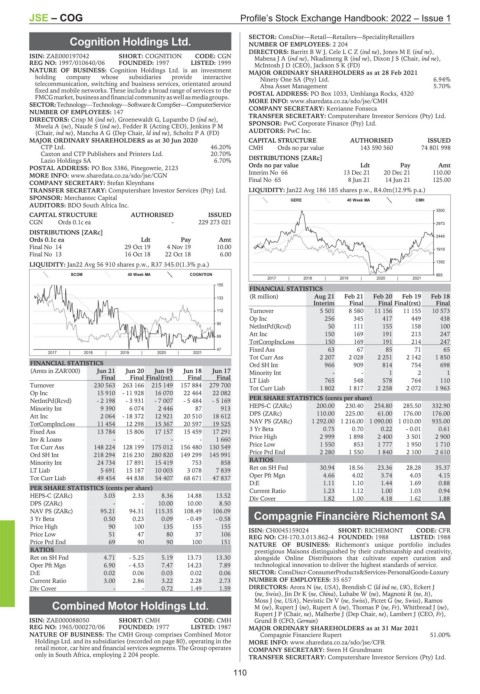

JSE – COG Profile’s Stock Exchange Handbook: 2022 – Issue 1

SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

Cognition Holdings Ltd. NUMBER OF EMPLOYEES: 2 204

COG DIRECTORS: BarrittBWJ, CeleLCZ(ind ne), JonesME(ind ne),

ISIN: ZAE000197042 SHORT: COGNITION CODE: CGN MabenaJA(ind ne), Nkadimeng R (ind ne), Dixon J S (Chair, ind ne),

REG NO: 1997/010640/06 FOUNDED: 1997 LISTED: 1999 McIntosh J D (CEO), Jackson S K (FD)

NATURE OF BUSINESS: Cognition Holdings Ltd. is an investment MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

holding company whose subsidiaries provide interactive Ninety One SA (Pty) Ltd. 6.94%

telecommunication, switching and business services, orientated around Absa Asset Management 5.70%

fixed and mobile networks. These include a broad range of services to the POSTAL ADDRESS: PO Box 1033, Umhlanga Rocks, 4320

FMCGmarket,businessandfinancialcommunityaswellasmediagroups.

SECTOR:Technology—Technology—Software&CompSer—ComputerService MORE INFO: www.sharedata.co.za/sdo/jse/CMH

COMPANY SECRETARY: Kerrianne Fonseca

NUMBER OF EMPLOYEES: 147

DIRECTORS: Crisp M (ind ne), Groenewaldt G, Lupambo D (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Mwela A (ne), Naude S (ind ne), Fedder R (Acting CEO), Jenkins P M SPONSOR: PwC Corporate Finance (Pty) Ltd.

(Chair, ind ne), Mancha A G (Dep Chair, ld ind ne), Scholtz P A (FD) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

CTP Ltd. 46.20% CMH Ords no par value 143 590 560 74 801 998

Caxton and CTP Publishers and Printers Ltd. 20.70%

Lazio Holdings SA 6.70% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 3386, Pinegowrie, 2123 Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/CGN Interim No 66 13 Dec 21 20 Dec 21 110.00

COMPANY SECRETARY: Stefan Kleynhans Final No 65 8 Jun 21 14 Jun 21 125.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan22 Avg 186 185 shares p.w., R4.0m(12.9% p.a.)

SPONSOR: Merchantec Capital GERE 40 Week MA CMH

AUDITORS: BDO South Africa Inc.

3500

CAPITAL STRUCTURE AUTHORISED ISSUED

CGN Ords 0.1c ea - 229 273 021 2973

DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt 2446

Final No 14 29 Oct 19 4 Nov 19 10.00

1919

Final No 13 16 Oct 18 22 Oct 18 6.00

1392

LIQUIDITY: Jan22 Avg 56 910 shares p.w., R37 345.0(1.3% p.a.)

SCOM 40 Week MA COGNITION 865

2017 | 2018 | 2019 | 2020 | 2021

155

FINANCIAL STATISTICS

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

133

Interim Final Final Final(rst) Final

112 Turnover 5 501 8 580 11 156 11 155 10 573

Op Inc 256 345 417 449 438

90

NetIntPd(Rcvd) 50 111 155 158 100

Att Inc 150 169 191 213 247

69

TotCompIncLoss 150 169 191 214 247

47 Fixed Ass 63 67 85 71 65

2017 | 2018 | 2019 | 2020 | 2021

Tot Curr Ass 2 207 2 028 2 251 2 142 1 850

FINANCIAL STATISTICS Ord SH Int 966 909 814 754 698

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Minority Int - - 1 2 1

Final Final Final(rst) Final Final LT Liab 765 548 578 764 110

Turnover 230 563 263 166 215 149 157 884 279 700 Tot Curr Liab 1 802 1 817 2 258 2 072 1 963

Op Inc 15 910 - 11 928 16 070 22 464 22 082

NetIntPd(Rcvd) - 2 198 - 3 931 - 7 007 - 5 484 - 5 169 PER SHARE STATISTICS (cents per share)

Minority Int 9 390 6 074 2 446 87 913 HEPS-C (ZARc) 200.00 230.40 254.80 285.50 332.90

Att Inc 2 064 - 18 372 12 921 20 510 18 612 DPS (ZARc) 110.00 225.00 61.00 176.00 176.00

TotCompIncLoss 11 454 12 298 15 367 20 597 19 525 NAV PS (ZARc) 1 292.00 1 216.00 1 090.00 1 010.00 935.00

Fixed Ass 13 784 15 806 17 157 15 459 17 291 3 Yr Beta 0.75 0.70 0.22 - 0.01 0.61

Inv & Loans - - - - 1 660 Price High 2 999 1 898 2 400 3 501 2 900

Tot Curr Ass 148 224 128 199 175 012 156 480 130 549 Price Low 1 550 853 1 777 1 950 1 710

Price Prd End 2 280 1 550 1 840 2 100 2 610

Ord SH Int 218 294 216 230 280 820 149 299 145 991

Minority Int 24 734 17 891 15 419 753 858 RATIOS

LT Liab 5 691 15 187 10 003 3 078 7 839 Ret on SH Fnd 30.94 18.56 23.36 28.28 35.37

Tot Curr Liab 49 454 44 838 54 407 68 671 47 837 Oper Pft Mgn 4.66 4.02 3.74 4.03 4.15

D:E 1.11 1.10 1.44 1.69 0.88

PER SHARE STATISTICS (cents per share) Current Ratio 1.23 1.12 1.00 1.03 0.94

HEPS-C (ZARc) 3.03 2.33 8.36 14.88 13.52 Div Cover 1.82 1.00 4.18 1.62 1.88

DPS (ZARc) - - 10.00 10.00 8.50

NAV PS (ZARc) 95.21 94.31 115.35 108.49 106.09

3 Yr Beta 0.50 0.23 0.09 - 0.49 - 0.58 Compagnie Financière Richemont SA

Price High 90 100 135 155 155 COM

CODE: CFR

Price Low 51 47 80 37 106 ISIN: CH0045159024 SHORT: RICHEMONT LISTED: 1988

REG NO: CH-170.3.013.862-4 FOUNDED: 1988

Price Prd End 69 90 90 100 151 NATURE OF BUSINESS: Richemont's unique portfolio includes

RATIOS prestigious Maisons distinguished by their craftsmanship and creativity,

Ret on SH Fnd 4.71 - 5.25 5.19 13.73 13.30 alongside Online Distributors that cultivate expert curation and

Oper Pft Mgn 6.90 - 4.53 7.47 14.23 7.89 technological innovation to deliver the highest standards of service.

D:E 0.02 0.06 0.03 0.02 0.06 SECTOR: ConsDiscr-ConsumerProducts&Services-PersonalGoods-Luxury

Current Ratio 3.00 2.86 3.22 2.28 2.73 NUMBER OF EMPLOYEES: 35 657

Div Cover - - 0.72 1.49 1.59 DIRECTORS: Arora N (ne, USA), Brendish C (ld ind ne, UK), Eckert J

(ne, Swiss), Jin Dr K (ne, China), Luhabe W (ne), Magnoni R (ne, It),

Moss J (ne, USA), Nevistic Dr V (ne, Swiss), Pictet G (ne, Swiss), Ramos

Combined Motor Holdings Ltd. M(ne), Rupert J (ne), Rupert A (ne), Thomas P (ne, Fr), Whitbread J (ne),

Rupert J P (Chair, ne), Malherbe J (Dep Chair, ne), Lambert J (CEO, Fr),

COM

ISIN: ZAE000088050 SHORT: CMH CODE: CMH Grund B (CFO, German)

REG NO: 1965/000270/06 FOUNDED: 1977 LISTED: 1987 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

NATURE OF BUSINESS: The CMH Group comprises Combined Motor Compagnie Financiere Rupert 51.00%

Holdings Ltd. and its subsidiaries (recorded on page 80), operating in the MORE INFO: www.sharedata.co.za/sdo/jse/CFR

retail motor, car hire and financial services segments. The Group operates COMPANY SECRETARY: Swen H Grundmann

only in South Africa, employing 2 204 people.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

110