Page 202 - 2021 Issue 2

P. 202

JSE – REM Profile’s Stock Exchange Handbook: 2021 – Issue 2

DIRECTORS: de BruynSEN(ind ne), Lubbe M,

Remgro Ltd. MagezaNP(ind ne), Malherbe J (ne),

MoleketiPJ(ind ne), MorobeMM(ind ne),

REM

NeethlingPJ(ne), NieuwoudtGG(ne),

Rantloane L (ind ne), Rupert A (ne),

Rupert J P (Chair, ne),

Robertson F (Co Dep Chair, ind ne),

Durand J J (CEO), Williams N (CFO)

POSTAL ADDRESS: PO Box 456, Stellenbosch,

Scan the QR code to 7599

visit our website EMAIL: dh@remgro.com

WEBSITE: www.remgro.com

TELEPHONE: 021-888-3000 FAX: 021-888-3399

COMPANY SECRETARY: Danielle Dreyer

ISIN: ZAE000026480 SHORT: REMGRO CODE: REM TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 1968/006415/06 FOUNDED: 2000 LISTED: 2000

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

NATURE OF BUSINESS:

BANKERS: First National Bank

Remgro Ltd. is an investment holding company established

with effect from 1 April 2000, after the restructuring of the CALENDAR Expected Status

former Rembrandt Group Ltd. The Group's interests consist Next Final Results Sep 2021 Unconfirmed

mainly of investments in consumer products; banking; Annual General Meeting Nov 2021 Unconfirmed

healthcare; insurance; industrial; infrastructure as well as Next Interim Results Mar 2022 Unconfirmed

media and sport.

The company's activities are concentrated mainly on the man- CAPITAL STRUCTURE AUTHORISED ISSUED

agement of investments and the provision of support rather REM Ords no par 1 000 000 000 529 217 007

than on being involved in the day-to-day management of DISTRIBUTIONS [ZARc]

business units of investees. Ords no par Ldt Pay Amt

Subsidiaries not wholly owned include listed companies with Interim No 41 20 Apr 21 26 Apr 21 30.00

independent boards of directors on which this company has Final No 40 10 Nov 20 16 Nov 20 50.00

20 Apr 20

14 Apr 20

non-executive representation. Non-subsidiary investments Interim No 39 12 Nov 19 18 Nov 19 155.98

Final No 38

253.20

comprisebothlistedandunlistedcompaniesnotcontrolledby

this company and which are mostly associated companies due LIQUIDITY: Mar21 Ave 8m shares p.w., R1 042.1m(83.1% p.a.)

to significant influence and board representation. FINA 40 Week MA REMGRO

21463

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

CONTROLLED BY: Rupert Beleggings (Pty) Ltd. 18870

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Other 83.65% 16278

Public Investment Commissioner 16.35%

NOTES:Remgrounbundledsharesintheapportionmentratioof0.7255039 13685

unbundled shares on 8 June 2020.

11093

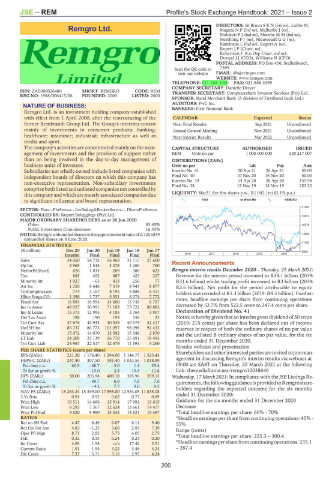

FINANCIAL STATISTICS

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 8500

Interim Final Final Final Final 2016 | 2017 | 2018 | 2019 | 2020 |

Sales 34 060 54 732 56 968 31 115 27 600 Recent Announcements

Op Inc 2 965 1 545 3 278 1 260 760

NetIntPd(Rcvd) 626 1 014 209 380 622 Remgro interim results December 2020 - Thursday, 25 March 2021:

Tax 885 452 987 423 227 Revenue for the interim period increased to R34.1 billion (2019:

Minority Int 1 027 - 63 433 256 77 R31.6 billion) whilst trading profit increased to R3 billion (2019:

Att Inc 1 250 6 646 7 319 8 943 8 877 R2.6 billion). Net profit for the period attributable to equity

TotCompIncLoss 774 3 167 8 195 8 888 6 411 holders was recorded at R1.3 billion (2019: R4.3 billion). Further-

Hline Erngs-CO 1 398 1 737 5 551 8 074 7 772

Fixed Ass 16 894 16 954 14 660 13 745 6 797 more, headline earnings per share from continuing operations

Inv in Assoc 48 927 50 991 71 183 73 722 80 883 decreased by 52.7% from 522.5 cents to 247.4 cents per share.

Inv & Loans 15 373 12 995 4 185 3 764 3 907 Declaration of Dividend No. 41

Def Tax Asset 198 190 199 158 23 Notice is hereby given that an interim gross dividend of 30 cents

Tot Curr Ass 47 676 43 933 40 539 40 375 22 317 (2019: 215 cents) per share has been declared out of income

Ord SH Int 86 737 86 773 101 097 98 098 92 432 reserves in respect of both the ordinary shares of no par value

Minority Int 15 072 14 670 15 092 15 348 2 870 and the unlisted B ordinary shares of no par value, for the six

LT Liab 24 209 23 139 26 770 25 891 18 493 months ended 31 December 2020.

Tot Curr Liab 24 967 22 517 12 579 11 591 5 260

Results webcast and presentation

PER SHARE STATISTICS (cents per share) Shareholdersandotherinterestedpartiesareinvitedtojoinman-

EPS (ZARc) 221.20 1 176.40 1 294.00 1 144.77 1 523.43

HEPS-C (ZARc) 247.40 307.50 981.40 1 033.55 1 018.89 agement in discussing Remgro's interim results via webcast at

Pct chng p.a. 60.9 - 68.7 - 5.0 1.4 25.4 09:00 am SAST on Thursday, 25 March 2021 at the following

Tr 5yr av grwth % - - 15.0 2.8 15.5 11.6 link: themediaframe.net/remgro10038646

DPS (ZARc) 30.00 205.98 409.18 385.96 359.13 Wednesday, 17 March 2021: In compliance with the JSE Listings Re-

Pct chng p.a. - - 49.7 6.0 7.5 7.6 quirements, thefollowingguidanceisprovided toRemgroshare-

Tr 5yr av grwth % - - 4.2 7.7 9.0 9.5 holders regarding the expected outcome for the six months

NAV PS (ZARc) 15 263.24 15 359.00 17 895.00 12 554.05 11 835.08

3 Yr Beta 0.91 0.92 0.62 0.77 0.89 ended 31 December 2020:

Price High 10 511 14 666 15 914 17 992 19 615 Guidance for the six months ended 31 December 2020

Price Low 8 293 7 367 12 624 13 661 14 477 Decrease

Price Prd End 9 620 9 990 13 632 14 821 15 487 *Total headline earnings per share: 60% - 70%

RATIOS *Headline earnings per share from continuing operations: 45% -

Ret on SH Fnd 4.47 6.49 6.67 8.11 9.40 55%

Ret On Tot Ass 4.83 - 1.35 3.69 2.93 7.39 Range (cents)

Oper Pft Mgn 8.71 2.82 5.75 4.05 2.75 *Total headline earnings per share: 225.3 – 300.4

D:E 0.32 0.33 0.24 0.24 0.20

Int Cover 4.85 1.54 n/a 17.42 2.91 *Headlineearningsper share fromcontinuingoperations: 235.1

Current Ratio 1.91 1.95 3.22 3.48 4.24 – 287.4

Div Cover 7.37 5.71 3.16 2.97 4.24

200