Page 201 - 2021 Issue 2

P. 201

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – RED

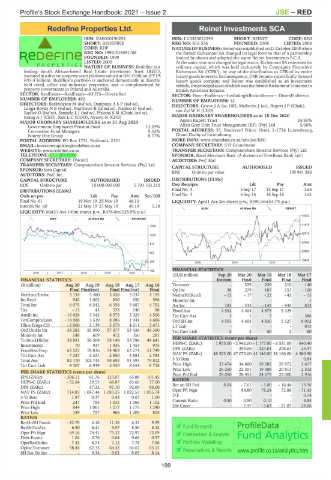

Redefine Properties Ltd. Reinet Investments SCA

RED REI

ISIN: ZAE000190252 ISIN: LU0383812293 SHORT: REINET CODE: RNI

SHORT: REDEFINE REG NO: B16.576 FOUNDED: 2008 LISTED: 2008

CODE: RDF NATUREOF BUSINESS:Reinet wasestablished on21 October 2008 when

REG NO: 1999/018591/06 the former Richemont SA changed its legal form to that of a partnership

FOUNDED: 1999 limited by shares and adopted the name Reinet Investments S.C.A.

LISTED: 2000 At the same time as it changed its legal status, Richemont SA redeemed its

NATURE OF BUSINESS: Redefine is a ordinary capital, which was held exclusively by Compagnie Financière

leading South African-based Real Estate Investment Trust (REIT), Richemont SA ("CFR"), by way of the distribution to CFR of its entire

invested in a diverse property asset platform valued at R81.0 billion (FY19: luxury goods interests. In consequence, CFR became a specifically focused

R95.4 billion). Redefine’s portfolio is anchored domestically in directly luxury goods company and Reinet was established as an investment

held retail, office and industrial properties, and is complemented by vehicle, theprincipalassetofwhich wastheformerRichemont’sinterestin

property investments in Poland and Australia. British American Tobacco.

SECTOR: RealEstate—RealEstate—REITS—Diversified SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

NUMBER OF EMPLOYEES: 492 NUMBER OF EMPLOYEES: 12

DIRECTORS: Barkhuysen M (ind ne), DambuzaASP(ind ne), DIRECTORS: GrieveJA(ne, UK), Malherbe J (ne), Rupert J P (Chair),

Langa-RoydsNB(ind ne), Matthews B (ld ind ne), Naidoo D (ind ne), van Zyl W H (CEO)

Radley D (ind ne), SenneloLJ(ind ne), Pityana S M (Chair, ind ne),

Konig A J (CEO), Kok L C (COO), Nyawo N (CFO) MAJOR ORDINARY SHAREHOLDERS as at 18 Dec 2020

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020 Anton Rupert Trust 24.93%

Allan Gray Unit Trust Management (RF) (Pty) Ltd.

5.06%

Government Employees Pension Fund 13.29%

Coronation Fund Managers 9.32% POSTAL ADDRESS: 35, Boulevard Prince Henri, L-1724 Luxembourg,

Ninety One Group 8.77% Grand Duchy of Luxembourg

POSTAL ADDRESS: PO Box 1731, Parklands, 2121 MORE INFO: www.sharedata.co.za/sdo/jse/RNI

EMAIL: investorenquiries@redefine.co.za COMPANY SECRETARY: S H Grundmann

WEBSITE: www.redefine.co.za TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TELEPHONE: 011-283-0000 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

COMPANY SECRETARY: (Vacant) AUDITORS: PwC Sàrl

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Java Capital RNI Ords no par value - 195 941 286

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [EURc]

RDF Ords no par 10 000 000 000 5 793 183 210 Dep Receipts Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 4 5 Sep 17 15 Sep 17 1.65

Ords no par Ldt Pay Amt Scr/100 Final No 3 6 Sep 16 16 Sep 16 1.61

Final No 61 19 Nov 19 25 Nov 19 48.13 - LIQUIDITY: Apr21 Ave 2m shares p.w., R590.3m(53.7% p.a.)

Interim No 60 21 May 19 27 May 19 49.19 5.18

ALSH 40 Week MA REINET

LIQUIDITY: Mar21 Ave 140m shares p.w., R476.6m(125.9% p.a.)

34632

SAPY 40 Week MA REDEFINE

31675

1229

28718

1022

25760

814

22803

607

19846

399 2018 | 2019 | 2020 |

192 FINANCIAL STATISTICS

2016 | 2017 | 2018 | 2019 | 2020 |

(EUR million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

FINANCIAL STATISTICS Interim Final Final Final Final

(R million) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16 Turnover - 329 239 210 140

Final Final(rst) Final Final(rst) Final Op Inc 38 279 187 153 - 100

NetRent/InvInc 5 134 5 480 5 438 5 037 4 195 NetIntPd(Rcvd) - 12 - 17 - 22 - 42 - 15

Int Recd 942 1 062 920 650 596 Minority Int - - - - 1

Total Inc 6 075 6 542 6 358 5 687 4 792 Att Inc 183 - 335 - 145 - 843 813

Tax - 13 43 533 240 88 Fixed Ass 4 552 4 404 4 875 5 129 -

Attrib Inc - 16 628 3 342 6 575 3 329 4 566 Tot Curr Ass 1 1 5 - 386

TotCompIncLoss - 14 988 3 519 8 086 1 941 4 686 Ord SH Int 4 551 4 403 4 830 5 127 6 002

Hline Erngs-CO - 2 860 2 139 3 679 4 211 3 471 LT Liab - - - - 813

Ord UntHs Int 38 283 55 960 57 677 53 436 49 360 Tot Curr Liab 2 2 50 2 80

Minority Int 548 609 472 350 281

TotStockHldInt 38 831 56 569 58 149 53 786 49 641 PER SHARE STATISTICS (cents per share)

Investments 70 937 1 936 1 454 975 HEPS-C (ZARc) 1 955.00 - 2 942.00 - 1 177.00 - 6 531.00 640.40

FixedAss/Prop 63 523 78 836 74 469 63 274 51 749 DPS (ZARc) - 394.06 323.81 298.61 25.97

Tot Curr Ass 7 327 3 321 2 850 3 881 2 783 NAV PS (ZARc) 48 523.00 47 073.00 41 146.00 38 166.00 4 380.90

Total Ass 82 170 102 743 98 693 91 493 79 812 3 Yr Beta - - - - 0.84

Tot Curr Liab 4 307 6 939 5 030 8 654 8 718 Price High 33 474 34 800 29 083 29 972 3 617

Price Low 26 250 22 301 19 308 20 813 2 532

PER SHARE STATISTICS (cents per share) Price Prd End 29 050 28 455 24 679 23 000 2 916

EPS (ZARc) - 306.11 61.76 123.07 65.88 101.45

HEPS-C (ZARc) - 52.64 39.53 68.87 83.60 77.00 RATIOS

DPS (ZARc) - 97.32 97.10 92.00 86.00 Ret on SH Fnd 8.04 - 7.61 - 3.00 - 16.44 13.56

NAV PS (ZARc) 714.85 1 047.44 1 083.25 1 022.53 1 055.74 Oper Pft Mgn - 84.80 78.24 72.86 - 71.43

3 Yr Beta 1.87 0.37 0.43 0.67 1.00 D:E - - - - 0.14

Price Prd End 247 785 1 035 1 066 1 102 Current Ratio 0.50 0.50 0.10 - 4.83

Price High 844 1 061 1 217 1 175 1 240 Div Cover - - 7.47 - 3.63 - 21.87 24.66

Price Low 139 757 966 1 005 805

RATIOS

RetOnSH Funds - 42.78 6.18 11.38 6.32 9.29

RetOnTotAss 6.90 6.41 9.57 8.50 8.32 Fund Research

Oper Pft Mgn 69.16 74.41 75.32 72.97 72.09 Comparison & Analysis

Debt:Equity 1.04 0.76 0.64 0.66 0.57

OperRetOnInv 7.43 6.74 7.12 7.78 7.96 Portfolio Modelling

OpInc:Turnover 58.44 62.33 64.42 64.62 63.12 Presentations & Reports www.profile.co.za/analytics.htm

SH Ret On Inv - 9.34 9.02 9.05 8.14

199