Page 85 - SHB 2021 Issue 4

P. 85

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – ARB

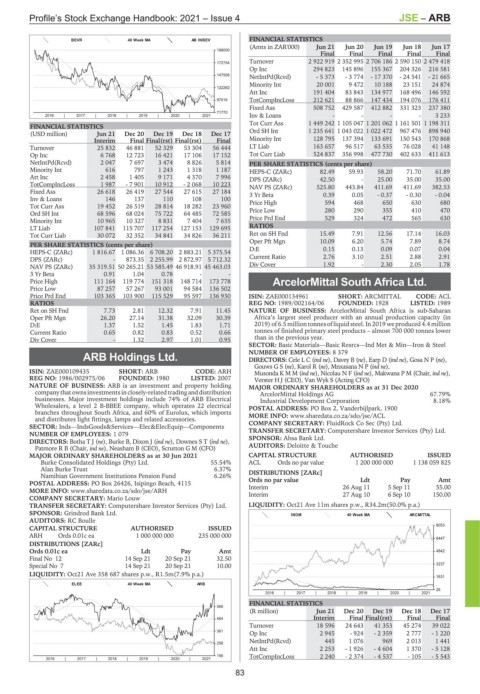

BEVR 40 Week MA AB INBEV FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

198000

Final Final Final Final Final

Turnover 2 922 919 2 352 995 2 706 186 2 590 150 2 479 418

172754

Op Inc 294 823 145 896 155 367 204 326 216 581

NetIntPd(Rcvd) - 5 373 - 3 774 - 17 370 - 24 541 - 21 665

147508

Minority Int 20 001 9 472 10 188 23 151 24 874

122262

Att Inc 191 404 83 843 134 977 168 496 146 592

97016 TotCompIncLoss 212 621 88 866 147 434 194 076 176 411

Fixed Ass 508 752 429 587 412 882 331 323 237 380

71770

2016 | 2017 | 2018 | 2019 | 2020 | 2021 Inv & Loans - - - - 3 233

Tot Curr Ass 1 449 242 1 105 047 1 201 062 1 161 501 1 198 311

FINANCIAL STATISTICS

(USD million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Ord SH Int 1 235 641 1 043 022 1 022 472 967 476 898 940

Interim Final Final(rst) Final(rst) Final Minority Int 128 795 137 394 133 691 150 543 170 868

Turnover 25 832 46 881 52 329 53 304 56 444 LT Liab 163 657 96 517 63 535 76 028 41 148

Op Inc 6 768 12 723 16 421 17 106 17 152 Tot Curr Liab 524 837 356 998 477 730 402 633 411 613

NetIntPd(Rcvd) 2 047 7 697 3 474 8 826 5 814 PER SHARE STATISTICS (cents per share)

Minority Int 616 797 1 243 1 318 1 187 HEPS-C (ZARc) 82.49 59.93 58.20 71.70 61.89

Att Inc 2 458 1 405 9 171 4 370 7 996 DPS (ZARc) 42.50 - 25.00 35.00 35.00

TotCompIncLoss 1 987 - 7 901 10 912 - 2 068 10 223 NAV PS (ZARc) 525.80 443.84 411.69 411.69 382.53

Fixed Ass 26 618 26 419 27 544 27 615 27 184 3 Yr Beta 0.39 0.05 - 0.37 - 0.30 - 0.04

Inv & Loans 146 137 110 108 100 Price High 594 468 650 630 680

Tot Curr Ass 19 452 26 519 28 814 18 282 23 960 Price Low 280 290 355 410 470

Ord SH Int 68 596 68 024 75 722 64 485 72 585

Minority Int 10 965 10 327 8 831 7 404 7 635 Price Prd End 529 324 472 565 630

LT Liab 107 841 115 707 117 254 127 153 129 695 RATIOS

Tot Curr Liab 30 072 32 352 34 841 34 826 36 211 Ret on SH Fnd 15.49 7.91 12.56 17.14 16.03

Oper Pft Mgn 10.09 6.20 5.74 7.89 8.74

PER SHARE STATISTICS (cents per share) D:E 0.15 0.13 0.09 0.07 0.04

HEPS-C (ZARc) 1 816.67 1 086.36 6 708.20 2 883.21 5 375.54

DPS (ZARc) - 873.35 2 255.99 2 872.97 5 712.32 Current Ratio 2.76 3.10 2.51 2.88 2.91

NAV PS (ZARc) 35 319.51 50 265.21 53 585.49 46 918.91 45 463.03 Div Cover 1.92 - 2.30 2.05 1.78

3 Yr Beta 0.91 1.04 0.78 - -

Price High 111 164 119 774 151 318 148 714 173 778 ArcelorMittal South Africa Ltd.

Price Low 87 257 57 267 93 001 94 584 136 502

ARC

Price Prd End 103 365 103 900 115 529 95 597 136 930 ISIN: ZAE000134961 SHORT: ARCMITTAL CODE: ACL

RATIOS REG NO: 1989/002164/06 FOUNDED: 1928 LISTED: 1989

Ret on SH Fnd 7.73 2.81 12.32 7.91 11.45 NATURE OF BUSINESS: ArcelorMittal South Africa is sub-Saharan

Oper Pft Mgn 26.20 27.14 31.38 32.09 30.39 Africa’s largest steel producer with an annual production capacity (in

D:E 1.37 1.52 1.45 1.83 1.71 2019) of 6.5 million tonnesof liquid steel. In 2019 we produced 4.4 million

Current Ratio 0.65 0.82 0.83 0.52 0.66 tonnes of finished primary steel products – almost 700 000 tonnes lower

Div Cover - 1.32 2.97 1.01 0.95 than in the previous year.

SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Iron & Steel

NUMBER OF EMPLOYEES: 8 379

ARB Holdings Ltd. DIRECTORS: Cele L C (ind ne), Davey B (ne), Earp D (ind ne), Gosa N P (ne),

ARB Gouws G S (ne), Karol R (ne), Mnxasana N P (ind ne),

ISIN: ZAE000109435 SHORT: ARB CODE: ARH MusondaKMM(ind ne), Nicolau N F (ind ne), Makwana P M (Chair, ind ne),

REG NO: 1986/002975/06 FOUNDED: 1980 LISTED: 2007 Verster H J (CEO), Van Wyk S (Acting CFO)

NATURE OF BUSINESS: ARB is an investment and property holding MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

company that ownsinvestmentsin closely-related trading anddistribution ArcelorMittal Holdings AG 67.79%

businesses. Major investment holdings include 74% of ARB Electrical Industrial Development Corporation 8.18%

Wholesalers, a level 2 B-BBEE company, which operates 22 electrical POSTAL ADDRESS: PO Box 2, Vanderbijlpark, 1900

branches throughout South Africa, and 60% of Eurolux, which imports MORE INFO: www.sharedata.co.za/sdo/jse/ACL

and distributes light fittings, lamps and related accessories.

SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

NUMBER OF EMPLOYEES: 1 079 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: BothaTJ(ne), BurkeB,Dixon J(ind ne), Downes S T (ind ne), SPONSOR: Absa Bank Ltd.

Patmore R B (Chair, ind ne), Neasham B (CEO), Scrutton G M (CFO) AUDITORS: Deloitte & Touche

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

Burke Consolidated Holdings (Pty) Ltd. 55.54% ACL Ords no par value 1 200 000 000 1 138 059 825

Alan Burke Trust 6.37% DISTRIBUTIONS [ZARc]

Namibian Government Institutions Pension Fund 6.26%

Pay

Amt

Ldt

POSTAL ADDRESS: PO Box 26426, Isipingo Beach, 4115 Ords no par value 26 Aug 11 5 Sep 11 55.00

Interim

MORE INFO: www.sharedata.co.za/sdo/jse/ARH Interim 27 Aug 10 6 Sep 10 150.00

COMPANY SECRETARY: Mario Louw

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct21 Ave 11m shares p.w., R34.2m(50.0% p.a.)

SPONSOR: Grindrod Bank Ltd. INDM 40 Week MA ARCMITTAL

AUDITORS: RC Boulle

8053

CAPITAL STRUCTURE AUTHORISED ISSUED

ARH Ords 0.01c ea 1 000 000 000 235 000 000

6447

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt 4842

Final No 12 14 Sep 21 20 Sep 21 32.50

Special No 7 14 Sep 21 20 Sep 21 10.00 3237

LIQUIDITY: Oct21 Ave 358 687 shares p.w., R1.5m(7.9% p.a.)

1631

ELEE 40 Week MA ARB

26

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

566

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

464 Interim Final Final(rst) Final Final

Turnover 18 596 24 643 41 353 45 274 39 022

361

Op Inc 2 945 - 924 - 2 359 2 777 - 1 220

NetIntPd(Rcvd) 445 1 076 969 2 013 1 441

258

Att Inc 2 253 - 1 926 - 4 604 1 370 - 5 128

156 TotCompIncLoss 2 240 - 2 374 - 4 537 - 105 - 5 543

2016 | 2017 | 2018 | 2019 | 2020 | 2021

83