Page 78 - SHB 2021 Issue 4

P. 78

JSE – AFR Profile’s Stock Exchange Handbook: 2021 – Issue 4

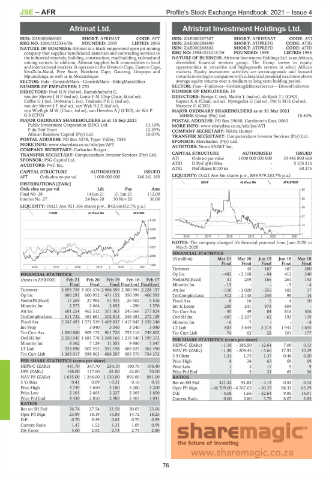

Afrimat Ltd. Afristrat Investment Holdings Ltd.

AFR AFR

ISIN: ZAE000086302 SHORT: AFRIMAT CODE: AFT ISIN: ZAE000287587 SHORT: AFRISTRAT CODE: ATI

REG NO: 2006/022534/06 FOUNDED: 2005 LISTED: 2006 ISIN: ZAE000288890 SHORT: ATIPREFG CODE: ATIG

NATURE OF BUSINESS: Afrimat is a black empowered open pit mining ISIN: ZAE000288882 SHORT: ATIPREFD CODE: ATID

company that supplies beneficiated materials and contracting services to REG NO: 1998/013215/06 FOUNDED: 1998 LISTED: 1998

the industrial minerals, building, construction, road building, railroad and NATURE OF BUSINESS: Afristrat Investment Holdings Ltd. is an African,

mining sectors. In addition, Afrimat supplies bulk commodities to local diversified financial services group. The Group invess in equity

and international markets. It operates in the Western Cape, Eastern Cape, opportunities in attractive and high-growth sectors in select African

KwaZulu-Natal, Free State, Northern Cape, Gauteng, Limpopo and markets. Equity investment activities are sector-agnostic and focused

Mpumalanga as well as in Mozambique. towardsinvestingincompanieswithsubstantialpotentialtoachieve above

SECTOR: Inds—Constr&Mats—Constr&Mats—BldngMats:Other average equity returns over a medium to long term holding period.

NUMBER OF EMPLOYEES: 2 270 SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

DIRECTORS: PoolHN(ind ne), Ramukhubathi C, NUMBER OF EMPLOYEES: 10

van der MerweJHP(ind ne), Louw F M (Dep Chair, ld ind ne), DIRECTORS: Beetge C (ne), Maitin Y (ind ne), de Kock T J (CFO),

CoffeeGJ(ne), Dotwana L (ne), TsukuduPRE(ind ne), Rayner K A (Chair, ind ne), Nyengedza G (ind ne), PittRMH(ind ne),

van der MerweJF(ind ne), van WykHJE(ind ne), Manyere G (CEO)

von Wielligh M W (Chair, ind ne), van Heerden A J (CEO), de Wit P MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

G S (CFO) MHMK Group (Pty) Ltd. 15.84%

MAJOR ORDINARY SHAREHOLDERS as at 15 Sep 2021 POSTAL ADDRESS: PO Box 39660, Garsfontein East, 0060

Public Investment Corporation (SOC) Ltd. 13.10% MORE INFO: www.sharedata.co.za/sdo/jse/ATI

F du Toit Trust 12.29% COMPANY SECRETARY: Nikita Hunter

African Rainbow Capital (Pty) Ltd. 10.01% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 5278, Tyger Valley, 7536 SPONSOR: Merchantec (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/AFT AUDITORS: Nexia SAB&T Inc.

COMPANY SECRETARY: Catharine Burger

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: PSG Capital Ltd. ATI Ords no par value 1 000 000 000 000 59 445 880 668

AUDITORS: PwC Inc. ATID D Pref @R100ea - 5 105 216

ATIG Pref shares R100 ea - 60 275

CAPITAL STRUCTURE AUTHORISED ISSUED

AFT Ords shrs no par val 1 000 000 000 146 341 193 LIQUIDITY: Oct21 Ave 8m shares p.w., R98 979.2(0.7% p.a.)

DISTRIBUTIONS [ZARc] GENF 40 Week MA AFRISTRAT

Ords shrs no par val Ldt Pay Amt 65

Final No 28 14 Jun 21 21 Jun 21 112.00

Interim No 27 24 Nov 20 30 Nov 20 36.00 52

LIQUIDITY: Oct21 Ave 921 366 shares p.w., R42.6m(32.7% p.a.) 39

CONM 40 Week MA AFRIMAT

27

6150

14

5209

1

2016 | 2017 | 2018 | 2019 | 2020 | 2021

4268

NOTES: The company changed it's financial year-end from June 2020 to

3327 March 2020.

FINANCIAL STATISTICS

2386

(R million) Mar 21 Mar 20 Jun 19 Jun 18 Mar 18

Final Final Final Final Final

1445

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Turnover - 45 167 467 380

FINANCIAL STATISTICS Op Inc - 482 - 2 168 - 84 412 240

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 NetIntPd(Rcvd) 31 259 166 261 193

Final Final Final Final(rst) Final(rst) Minority Int - 13 - - - 5 - 4

Turnover 3 693 759 3 304 376 2 966 399 2 380 994 2 228 157 Att Inc - 538 - 2 020 - 255 102 17

Op Inc 886 291 600 952 471 152 350 399 406 595 TotCompIncLoss - 512 - 2 145 - 245 95 14

NetIntPd(Rcvd) 17 269 27 982 51 935 26 502 5 516 Fixed Ass 8 16 5 4 10

Minority Int 2 573 2 664 2 852 - 290 1 570 Inv & Loans 200 241 973 804 -

Att Inc 601 254 462 512 301 363 245 668 277 824 Tot Curr Ass 45 49 84 816 506

TotCompIncLoss 611 722 461 661 302 812 246 481 272 129 Ord SH Int - 687 - 2 207 - 62 193 119

Fixed Ass 2 247 493 1 571 519 1 469 837 1 417 845 1 058 240 Minority Int - 6 7 - - - 8

Inv Prop - 3 040 3 040 3 040 3 040 LT Liab 803 3 644 3 213 1 941 1 655

Tot Curr Ass 1 850 880 909 172 901 720 755 116 749 802 Tot Curr Liab 74 62 22 101 177

Ord SH Int 2 250 045 1 681 778 1 398 166 1 219 340 1 199 372 PER SHARE STATISTICS (cents per share)

Minority Int 8 362 7 129 11 351 9 980 7 547 HEPS-C (ZARc) - 1.16 - 186.50 - 12.64 7.00 0.13

LT Liab 933 896 507 452 591 198 609 825 362 490 NAV PS (ZARc) - 1.48 - 204.45 - 5.66 17.92 10.29

Tot Curr Liab 1 263 017 598 903 686 297 695 570 754 372 3 Yr Beta 1.24 1.75 1.37 0.46 0.20

PER SHARE STATISTICS (cents per share) Price High 8 24 63 69 69

HEPS-C (ZARc) 441.70 347.70 234.10 180.70 196.40 Price Low 1 2 17 9 9

DPS (ZARc) 148.00 117.00 81.00 62.00 70.00 Price Prd End 1 3 21 65 36

NAV PS (ZARc) 1 635.00 1 246.00 1 030.00 893.00 881.00 RATIOS

3 Yr Beta 0.41 0.09 - 0.31 0.16 0.15 Ret on SH Fnd 321.32 91.82 - 4.13 0.53 0.14

Price High 4 749 3 650 3 180 3 200 3 200 Oper Pft Mgn - 66 709.00 - 4 767.65 - 50.33 88.32 63.29

Price Low 2 101 2 665 2 227 2 305 1 800 D:E - 4.68 - 1.66 - 52.64 9.95 14.91

Price Prd End 4 430 2 850 2 980 2 903 3 041 Current Ratio 0.60 0.80 3.78 8.07 2.85

RATIOS

Ret on SH Fnd 26.74 27.54 21.58 20.03 23.06

Oper Pft Mgn 23.99 18.19 15.88 14.72 18.25

D:E 0.70 0.39 0.62 0.70 0.59

Current Ratio 1.47 1.52 1.31 1.09 0.99

Div Cover 3.00 2.92 2.73 2.75 2.80

76