Page 92 - SHB 2021 Issue 4

P. 92

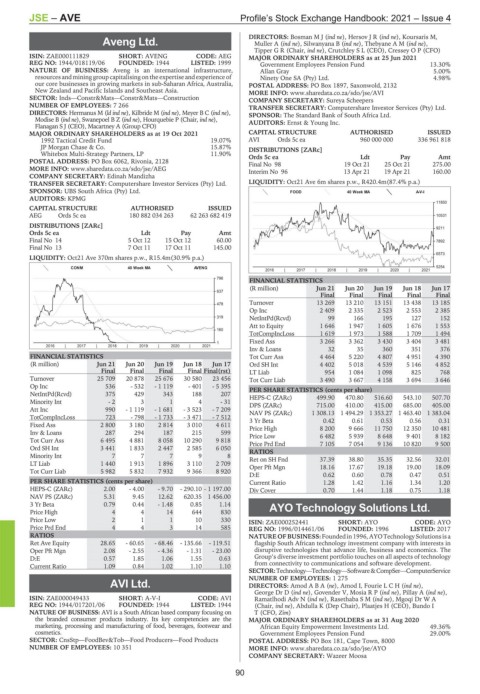

JSE – AVE Profile’s Stock Exchange Handbook: 2021 – Issue 4

DIRECTORS: BosmanMJ(ind ne), HersovJR(ind ne), Koursaris M,

Aveng Ltd. Muller A (ind ne), Silwanyana B (ind ne), ThebyaneAM(ind ne),

Tipper G R (Chair, ind ne), Crutchley S L (CEO), Cressey O P (CFO)

AVE

ISIN: ZAE000111829 SHORT: AVENG CODE: AEG MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2021

REG NO: 1944/018119/06 FOUNDED: 1944 LISTED: 1999 Government Employees Pension Fund 13.30%

NATURE OF BUSINESS: Aveng is an international infrastructure, Allan Gray 5.00%

resources and mining group capitalising on the expertise and experience of Ninety One SA (Pty) Ltd. 4.98%

our core businesses in growing markets in sub-Saharan Africa, Australia, POSTAL ADDRESS: PO Box 1897, Saxonwold, 2132

New Zealand and Pacific Islands and Southeast Asia. MORE INFO: www.sharedata.co.za/sdo/jse/AVI

SECTOR: Inds—Constr&Mats—Constr&Mats—Construction COMPANY SECRETARY: Sureya Scheepers

NUMBER OF EMPLOYEES: 7 266 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Hermanus M (ld ind ne), Kilbride M (ind ne), Meyer B C (ind ne), SPONSOR: The Standard Bank of South Africa Ltd.

Modise B (ind ne), Swanepoel B Z (ind ne), Hourquebie P (Chair, ind ne), AUDITORS: Ernst & Young Inc.

Flanagan S J (CEO), Macartney A (Group CFO)

MAJOR ORDINARY SHAREHOLDERS as at 19 Oct 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

1992 Tactical Credit Fund 19.07% AVI Ords 5c ea 960 000 000 336 961 818

JP Morgan Chase & Co. 15.87% DISTRIBUTIONS [ZARc]

Whitebox Multi-Strategy Partners, LP 11.90% Ords 5c ea Ldt Pay Amt

POSTAL ADDRESS: PO Box 6062, Rivonia, 2128 Final No 98 19 Oct 21 25 Oct 21 275.00

MORE INFO: www.sharedata.co.za/sdo/jse/AEG Interim No 96 13 Apr 21 19 Apr 21 160.00

COMPANY SECRETARY: Edinah Mandizha

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct21 Ave 6m shares p.w., R420.4m(87.4% p.a.)

SPONSOR: UBS South Africa (Pty) Ltd. FOOD 40 Week MA A-V-I

AUDITORS: KPMG

11850

CAPITAL STRUCTURE AUTHORISED ISSUED

AEG Ords 5c ea 180 882 034 263 62 263 682 419 10531

DISTRIBUTIONS [ZARc]

9211

Ords 5c ea Ldt Pay Amt

Final No 14 5 Oct 12 15 Oct 12 60.00 7892

Final No 13 7 Oct 11 17 Oct 11 145.00

6573

LIQUIDITY: Oct21 Ave 370m shares p.w., R15.4m(30.9% p.a.)

CONM 40 Week MA AVENG 5254

2016 | 2017 | 2018 | 2019 | 2020 | 2021

796

FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

637

Final Final Final Final Final

478 Turnover 13 269 13 210 13 151 13 438 13 185

Op Inc 2 409 2 335 2 523 2 553 2 385

319 NetIntPd(Rcvd) 99 166 195 127 152

Att to Equity 1 646 1 947 1 605 1 676 1 553

160

TotCompIncLoss 1 619 1 973 1 588 1 709 1 494

1 Fixed Ass 3 266 3 362 3 430 3 404 3 481

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Inv & Loans 32 35 360 351 376

FINANCIAL STATISTICS Tot Curr Ass 4 464 5 220 4 807 4 951 4 390

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Ord SH Int 4 402 5 018 4 539 5 146 4 852

Final Final Final Final Final(rst) LT Liab 954 1 084 1 098 825 768

Turnover 25 709 20 878 25 676 30 580 23 456 Tot Curr Liab 3 490 3 667 4 158 3 694 3 646

Op Inc 536 - 532 - 1 119 - 401 - 5 395 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 375 429 343 188 207 HEPS-C (ZARc) 499.90 470.80 516.60 543.10 507.70

Minority Int - 2 3 1 4 - 31 DPS (ZARc) 715.00 410.00 415.00 685.00 405.00

Att Inc 990 - 1 119 - 1 681 - 3 523 - 7 209 NAV PS (ZARc) 1 308.13 1 494.29 1 353.27 1 463.40 1 383.04

TotCompIncLoss 723 - 798 - 1 733 - 3 471 - 7 512 3 Yr Beta 0.42 0.61 0.53 0.56 0.31

Fixed Ass 2 800 3 180 2 814 3 010 4 611 Price High 8 200 9 666 11 750 12 350 10 481

Inv & Loans 287 294 187 215 599 Price Low 6 482 5 939 8 648 9 401 8 182

Tot Curr Ass 6 495 4 881 8 058 10 290 9 818 Price Prd End 7 105 7 054 9 136 10 820 9 500

Ord SH Int 3 441 1 833 2 447 2 585 6 050

RATIOS

Minority Int 7 7 7 9 8 Ret on SH Fnd 37.39 38.80 35.35 32.56 32.01

LT Liab 1 440 1 913 1 896 3 110 2 709 Oper Pft Mgn 18.16 17.67 19.18 19.00 18.09

Tot Curr Liab 5 982 5 832 7 932 9 366 8 920

D:E 0.62 0.60 0.78 0.47 0.51

PER SHARE STATISTICS (cents per share) Current Ratio 1.28 1.42 1.16 1.34 1.20

HEPS-C (ZARc) 2.00 - 4.00 - 9.70 - 290.10 - 1 197.00 Div Cover 0.70 1.44 1.18 0.75 1.18

NAV PS (ZARc) 5.31 9.45 12.62 620.35 1 456.00

3 Yr Beta 0.79 0.44 - 1.48 0.85 1.14 AYO Technology Solutions Ltd.

Price High 4 4 14 644 830

AYO

Price Low 2 1 1 10 330 ISIN: ZAE000252441 SHORT: AYO CODE: AYO

Price Prd End 4 4 3 14 585 REG NO: 1996/014461/06 FOUNDED: 1996 LISTED: 2017

RATIOS NATUREOF BUSINESS:Foundedin1996, AYOTechnology Solutionsisa

Ret Ave Equity 28.65 - 60.65 - 68.46 - 135.66 - 119.51 flagship South African technology investment company with interests in

Oper Pft Mgn 2.08 - 2.55 - 4.36 - 1.31 - 23.00 disruptive technologies that advance life, business and economics. The

D:E 0.57 1.85 1.06 1.55 0.63 Group’s diverse investment portfolio touches on all aspects of technology

Current Ratio 1.09 0.84 1.02 1.10 1.10 from connectivity to communications and software development.

SECTOR:Technology—Technology—Software&CompSer—ComputerService

NUMBER OF EMPLOYEES: 1 275

AVI Ltd. DIRECTORS: AmodABA(ne), Amod I, FourieLCH(ind ne),

George Dr D (ind ne), Govender V, MosiaRP(ind ne), Pillay A (ind ne),

AVI

ISIN: ZAE000049433 SHORT: A-V-I CODE: AVI Ramatlhodi Adv N (ind ne), RasethabaSM(ind ne), Mgoqi Dr W A

REG NO: 1944/017201/06 FOUNDED: 1944 LISTED: 1944 (Chair, ind ne), Abdulla K (Dep Chair), Plaatjes H (CEO), Bundo I

NATURE OF BUSINESS: AVI is a South African based company focusing on T (CFO, Zim)

the branded consumer products industry. Its key competencies are the MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

marketing, processing and manufacturing of food, beverages, footwear and African Equity Empowerment Investments Ltd. 49.36%

cosmetics. Government Employees Pension Fund 29.00%

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products POSTAL ADDRESS: PO Box 181, Cape Town, 8000

NUMBER OF EMPLOYEES: 10 351 MORE INFO: www.sharedata.co.za/sdo/jse/AYO

COMPANY SECRETARY: Wazeer Moosa

90