Page 86 - SHB 2021 Issue 4

P. 86

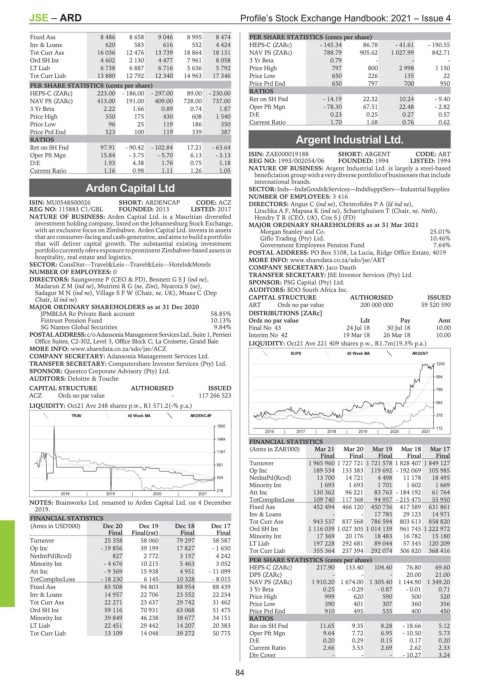

JSE – ARD Profile’s Stock Exchange Handbook: 2021 – Issue 4

Fixed Ass 8 486 8 658 9 046 8 995 8 474 PER SHARE STATISTICS (cents per share)

Inv & Loans 620 583 616 552 4 424 HEPS-C (ZARc) - 145.34 86.78 - 41.61 - 190.55

Tot Curr Ass 16 036 12 476 13 739 18 864 18 131 NAV PS (ZARc) 788.79 905.62 1 027.99 842.71

Ord SH Int 4 602 2 130 4 477 7 961 8 058 3 Yr Beta 0.79 - - -

LT Liab 6 738 6 887 6 716 5 636 5 792 Price High 797 800 2 998 1 150

Tot Curr Liab 13 880 12 792 12 340 14 963 17 346 Price Low 650 226 135 22

PER SHARE STATISTICS (cents per share) Price Prd End 650 797 700 950

HEPS-C (ZARc) 223.00 - 186.00 - 297.00 89.00 - 230.00 RATIOS

NAV PS (ZARc) 413.00 191.00 409.00 728.00 737.00 Ret on SH Fnd - 14.19 22.32 10.24 - 9.40

3 Yr Beta 2.22 1.66 0.89 0.74 1.87 Oper Pft Mgn - 78.30 67.51 22.48 - 2.82

Price High 550 175 430 608 1 540 D:E 0.23 0.25 0.27 0.57

Price Low 96 25 119 186 350 Current Ratio 1.70 1.68 0.76 0.62

Price Prd End 523 100 119 339 387

RATIOS Argent Industrial Ltd.

Ret on SH Fnd 97.91 - 90.42 - 102.84 17.21 - 63.64 ARG

Oper Pft Mgn 15.84 - 3.75 - 5.70 6.13 - 3.13 ISIN: ZAE000019188 SHORT: ARGENT CODE: ART

D:E 1.93 4.38 1.76 0.75 1.18 REG NO: 1993/002054/06 FOUNDED: 1994 LISTED: 1994

NATURE OF BUSINESS: Argent Industrial Ltd. is largely a steel-based

Current Ratio 1.16 0.98 1.11 1.26 1.05

beneficiation group with a very diverse portfolio of businesses that include

international brands.

Arden Capital Ltd SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies

NUMBER OF EMPLOYEES: 3 416

ARD

ISIN: MU0548S00026 SHORT: ARDENCAP CODE: ACZ DIRECTORS: Angus C (ind ne), ChristofidesPA(ld ind ne),

REG NO: 115883 C1/GBL FOUNDED: 2013 LISTED: 2017 Litschka A F, Mapasa K (ind ne), Scharrighuisen T (Chair, ne, Neth),

NATURE OF BUSINESS: Arden Capital Ltd. is a Mauritian diversifed Hendry T R (CEO, UK), Cox S J (FD)

investment holding company, listed on the Johannesburg Stock Exchange, MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

with an exclusive focus on Zimbabwe. Arden Capital Ltd. invests in assets Morgan Stanley and Co. 25.01%

that are consumer-facing andcash-generative, andaims to build a portfolio Giflo Trading (Pty) Ltd. 10.46%

that will deliver capital growth. The substantial existing investment Government Employees Pension Fund 7.64%

portfolio currently ofers exposure to prominent Zimbabwe-based assets in POSTAL ADDRESS: PO Box 5108, La Lucia, Ridge Office Estate, 4019

hospitality, real estate and logistics. MORE INFO: www.sharedata.co.za/sdo/jse/ART

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Hotels&Motels COMPANY SECRETARY: Jaco Dauth

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DIRECTORS: Saungweme P (CEO & FD), BennettGSJ(ind ne), SPONSOR: PSG Capital (Pty) Ltd.

MadarunZM(ind ne), MuirimiRG(ne, Zim), Nyarota S (ne), AUDITORS: BDO South Africa Inc.

SadagurMN(ind ne), VillageSFW (Chair, ne, UK), Mtasa C (Dep

Chair, ld ind ne) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 ART Ords no par value 200 000 000 59 520 590

JPMBLSA Re Private Bank account 58.85% DISTRIBUTIONS [ZARc]

Fintrust Pension Fund 10.13% Ords no par value Ldt Pay Amt

SG Nantes Global Securities 9.84% Final No 43 24 Jul 18 30 Jul 18 10.00

POSTALADDRESS:c/oAdansoniaManagementServicesLtd.,Suite1,Perrieri Interim No 42 19 Mar 18 26 Mar 18 10.00

Office Suites, C2-302, Level 3, Office Block C, La Croisette, Grand Baie LIQUIDITY: Oct21 Ave 221 409 shares p.w., R1.7m(19.3% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/ACZ

SUPS 40 Week MA ARGENT

COMPANY SECRETARY: Adansonia Management Services Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 1200

SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: Deloitte & Touche 994

CAPITAL STRUCTURE AUTHORISED ISSUED 789

ACZ Ords no par value - 117 266 523

583

LIQUIDITY: Oct21 Ave 248 shares p.w., R1 571.2(-% p.a.)

TRAV 40 Week MA ARDENCAP 378

1800

172

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1484

FINANCIAL STATISTICS

(Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

1167

Final Final Final Final Final

851 Turnover 1 965 960 1 727 721 1 721 578 1 828 407 1 849 127

Op Inc 189 534 133 383 119 692 - 192 069 105 985

534 NetIntPd(Rcvd) 13 700 14 721 4 498 11 178 18 495

Minority Int 1 693 1 693 1 701 1 602 1 669

218 Att Inc 130 362 96 221 83 763 - 184 192 61 764

2018 | 2019 | 2020 | 2021

TotCompIncLoss 109 740 117 368 94 957 - 215 475 55 950

NOTES: Brainworks Ltd. renamed to Arden Capital Ltd. on 4 December

2019. Fixed Ass 452 494 466 120 450 736 417 589 631 861

Inv & Loans - - 17 785 29 123 14 971

FINANCIAL STATISTICS Tot Curr Ass 943 537 837 568 786 594 803 613 858 820

(Amts in USD'000) Dec 20 Dec 19 Dec 18 Dec 17 Ord SH Int 1 116 039 1 027 305 1 014 139 961 745 1 222 972

Final Final(rst) Final Final Minority Int 17 369 20 176 18 483 16 782 15 180

Turnover 25 358 58 060 79 297 58 587 LT Liab 197 228 292 681 89 044 57 345 120 209

Op Inc - 19 856 39 199 17 827 - 1 650 Tot Curr Liab 355 364 237 394 292 074 306 820 368 416

NetIntPd(Rcvd) 827 2 772 3 157 4 242

Minority Int - 4 676 10 215 5 463 3 052 PER SHARE STATISTICS (cents per share) 104.40 76.80 69.60

HEPS-C (ZARc)

217.90

133.40

Att Inc - 9 369 15 938 4 951 - 11 099 DPS (ZARc) - - - 20.00 21.00

TotCompIncLoss - 18 230 6 145 10 328 - 8 015 NAV PS (ZARc) 1 910.20 1 674.00 1 305.40 1 144.90 1 349.20

Fixed Ass 85 508 94 803 88 954 88 439 3 Yr Beta 0.25 - 0.29 - 0.87 - 0.01 0.71

Inv & Loans 14 957 22 706 23 552 22 254 Price High 999 620 590 500 520

Tot Curr Ass 22 271 23 637 29 742 31 462 Price Low 390 401 307 360 356

Ord SH Int 59 116 70 931 63 068 51 475 Price Prd End 910 495 535 400 450

Minority Int 39 849 46 238 38 677 34 151 RATIOS

LT Liab 22 451 29 442 14 207 20 383 Ret on SH Fnd 11.65 9.35 8.28 - 18.66 5.12

Tot Curr Liab 13 109 14 048 39 272 50 775 Oper Pft Mgn 9.64 7.72 6.95 - 10.50 5.73

D:E 0.20 0.29 0.15 0.17 0.20

Current Ratio 2.66 3.53 2.69 2.62 2.33

Div Cover - - - - 10.27 3.24

84