Page 196 - 2021 Issue 2

P. 196

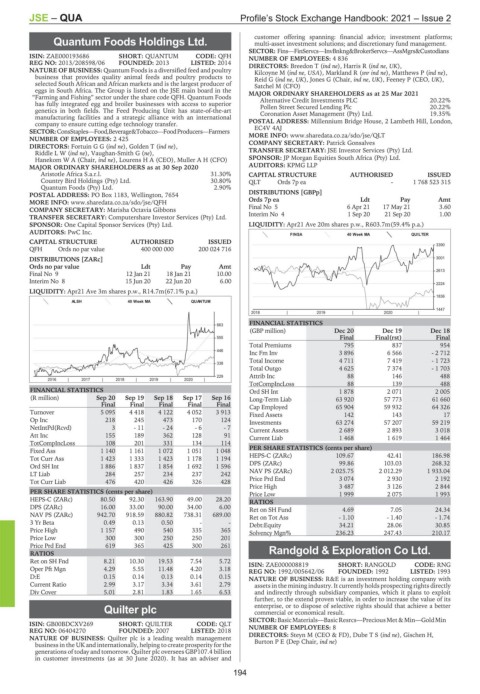

JSE – QUA Profile’s Stock Exchange Handbook: 2021 – Issue 2

customer offering spanning: financial advice; investment platforms;

Quantum Foods Holdings Ltd. multi-asset investment solutions; and discretionary fund management.

QUA SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

ISIN: ZAE000193686 SHORT: QUANTUM CODE: QFH NUMBER OF EMPLOYEES: 4 836

REG NO: 2013/208598/06 FOUNDED: 2013 LISTED: 2014 DIRECTORS: Breedon T (ind ne), Harris R (ind ne, UK),

NATURE OF BUSINESS: Quantum Foods is a diversified feed and poultry Kilcoyne M (ind ne, USA), Markland R (snr ind ne), Matthews P (ind ne),

business that provides quality animal feeds and poultry products to Reid G (ind ne, UK), Jones G (Chair, ind ne, UK), Feeney P (CEO, UK),

selected South African and African markets and is the largest producer of Satchel M (CFO)

eggs in South Africa. The Group is listed on the JSE main board in the

“Farming and Fishing” sector under the share code QFH. Quantum Foods MAJOR ORDINARY SHAREHOLDERS as at 25 Mar 2021 20.22%

Alternative Credit Investments PLC

has fully integrated egg and broiler businesses with access to superior Pollen Street Secured Lending Plc 20.22%

genetics in both fields. The Feed Producing Unit has state-of-the-art Coronation Asset Management (Pty) Ltd. 19.35%

manufacturing facilities and a strategic alliance with an international

company to ensure cutting edge technology transfer. POSTAL ADDRESS: Millennium Bridge House, 2 Lambeth Hill, London,

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers EC4V 4AJ

NUMBER OF EMPLOYEES: 2 425 MORE INFO: www.sharedata.co.za/sdo/jse/QLT

COMPANY SECRETARY: Patrick Gonsalves

DIRECTORS: FortuinGG(ind ne), Golden T (ind ne),

RiddleLW(ind ne), Vaughan-Smith G (ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Hanekom W A (Chair, ind ne), Lourens H A (CEO), Muller A H (CFO) SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 AUDITORS: KPMG LLP

Aristotle Africa S.a.r.l. 31.30% CAPITAL STRUCTURE AUTHORISED ISSUED

Country Bird Holdings (Pty) Ltd. 30.80% QLT Ords 7p ea - 1 768 523 315

Quantum Foods (Pty) Ltd. 2.90%

POSTAL ADDRESS: PO Box 1183, Wellington, 7654 DISTRIBUTIONS [GBPp]

MORE INFO: www.sharedata.co.za/sdo/jse/QFH Ords 7p ea Ldt Pay Amt

COMPANY SECRETARY: Marisha Octavia Gibbons Final No 5 6 Apr 21 17 May 21 3.60

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 4 1 Sep 20 21 Sep 20 1.00

SPONSOR: One Capital Sponsor Services (Pty) Ltd. LIQUIDITY: Apr21 Ave 20m shares p.w., R603.7m(59.4% p.a.)

AUDITORS: PwC Inc.

FINSA 40 Week MA QUILTER

CAPITAL STRUCTURE AUTHORISED ISSUED

QFH Ords no par value 400 000 000 200 024 716 3390

DISTRIBUTIONS [ZARc] 3001

Ords no par value Ldt Pay Amt

2613

Final No 9 12 Jan 21 18 Jan 21 10.00

Interim No 8 15 Jun 20 22 Jun 20 6.00 2224

LIQUIDITY: Apr21 Ave 3m shares p.w., R14.7m(67.1% p.a.)

1836

ALSH 40 Week MA QUANTUM

1447

2018 | 2019 | 2020 |

FINANCIAL STATISTICS

663

(GBP million) Dec 20 Dec 19 Dec 18

555 Final Final(rst) Final

Total Premiums 795 837 954

446

Inc Fm Inv 3 896 6 566 - 2 712

Total Income 4 711 7 419 - 1 723

338

Total Outgo 4 625 7 374 - 1 703

229 Attrib Inc 88 146 488

2016 | 2017 | 2018 | 2019 | 2020 |

TotCompIncLoss 88 139 488

FINANCIAL STATISTICS Ord SH Int 1 878 2 071 2 005

(R million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16 Long-Term Liab 63 920 57 773 61 660

Final Final Final Final Final Cap Employed 65 904 59 932 64 326

Turnover 5 095 4 418 4 122 4 052 3 913 Fixed Assets 142 143 17

Op Inc 218 245 473 170 124 Investments 63 274 57 207 59 219

NetIntPd(Rcvd) 3 -11 - 24 -6 -7 Current Assets 2 689 2 893 3 018

Att Inc 155 189 362 128 91 Current Liab 1 468 1 619 1 464

TotCompIncLoss 108 201 331 134 114

Fixed Ass 1 140 1 161 1 072 1 051 1 048 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 423 1 333 1 423 1 178 1 194 HEPS-C (ZARc) 109.67 42.41 186.98

Ord SH Int 1 886 1 837 1 854 1 692 1 596 DPS (ZARc) 99.86 103.03 268.32

LT Liab 284 257 234 237 242 NAV PS (ZARc) 2 025.75 2 012.29 1 933.04

Tot Curr Liab 476 420 426 326 428 Price Prd End 3 074 2 930 2 192

Price High 3 487 3 126 2 844

PER SHARE STATISTICS (cents per share) Price Low 1 999 2 075 1 993

HEPS-C (ZARc) 80.50 92.30 163.90 49.00 28.20 RATIOS

DPS (ZARc) 16.00 33.00 90.00 34.00 6.00 Ret on SH Fund 4.69 7.05 24.34

NAV PS (ZARc) 942.70 918.59 880.82 738.31 689.00 Ret on Tot Ass - 1.10 - 1.40 - 1.74

3 Yr Beta 0.49 0.13 0.50 - - Debt:Equity 34.21 28.06 30.85

Price High 1 157 490 540 335 365 Solvency Mgn% 236.23 247.43 210.17

Price Low 300 300 250 250 201

Price Prd End 619 365 425 300 261

RATIOS Randgold & Exploration Co Ltd.

Ret on SH Fnd 8.21 10.30 19.53 7.54 5.72 ISIN: ZAE000008819 SHORT: RANGOLD CODE: RNG

RAN

Oper Pft Mgn 4.29 5.55 11.48 4.20 3.18 REG NO: 1992/005642/06 FOUNDED: 1992 LISTED: 1993

D:E 0.15 0.14 0.13 0.14 0.15 NATURE OF BUSINESS: R&E is an investment holding company with

Current Ratio 2.99 3.17 3.34 3.61 2.79 assets in the mining industry. It currently holds prospecting rights directly

Div Cover 5.01 2.81 1.83 1.65 6.53 and indirectly through subsidiary companies, which it plans to exploit

further, to the extend proven viable, in order to increase the value of its

Quilter plc enterprise, or to dispose of selective rights should that achieve a better

commercial or economical result.

QUI SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

ISIN: GB00BDCXV269 SHORT: QUILTER CODE: QLT

REG NO: 06404270 FOUNDED: 2007 LISTED: 2018 NUMBER OF EMPLOYEES: 8

NATURE OF BUSINESS: Quilter plc is a leading wealth management DIRECTORS: Steyn M (CEO & FD), DubeTS(ind ne), Gischen H,

business in the UK and internationally, helping to create prosperity for the Burton P E (Dep Chair, ind ne)

generations of today and tomorrow. Quilter plc oversees GBP107.4 billion

in customer investments (as at 30 June 2020). It has an adviser and

194