Page 87 - SHB 2021 Issue 4

P. 87

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – ARR

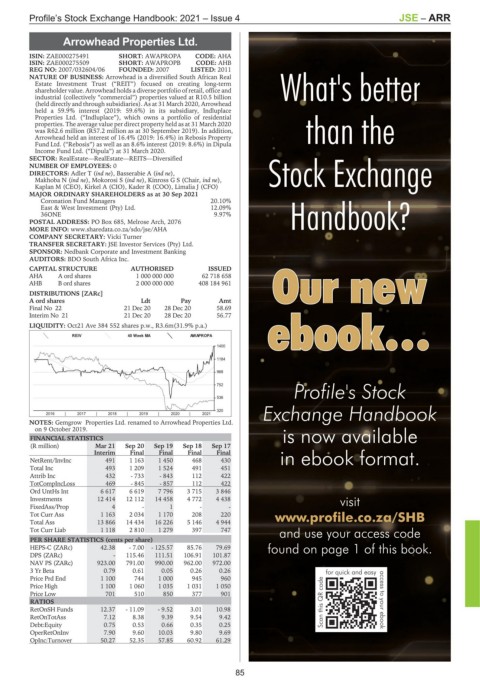

Arrowhead Properties Ltd.

ARR

ISIN: ZAE000275491 SHORT: AWAPROPA CODE: AHA

ISIN: ZAE000275509 SHORT: AWAPROPB CODE: AHB

REG NO: 2007/032604/06 FOUNDED: 2007 LISTED: 2011

NATURE OF BUSINESS: Arrowhead is a diversified South African Real

Estate Investment Trust (“REIT”) focused on creating long-term What's better

shareholder value. Arrowhead holds a diverse portfolio of retail, office and

industrial (collectively “commercial”) properties valued at R10.5 billion

(held directly and through subsidiaries). As at 31 March 2020, Arrowhead

held a 59.9% interest (2019: 59.6%) in its subsidiary, Indluplace

Properties Ltd. (“Indluplace”), which owns a portfolio of residential

properties. The average value per direct property held as at 31 March 2020

was R62.6 million (R57.2 million as at 30 September 2019). In addition, than the

Arrowhead held an interest of 16.4% (2019: 16.4%) in Rebosis Property

Fund Ltd. (“Rebosis”) as well as an 8.6% interest (2019: 8.6%) in Dipula

Income Fund Ltd. (“Dipula”) at 31 March 2020.

SECTOR: RealEstate—RealEstate—REITS—Diversified

NUMBER OF EMPLOYEES: 0

DIRECTORS: Adler T (ind ne), Basserabie A (ind ne), Stock Exchange

Makhoba N (ind ne), Mokorosi S (ind ne), Kinross G S (Chair, ind ne),

Kaplan M (CEO), Kirkel A (CIO), Kader R (COO), Limalia J (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2021

Coronation Fund Managers 20.10%

East & West Investment (Pty) Ltd. 12.09%

36ONE 9.97% Handbook?

POSTAL ADDRESS: PO Box 685, Melrose Arch, 2076

MORE INFO: www.sharedata.co.za/sdo/jse/AHA

COMPANY SECRETARY: Vicki Turner

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

Amt OOuurr nneeww

AHA A ord shares 1 000 000 000 62 718 658

AHB B ord shares 2 000 000 000 408 184 961

DISTRIBUTIONS [ZARc]

A ord shares Ldt Pay

Final No 22 21 Dec 20 28 Dec 20 58.69

Interim No 21 21 Dec 20 28 Dec 20 56.77

e ebbooookk……

LIQUIDITY: Oct21 Ave 384 552 shares p.w., R3.6m(31.9% p.a.)

REIV 40 Week MA AWAPROPA

1400

1184

968

Profile's Stock

752

536

Exchange Handbook

320

2016 | 2017 | 2018 | 2019 | 2020 | 2021

NOTES: Gemgrow Properties Ltd. renamed to Arrowhead Properties Ltd.

on 9 October 2019.

FINANCIAL STATISTICS is now available

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final Final Final

NetRent/InvInc 491 1 163 1 450 468 430 in ebook format.

Total Inc 493 1 209 1 524 491 451

Attrib Inc 432 - 733 - 843 112 422

TotCompIncLoss 469 - 845 - 857 112 422

Ord UntHs Int 6 617 6 619 7 796 3 715 3 846

Investments 12 414 12 112 14 458 4 772 4 438 visit

FixedAss/Prop 4 - 1 - -

Tot Curr Ass 1 163 2 034 1 170 208 220 www.profile.co.za/SHB

Total Ass 13 866 14 434 16 226 5 146 4 944

Tot Curr Liab 1 118 2 810 1 279 397 747 and use your access code

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 42.38 - 7.00 - 125.57 85.76 79.69 found on page 1 of this book.

DPS (ZARc) - 115.46 111.51 106.91 101.87

NAV PS (ZARc) 923.00 791.00 990.00 962.00 972.00

3 Yr Beta 0.79 0.61 0.05 0.26 0.26 for quick and easy

Price Prd End 1 100 744 1 000 945 960

Price High 1 100 1 060 1 035 1 031 1 050

Price Low 701 510 850 377 901

RATIOS Scan this QR code access to your ebook

RetOnSH Funds 12.37 - 11.09 - 9.52 3.01 10.98

RetOnTotAss 7.12 8.38 9.39 9.54 9.42

Debt:Equity 0.75 0.53 0.66 0.35 0.25

OperRetOnInv 7.90 9.60 10.03 9.80 9.69

OpInc:Turnover 50.27 52.35 57.85 60.92 61.29

85