Page 84 - SHB 2021 Issue 4

P. 84

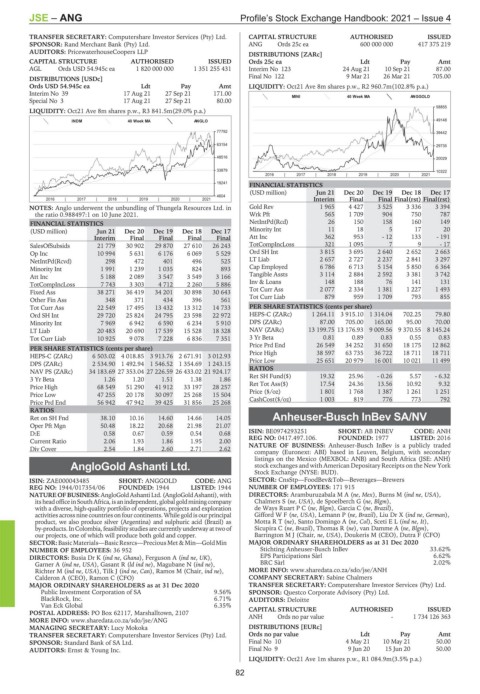

JSE – ANG Profile’s Stock Exchange Handbook: 2021 – Issue 4

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Rand Merchant Bank (Pty) Ltd. ANG Ords 25c ea 600 000 000 417 375 219

AUDITORS: PricewaterhouseCoopers LLP

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords 25c ea Ldt Pay Amt

AGL Ords USD 54.945c ea 1 820 000 000 1 351 255 431 Interim No 123 24 Aug 21 10 Sep 21 87.00

DISTRIBUTIONS [USDc] Final No 122 9 Mar 21 26 Mar 21 705.00

Ords USD 54.945c ea Ldt Pay Amt LIQUIDITY: Oct21 Ave 8m shares p.w., R2 960.7m(102.8% p.a.)

Interim No 39 17 Aug 21 27 Sep 21 171.00

MINI 40 Week MA ANGGOLD

Special No 3 17 Aug 21 27 Sep 21 80.00

58855

LIQUIDITY: Oct21 Ave 8m shares p.w., R3 841.5m(29.0% p.a.)

INDM 40 Week MA ANGLO 49148

77792 39442

63154 29735

48516 20029

33879 10322

2016 | 2017 | 2018 | 2019 | 2020 | 2021

19241

FINANCIAL STATISTICS

(USD million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

4604

2016 | 2017 | 2018 | 2019 | 2020 | 2021 Interim Final Final Final(rst) Final(rst)

NOTES: Anglo underwent the unbundling of Thungela Resources Ltd. in Gold Rev 1 965 4 427 3 525 3 336 3 394

the ratio 0.988497:1 on 10 June 2021. Wrk Pft 565 1 709 904 750 787

FINANCIAL STATISTICS NetIntPd(Rcd) 26 150 158 160 149

(USD million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Minority Int 11 18 5 17 20

Interim Final Final Final Final Att Inc 362 953 - 12 133 - 191

SalesOfSubsids 21 779 30 902 29 870 27 610 26 243 TotCompIncLoss 321 1 095 7 9 - 17

Op Inc 10 994 5 631 6 176 6 069 5 529 Ord SH Int 3 815 3 695 2 640 2 652 2 663

NetIntPd(Rcvd) 298 472 401 496 525 LT Liab 2 657 2 727 2 237 2 841 3 297

Minority Int 1 991 1 239 1 035 824 893 Cap Employed 6 786 6 713 5 154 5 850 6 364

Att Inc 5 188 2 089 3 547 3 549 3 166 Tangible Assts 3 114 2 884 2 592 3 381 3 742

TotCompIncLoss 7 743 3 303 4 712 2 260 5 886 Inv & Loans 148 188 76 141 131

Fixed Ass 38 271 36 419 34 201 30 898 30 643 Tot Curr Ass 2 077 2 334 1 381 1 227 1 493

Other Fin Ass 348 371 434 396 561 Tot Curr Liab 879 959 1 709 793 855

Tot Curr Ass 22 549 17 495 13 432 13 312 14 733 PER SHARE STATISTICS (cents per share)

Ord SH Int 29 720 25 824 24 795 23 598 22 972 HEPS-C (ZARc) 1 264.11 3 915.10 1 314.04 702.25 79.80

Minority Int 7 969 6 942 6 590 6 234 5 910 DPS (ZARc) 87.00 705.00 165.00 95.00 70.00

LT Liab 20 483 20 690 17 539 15 528 18 328 NAV (ZARc) 13 199.75 13 176.93 9 009.56 9 370.55 8 145.24

Tot Curr Liab 10 925 9 078 7 228 6 836 7 351 3 Yr Beta 0.81 0.89 0.83 0.55 0.83

Price Prd End 26 549 34 252 31 650 18 175 12 862

PER SHARE STATISTICS (cents per share) Price High 38 597 63 735 36 722 18 711 18 711

HEPS-C (ZARc) 6 503.02 4 018.85 3 913.76 2 671.91 3 012.93

DPS (ZARc) 2 534.90 1 492.94 1 546.52 1 354.69 1 243.15 Price Low 25 651 20 979 16 001 10 021 11 499

NAV PS (ZARc) 34 183.69 27 353.04 27 226.59 26 433.02 21 924.17 RATIOS

3 Yr Beta 1.26 1.20 1.51 1.38 1.86 Ret SH Fund($) 19.32 25.96 - 0.26 5.57 - 6.32

Price High 68 549 51 290 41 912 33 197 28 257 Ret Tot Ass($) 17.54 24.36 13.56 10.92 9.32

Price ($/oz) 1 801 1 768 1 387 1 261 1 251

Price Low 47 255 20 178 30 097 25 268 15 504

Price Prd End 56 942 47 942 39 425 31 856 25 268 CashCost($/oz) 1 003 819 776 773 792

RATIOS

Ret on SH Fnd 38.10 10.16 14.60 14.66 14.05 Anheuser-Busch InBev SA/NV

Oper Pft Mgn 50.48 18.22 20.68 21.98 21.07 ANH

D:E 0.58 0.67 0.59 0.54 0.68 ISIN: BE0974293251 SHORT: AB INBEV CODE: ANH

Current Ratio 2.06 1.93 1.86 1.95 2.00 REG NO: 0417.497.106. FOUNDED: 1977 LISTED: 2016

NATURE OF BUSINESS: Anheuser-Busch InBev is a publicly traded

Div Cover 2.54 1.84 2.60 2.71 2.62

company (Euronext: ABI) based in Leuven, Belgium, with secondary

listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH)

AngloGold Ashanti Ltd. stock exchanges and with American Depositary Receipts on the New York

Stock Exchange (NYSE: BUD).

ANG

ISIN: ZAE000043485 SHORT: ANGGOLD CODE: ANG SECTOR: CnsStp—FoodBev&Tob—Beverages—Brewers

REG NO: 1944/017354/06 FOUNDED: 1944 LISTED: 1944 NUMBER OF EMPLOYEES: 171 915

NATUREOFBUSINESS: AngloGoldAshantiLtd.(AngloGoldAshanti),with DIRECTORS: AramburuzabalaMA(ne, Mex), Burns M (ind ne, USA),

itsheadofficeinSouthAfrica,isanindependent,globalgoldminingcompany Chalmers S (ne, USA), de Spoelberch G (ne, Blgm),

with a diverse, high-quality portfolio of operations, projects and exploration de Ways RuartPC(ne, Blgm), Garcia C (ne, Brazil),

activities across nine countries on four continents. While gold is our principal GiffordWF(ne, USA), Lemann P (ne, Brazil), Liu Dr X (ind ne, German),

product, we also produce silver (Argentina) and sulphuric acid (Brazil) as MottaRT(ne), Santo Domingo A (ne, Col), ScetiEL(ind ne, It),

by-products. In Colombia, feasibility studies are currently underway at two of Sicupira C (ne, Brazil), Thomas R (ne), van Damme A (ne, Blgm),

our projects, one of which will produce both gold and copper. Barrington M J (Chair, ne, USA), Doukeris M (CEO), Dutra F (CFO)

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

NUMBER OF EMPLOYEES: 36 952 Stichting Anheuser-Busch InBev 33.62%

DIRECTORS: Busia Dr K (ind ne, Ghana), Ferguson A (ind ne, UK), EPS Participations Sàrl 6.62%

Garner A (ind ne, USA), Gasant R (ld ind ne), Magubane N (ind ne), BRC Sàrl 2.02%

Richter M (ind ne, USA), Tilk J (ind ne, Can), Ramos M (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/ANH

Calderon A (CEO), Ramon C (CFO) COMPANY SECRETARY: Sabine Chalmers

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Public Investment Corporation of SA 9.56% SPONSOR: Questco Corporate Advisory (Pty) Ltd.

BlackRock, Inc. 6.71% AUDITORS: Deloitte

Van Eck Global 6.35%

ISSUED

POSTAL ADDRESS: PO Box 62117, Marshalltown, 2107 CAPITAL STRUCTURE AUTHORISED - 1 734 126 363

Ords no par value

ANH

MORE INFO: www.sharedata.co.za/sdo/jse/ANG

MANAGING SECRETARY: Lucy Mokoka DISTRIBUTIONS [EURc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSOR: Standard Bank of SA Ltd. Final No 10 4 May 21 10 May 21 50.00

AUDITORS: Ernst & Young Inc. Final No 9 9 Jun 20 15 Jun 20 50.00

LIQUIDITY: Oct21 Ave 1m shares p.w., R1 084.9m(3.5% p.a.)

82