Page 82 - SHB 2021 Issue 4

P. 82

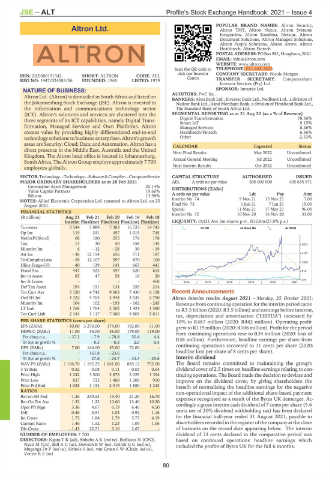

JSE – ALT Profile’s Stock Exchange Handbook: 2021 – Issue 4

POPULAR BRAND NAMES: Altron Security,

Altron Ltd. Altron TMT, Altron Nexus, Altron Systems

Integration, Altron Karabina, Netstar, Altron

ALT

Document Solutions, Altron Managed Solutions,

Altron People Solutions, Altron Arrow, Altron

Healthtech, Altron Fintech

POSTAL ADDRESS:POBox981, Houghton,2041

EMAIL: info@altron.com

WEBSITE: www.altron.com

Scan the QR code to TELEPHONE: 011-645-3600

visit our Investor COMPANY SECRETARY: Nicole Morgan

ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL Centre

REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979 TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

NATURE OF BUSINESS: SPONSOR: Investec Ltd.

Altron Ltd. (Altron) is domiciled in South Africa and listed on AUDITORS: PwC Inc.

BANKERS: Absa Bank Ltd., Investec Bank Ltd., Nedbank Ltd., a division of

the Johannesburg Stock Exchange (JSE). Altron is invested in Nedcor Bank Ltd., Rand Merchant Bank, a division of FirstRand Bank Ltd.,

the information and communications technology sector The Standard Bank of South Africa Ltd.

(ICT). Altron's solutions and services are clustered into the SEGMENTAL REPORTING as at 31 Aug 20 (asa%of Revenue)

three segments of its ICT capabilities, namely Digital Trans- Digital Transformation 78.56%

9.15%

Smart IoT

formation, Managed Services and Own Platforms. Altron Managed Services 8.26%

creates value by providing highly differentiated end-to-end Healthtech/Fintech 6.56%

technology solutions to business enterprises. Altron's growth Other -2.53%

areas are Security; Cloud; Data; and Automation. Altron has a

CALENDAR Expected Status

direct presence in the Middle East, Australia and the United Next Final Results May 2022 Unconfirmed

Kingdom. The Altron head office is located in Johannesburg,

South Africa. The Altron Group employs approximately 7 700 Annual General Meeting Jul 2022 Unconfirmed

employees globally. Next Interim Results Oct 2022 Unconfirmed

SECTOR:Technology—Technology—Software&CompSer—ComputerService CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 AEL A ords no par value 500 000 000 405 635 971

Coronation Asset Management 25.14% DISTRIBUTIONS [ZARc]

Value Capital Partners 19.60%

Biltron 13.98% A ords no par value Ldt Pay Amt

NOTES: Allied Electronic Corporation Ltd. renamed to Altron Ltd. on 25 Interim No 74 9 Nov 21 15 Nov 21 7.00

August 2021. Final No 73 1 Jun 21 7 Jun 21 15.00

Special 11 May 21 17 May 21 96.00

FINANCIAL STATISTICS Interim No 72 10 Nov 20 16 Nov 20 33.00

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

Interim Final(rst) Final(rst) Final(rst) Final(rst) LIQUIDITY: Oct21 Ave 2m shares p.w., R32.0m(27.0% p.a.)

Turnover 3 544 7 089 7 383 15 723 14 743 SCOM 40 Week MA ALTRON

Op Inc 119 331 457 1 015 745

NetIntPd(Rcvd) 68 180 255 176 178

Tax 17 30 50 158 145 2823

Minority Int 6 - 12 - 28 39 - 19

Att Inc - 36 12 154 656 711 187 2187

TotCompIncLoss - 59 12 107 597 870 100

1550

Hline Erngs-CO 40 129 141 663 441

Fixed Ass 447 422 597 620 615 914

Inv in Assoc 65 47 58 19 20

Inv & Loans - - - - 468 2016 | 2017 | 2018 | 2019 | 2020 | 2021 277

Def Tax Asset 194 151 134 155 214

Tot Curr Ass 3 120 4 742 9 063 7 430 6 138 Recent Announcements

Ord SH Int 4 322 4 764 3 944 3 535 2 790 Altron interim results August 2021 - Monday, 25 October 2021:

Minority Int 104 102 - 193 - 162 - 245 Revenue from continuing operation for the interim period came

LT Liab 1 768 1 764 2 502 1 424 1 580 to R3.5 billion (2020: R3.5 billion) and earnings before interest,

Tot Curr Liab 2 144 3 117 7 360 6 804 5 811

tax, depreciation and amortisation ("EBITDA") increased by

PER SHARE STATISTICS (cents per share) 10% to R487 million (2020: R442 million). Operating profit

EPS (ZARc) - 10.00 3 270.00 174.00 192.00 51.00 grew to R119 million (2020: R106 million). Profit for the period

HEPS-C (ZARc) 11.00 35.00 38.00 179.00 119.00 from continuing operations rose to R34 million (2020: loss of

Pct chng p.a. - 37.1 - 7.9 - 78.8 50.4 4.4 R58 million). Furthermore, headline earnings per share from

Tr 5yr av grwth % - - 8.3 - 8.3 2.0 0.4

DPS (ZARc) 7.00 144.00 55.00 72.00 - continuing operations recovered to 11 cents per share (2020:

Pct chng p.a. - 161.8 - 23.6 - - headline loss per share of 8 cents per share).

Tr 5yr av grwth % - 27.6 - 24.7 - 32.3 - 25.6 Interim dividend

NAV PS (ZARc) 1 166.70 1 192.25 1 061.00 885.12 752.00 The Board remains committed to maintaining the group's

3 Yr Beta 0.32 0.08 0.11 - 0.03 0.64 dividend cover of 2.5 times on headline earnings relating to con-

Price High 1 242 3 500 2 875 2 029 1 394 tinuing operations. The Board made the decision to deviate and

Price Low 837 723 1 400 1 200 950 improve on the dividend cover, by giving shareholders the

Price Prd End 1 038 1 153 2 019 1 880 1 245 benefit of normalising the headline earnings for the negative

RATIOS non-operational impact of the additional share-based payment

Ret on SH Fnd - 1.36 249.53 19.40 21.30 16.70 expenses recognised as a result of the Bytes UK demerger. Ac-

Ret On Tot Ass 1.33 1.22 10.60 13.40 10.20 cordingly a gross interim cash dividend of 7 cents per share (5.6

Oper Pft Mgn 3.36 4.67 6.19 6.46 4.50

D:E 0.46 0.51 1.03 0.92 1.16 cents net of 20% dividend withholding tax) has been declared

Int Cover 1.75 1.84 1.79 5.77 4.19 for the financial half-year ended 31 August 2021, payable to

Current Ratio 1.46 1.52 1.23 1.09 1.06 shareholders recorded inthe register ofthe companyatthe close

Div Cover - 1.43 22.71 3.16 2.67 - of business on the record date appearing below. The interim

NUMBER OF EMPLOYEES: 7 700 dividend of 33 cents declared in the comparative period was

DIRECTORS: NgaraTR(alt), SithebeAK(ind ne), Bofilatos N (CFO), based on continued operations' headline earnings which

Nyati M (CE), BallAC(ne), DawsonBW(ne), GelinkGG(ind ne), included the profits of Bytes UK for the full 6 months.

Mnganga Dr P (ind ne), Sithole S (ne), van Graan S W (Chair, ind ne),

VenterRE(ne)

80