Page 207 - 2021 Issue 2

P. 207

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – RHB

POSTAL ADDRESS: Private Bag X1000, Saxonworld, 2132

RH Bophelo Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/RMH

RHB COMPANY SECRETARY: E J Marais

ISIN: ZAE000244737 SHORT: RHBOPHELO CODE: RHB TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 2016/533398/06 FOUNDED: 2016 LISTED: 2017 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

NATURE OF BUSINESS: RH Bophelo is a healthcare investment vehicle that

aims to produce superior returns, whilst contributing to socio-economic AUDITORS: Deloitte Touche Tohmatsu

value creation and development of South Africa and making an important CAPITAL STRUCTURE AUTHORISED ISSUED

contribution to ongoing transformation in South Africa. RMH Ords 1c ea 2 000 000 000 1 411 703 218

SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts DISTRIBUTIONS [ZARc]

NUMBER OF EMPLOYEES: 0 Ords 1c ea Ldt Pay Amt

DIRECTORS: Clarke C W, Lerutla D (ne), Motuba DrSG(ld ind ne), Special No 1 4 May 21 10 May 21 80.00

Nomvalo V P, Ntshwana DrKR(ind ne), Segooa B (ne), Sekete Dr

PD(ne), Oliphant J R (Chair, ne), Zunga Q (CEO & MD), Mhlaba K D Final No 58 23 Sep 19 30 Sep 19 6.28

(CFO) LIQUIDITY: Apr21 Ave 36m shares p.w., R518.2m(131.8% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 16 Oct 2020

Public Investment Corporation 69.22% BANK 40 Week MA RMBH

Sentio Capital Management 10.00% 305

RQ Capital Partners 3.00%

POSTAL ADDRESS:PostnetSuite510, PrivateBagX1,MelroseArch,2076 265

MORE INFO: www.sharedata.co.za/sdo/jse/RHB

226

COMPANY SECRETARY: Ragni Naicker

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

186

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

AUDITORS: Deloitte & Touche 147

CAPITAL STRUCTURE AUTHORISED ISSUED

107

RHB Ords no par 10 000 000 000 64 691 298 2016 | 2017 | 2018 | 2019 | 2020 |

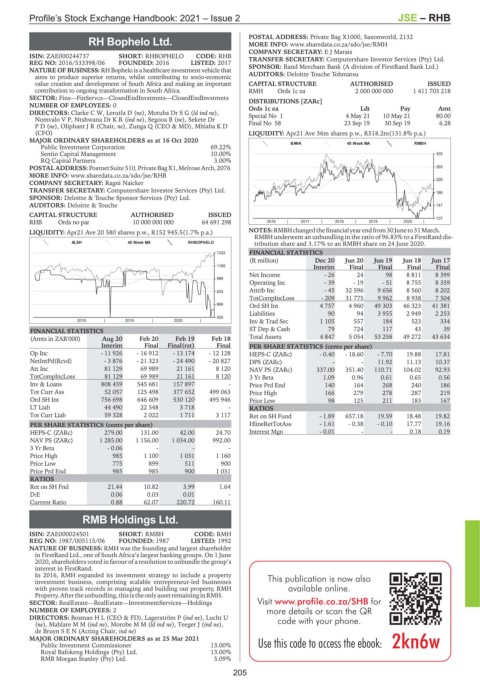

LIQUIDITY: Apr21 Ave 20 580 shares p.w., R152 945.5(1.7% p.a.) NOTES:RMBHchangedthefinancialyearendfrom30Juneto31March.

RMBH underwent an unbundling in the ratio of 96.83% to a FirstRand dis-

ALSH 40 Week MA RHBOPHELO tribution share and 3.17% to an RMBH share on 24 June 2020.

1332 FINANCIAL STATISTICS

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

1165 Interim Final Final Final Final

Net Income - 26 24 98 8 811 8 399

999

Operating Inc - 39 - 19 - 51 8 755 8 359

833 Attrib Inc - 45 32 596 9 656 8 560 8 202

TotCompIncLoss - 209 31 775 9 962 8 938 7 504

666 Ord SH Int 4 757 4 960 49 303 46 323 41 381

Liabilities 90 94 3 955 2 949 2 253

500

2018 | 2019 | 2020 | Inv & Trad Sec 1 105 557 184 523 334

FINANCIAL STATISTICS ST Dep & Cash 79 724 117 43 39

(Amts in ZAR'000) Aug 20 Feb 20 Feb 19 Feb 18 Total Assets 4 847 5 054 53 258 49 272 43 634

Interim Final Final(rst) Final PER SHARE STATISTICS (cents per share)

Op Inc - 11 926 - 16 912 - 13 174 - 12 128 HEPS-C (ZARc) - 0.40 - 18.60 - 7.70 19.88 17.81

NetIntPd(Rcvd) - 3 876 - 21 323 - 24 490 - 20 827 DPS (ZARc) - - 11.92 11.13 10.37

Att Inc 81 129 69 989 21 161 8 120 NAV PS (ZARc) 337.00 351.40 110.71 104.02 92.93

TotCompIncLoss 81 129 69 989 21 161 8 120 3 Yr Beta 1.09 0.96 0.61 0.65 0.56

Inv & Loans 808 459 545 681 157 897 - Price Prd End 140 164 268 240 186

Tot Curr Ass 52 057 125 498 377 652 499 063 Price High 166 279 278 287 219

Ord SH Int 756 698 646 609 530 120 495 946 Price Low 98 125 211 183 167

LT Liab 44 490 22 548 3 718 - RATIOS

Tot Curr Liab 59 328 2 022 1 711 3 117 Ret on SH Fund - 1.89 657.18 19.59 18.48 19.82

PER SHARE STATISTICS (cents per share) HlineRetTotAss - 1.61 - 0.38 - 0.10 17.77 19.16

HEPS-C (ZARc) 279.00 131.00 42.00 24.70 Interest Mgn - 0.01 - - 0.18 0.19

NAV PS (ZARc) 1 285.00 1 156.00 1 034.00 992.00

3 Yr Beta - 0.06 - - -

Price High 985 1 100 1 031 1 160

Price Low 775 899 511 900

Price Prd End 985 985 900 1 031

RATIOS

Ret on SH Fnd 21.44 10.82 3.99 1.64

D:E 0.06 0.03 0.01 -

Current Ratio 0.88 62.07 220.72 160.11

RMB Holdings Ltd.

RMB

ISIN: ZAE000024501 SHORT: RMBH CODE: RMH

REG NO: 1987/005115/06 FOUNDED: 1987 LISTED: 1992

NATURE OF BUSINESS: RMH was the founding and largest shareholder

in FirstRand Ltd., one of South Africa’s largest banking groups. On 1 June

2020, shareholders voted in favour of a resolution to unbundle the group’s

interest in FirstRand.

In 2016, RMH expanded its investment strategy to include a property This publication is now also

investment business, comprising scalable entrepreneur-led businesses

with proven track records in managing and building out property, RMH available online.

Property.Aftertheunbundling,thisistheonlyassetremaininginRMH.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings Visit www.profile.co.za/SHB for

NUMBER OF EMPLOYEES: 2 more details or scan the QR

DIRECTORS: Bosman H L (CEO & FD), Lagerström P (ind ne), Lucht U

(ne), MahlareMM(ind ne), MorobeMM(ld ind ne), Teeger J (ind ne), code with your phone.

de BruynSEN (Acting Chair, ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 25 Mar 2021

Public Investment Commissioner 13.00% Usethiscodetoaccess theebook:

Royal Bafokeng Holdings (Pty) Ltd. 13.00%

RMB Morgan Stanley (Pty) Ltd. 5.09%

205