Page 106 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 106

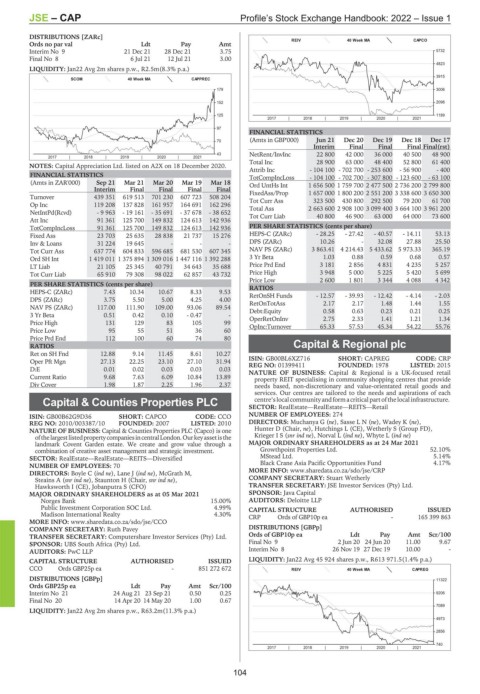

JSE – CAP Profile’s Stock Exchange Handbook: 2022 – Issue 1

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt REIV 40 Week MA CAPCO

Interim No 9 21 Dec 21 28 Dec 21 3.75 5732

Final No 8 6 Jul 21 12 Jul 21 3.00

4823

LIQUIDITY: Jan22 Avg 2m shares p.w., R2.5m(8.3% p.a.)

3915

SCOM 40 Week MA CAPPREC

179 3006

152 2098

125 1189

2017 | 2018 | 2019 | 2020 | 2021

97

FINANCIAL STATISTICS

70 (Amts in GBP'000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final Final Final(rst)

43 NetRent/InvInc 22 800 42 000 36 000 40 500 48 900

2017 | 2018 | 2019 | 2020 | 2021

Total Inc 28 900 63 000 48 400 52 800 61 400

NOTES: Capital Appreciation Ltd. listed on A2X on 18 December 2020.

Attrib Inc - 104 100 - 702 700 - 253 600 - 56 900 - 400

FINANCIAL STATISTICS TotCompIncLoss - 104 100 - 702 700 - 307 800 - 123 600 - 63 100

(Amts in ZAR'000) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 Ord UntHs Int 1 656 500 1 759 700 2 477 500 2 736 200 2 799 800

Interim Final Final Final Final

Turnover 439 351 619 513 701 230 607 723 508 204 FixedAss/Prop 1 657 000 1 800 200 2 551 200 3 338 600 3 650 300

Tot Curr Ass

292 500

430 800

323 500

79 200

61 700

Op Inc 119 208 137 828 161 957 164 691 162 296 Total Ass 2 663 600 2 908 100 3 099 400 3 664 100 3 961 200

NetIntPd(Rcvd) - 9 963 - 19 161 - 35 691 - 37 678 - 38 652 Tot Curr Liab 40 800 46 900 63 000 64 000 73 600

Att Inc 91 361 125 700 149 832 124 613 142 936

TotCompIncLoss 91 361 125 700 149 832 124 613 142 936 PER SHARE STATISTICS (cents per share)

Fixed Ass 23 703 25 635 28 838 21 737 15 276 HEPS-C (ZARc) - 28.25 - 27.42 - 40.57 - 14.11 53.13

Inv & Loans 31 224 19 645 - - - DPS (ZARc) 10.26 - 32.08 27.88 25.50

Tot Curr Ass 637 774 604 833 596 685 681 530 607 345 NAV PS (ZARc) 3 863.41 4 214.43 5 433.62 5 973.33 365.19

Ord SH Int 1 419 011 1 375 894 1 309 016 1 447 116 1 392 288 3 Yr Beta 1.03 0.88 0.59 0.68 0.57

LT Liab 21 105 25 345 40 791 34 643 35 688 Price Prd End 3 181 2 856 4 831 4 235 5 257

Tot Curr Liab 65 910 79 308 98 022 62 857 43 732 Price High 3 948 5 000 5 225 5 420 5 699

Price Low 2 600 1 801 3 344 4 088 4 342

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 7.43 10.34 10.67 8.33 9.53 RetOnSH Funds - 12.57 - 39.93 - 12.42 - 4.14 - 2.03

DPS (ZARc) 3.75 5.50 5.00 4.25 4.00 RetOnTotAss 2.17 2.17 1.48 1.44 1.55

NAV PS (ZARc) 117.00 111.90 109.00 93.06 89.54 Debt:Equity 0.58 0.63 0.23 0.21 0.25

3 Yr Beta 0.51 0.42 0.10 - 0.47 - OperRetOnInv 2.75 2.33 1.41 1.21 1.34

Price High 131 129 83 105 99

OpInc:Turnover 65.33 57.53 45.34 54.22 55.76

Price Low 95 55 51 36 60

Price Prd End 112 100 60 74 80

RATIOS Capital & Regional plc

Ret on SH Fnd 12.88 9.14 11.45 8.61 10.27 CAP

CODE: CRP

Oper Pft Mgn 27.13 22.25 23.10 27.10 31.94 ISIN: GB00BL6XZ716 SHORT: CAPREG LISTED: 2015

FOUNDED: 1978

REG NO: 01399411

D:E 0.01 0.02 0.03 0.03 0.03 NATURE OF BUSINESS: Capital & Regional is a UK-focused retail

Current Ratio 9.68 7.63 6.09 10.84 13.89 property REIT specialising in community shopping centres that provide

Div Cover 1.98 1.87 2.25 1.96 2.37 needs based, non-discretionary and value-orientated retail goods and

services. Our centres are tailored to the needs and aspirations of each

Capital & Counties Properties PLC centre’slocalcommunityandformacriticalpartofthelocalinfrastructure.

SECTOR: RealEstate—RealEstate—REITS—Retail

CAP

ISIN: GB00B62G9D36 SHORT: CAPCO CODE: CCO NUMBER OF EMPLOYEES: 274

REG NO: 2010/003387/10 FOUNDED: 2007 LISTED: 2010 DIRECTORS: Muchanya G (ne), SasseLN(ne), Wadey K (ne),

NATURE OF BUSINESS: Capital & Counties Properties PLC (Capco) is one Hunter D (Chair, ne), Hutchings L (CE), Wetherly S (Group FD),

ofthelargestlistedpropertycompaniesincentralLondon.Ourkeyassetisthe KriegerIS(snr ind ne), Norval L (ind ne), Whyte L (ind ne)

landmark Covent Garden estate. We create and grow value through a MAJOR ORDINARY SHAREHOLDERS as at 24 Mar 2021

combination of creative asset management and strategic investment. Growthpoint Properties Ltd. 52.10%

SECTOR: RealEstate—RealEstate—REITS—Diversified MStead Ltd. 5.14%

NUMBER OF EMPLOYEES: 70 Black Crane Asia Pacific Opportunities Fund 4.17%

DIRECTORS: Boyle C (ind ne), Lane J (ind ne), McGrath M, MORE INFO: www.sharedata.co.za/sdo/jse/CRP

Steains A (snr ind ne), Staunton H (Chair, snr ind ne), COMPANY SECRETARY: Stuart Wetherly

Hawksworth I (CE), Jobanputra S (CFO) TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 05 Mar 2021 SPONSOR: Java Capital

Norges Bank 15.00% AUDITORS: Deloitte LLP

Public Investment Corporation SOC Ltd. 4.99% CAPITAL STRUCTURE AUTHORISED ISSUED

Madison International Realty 4.30% CRP Ords of GBP10p ea - 165 399 863

MORE INFO: www.sharedata.co.za/sdo/jse/CCO

COMPANY SECRETARY: Ruth Pavey DISTRIBUTIONS [GBPp]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords of GBP10p ea Ldt Pay Amt Scr/100

SPONSOR: UBS South Africa (Pty) Ltd. Final No 9 2 Jun 20 24 Jun 20 11.00 9.67

AUDITORS: PwC LLP Interim No 8 26 Nov 19 27 Dec 19 10.00 -

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan22 Avg 45 924 shares p.w., R613 971.5(1.4% p.a.)

CCO Ords GBP25p ea - 851 272 672 REIV 40 Week MA CAPREG

DISTRIBUTIONS [GBPp] 11322

Ords GBP25p ea Ldt Pay Amt Scr/100

Interim No 21 24 Aug 21 23 Sep 21 0.50 0.25 9206

Final No 20 14 Apr 20 14 May 20 1.00 0.67

7089

LIQUIDITY: Jan22 Avg 2m shares p.w., R63.2m(11.3% p.a.)

4973

2856

740

2017 | 2018 | 2019 | 2020 | 2021

104