Page 144 - 2021 Issue 2

P. 144

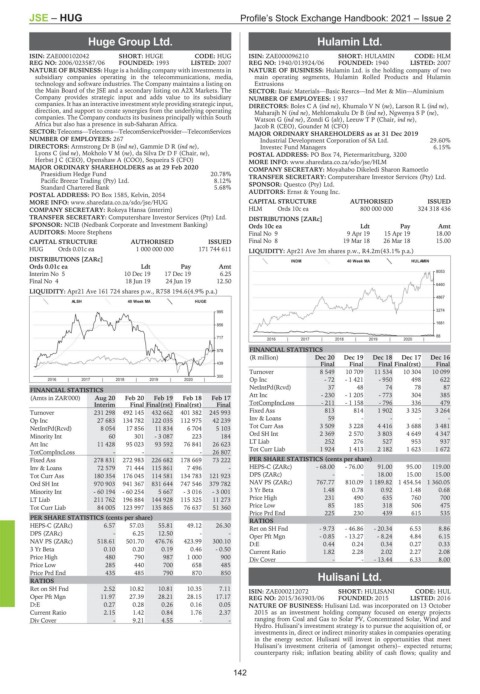

JSE – HUG Profile’s Stock Exchange Handbook: 2021 – Issue 2

Huge Group Ltd. Hulamin Ltd.

HUG HUL

ISIN: ZAE000102042 SHORT: HUGE CODE: HUG ISIN: ZAE000096210 SHORT: HULAMIN CODE: HLM

REG NO: 2006/023587/06 FOUNDED: 1993 LISTED: 2007 REG NO: 1940/013924/06 FOUNDED: 1940 LISTED: 2007

NATURE OF BUSINESS: Huge is a holding company with investments in NATURE OF BUSINESS: Hulamin Ltd. is the holding company of two

subsidiary companies operating in the telecommunications, media, main operating segments, Hulamin Rolled Products and Hulamin

technology and software industries. The Company maintains a listing on Extrusions

the Main Board of the JSE and a secondary listing on A2X Markets. The SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Aluminium

Company provides strategic input and adds value to its subsidiary NUMBER OF EMPLOYEES: 1 937

companies. It has an interactive investment style providing strategic input, DIRECTORS: BolesCA(ind ne), KhumaloVN(ne), LarsonRL(ind ne),

direction, and support to create synergies from the underlying operating Maharajh N (ind ne), Mehlomakulu Dr B (ind ne), NgwenyaSP(ne),

companies. The Company conducts its business principally within South Watson G (ind ne), Zondi G (alt), Leeuw T P (Chair, ind ne),

Africa but also has a presence in sub-Saharan Africa. Jacob R (CEO), Gounder M (CFO)

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

NUMBER OF EMPLOYEES: 267 Industrial Development Corporation of SA Ltd. 29.60%

DIRECTORS: Armstrong Dr B (ind ne), GammieDR(ind ne), Investec Fund Managers 6.15%

Lyons C (ind ne), MokholoVM(ne), da Silva Dr D F (Chair, ne), POSTAL ADDRESS: PO Box 74, Pietermaritzburg, 3200

Herbst J C (CEO), Openshaw A (COO), Sequeira S (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/HLM

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 COMPANY SECRETARY: Moyahabo Dikeledi Sharon Ramoetlo

Praesidium Hedge Fund 20.78% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Pacific Breeze Trading (Pty) Ltd. 8.12%

Standard Chartered Bank 5.68% SPONSOR: Questco (Pty) Ltd.

POSTAL ADDRESS: PO Box 1585, Kelvin, 2054 AUDITORS: Ernst & Young Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/HUG CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Rokeya Hansa (interim) HLM Ords 10c ea 800 000 000 324 318 436

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: NCIB (Nedbank Corporate and Investment Banking) Ords 10c ea Ldt Pay Amt

AUDITORS: Moore Stephens Final No 9 9 Apr 19 15 Apr 19 18.00

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 8 19 Mar 18 26 Mar 18 15.00

HUG Ords 0.01c ea 1 000 000 000 171 744 611 LIQUIDITY: Apr21 Ave 3m shares p.w., R4.2m(43.1% p.a.)

DISTRIBUTIONS [ZARc] INDM 40 Week MA HULAMIN

Ords 0.01c ea Ldt Pay Amt

8053

Interim No 5 10 Dec 19 17 Dec 19 6.25

Final No 4 18 Jun 19 24 Jun 19 12.50

6460

LIQUIDITY: Apr21 Ave 161 724 shares p.w., R758 194.6(4.9% p.a.)

4867

ALSH 40 Week MA HUGE

995 3274

1681

856

717 88

2016 | 2017 | 2018 | 2019 | 2020 |

578 FINANCIAL STATISTICS

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

439 Final Final Final Final(rst) Final

Turnover 8 549 10 709 11 534 10 304 10 099

300

2016 | 2017 | 2018 | 2019 | 2020 | Op Inc - 72 - 1 421 - 950 498 622

NetIntPd(Rcvd) 37 48 74 78 87

FINANCIAL STATISTICS

Att Inc - 230 - 1 205 - 773 304 385

(Amts in ZAR'000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

Interim Final Final(rst) Final(rst) Final TotCompIncLoss - 211 - 1 158 - 796 336 479

Turnover 231 298 492 145 432 662 401 382 245 993 Fixed Ass 813 814 1 902 3 325 3 264

Op Inc 27 683 134 782 122 035 112 975 42 239 Inv & Loans 59 - - - -

Tot Curr Ass 3 509 3 228 4 416 3 688 3 481

NetIntPd(Rcvd) 8 054 17 856 11 834 6 704 5 103

Minority Int 60 301 - 3 087 223 184 Ord SH Int 2 369 2 570 3 803 4 649 4 347

Att Inc 11 428 95 023 93 592 76 841 26 623 LT Liab 252 276 527 953 937

TotCompIncLoss - - - - 26 807 Tot Curr Liab 1 924 1 413 2 182 1 623 1 672

Fixed Ass 278 831 272 983 226 682 178 669 73 222 PER SHARE STATISTICS (cents per share)

Inv & Loans 72 579 71 444 115 861 7 496 - HEPS-C (ZARc) - 68.00 - 76.00 91.00 95.00 119.00

Tot Curr Ass 180 354 176 045 114 581 134 783 121 923 DPS (ZARc) - - 18.00 15.00 15.00

Ord SH Int 970 903 941 367 831 644 747 546 379 782 NAV PS (ZARc) 767.77 810.09 1 189.82 1 454.54 1 360.05

Minority Int - 60 194 - 60 254 5 667 - 3 016 - 3 001 3 Yr Beta 1.48 0.78 0.92 1.48 0.68

LT Liab 211 762 196 884 144 928 115 325 11 273 Price High 231 490 635 760 700

Tot Curr Liab 84 005 123 997 135 865 76 637 51 360 Price Low 85 185 318 506 475

Price Prd End 225 230 439 615 535

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 6.57 57.03 55.81 49.12 26.30

Ret on SH Fnd - 9.73 - 46.86 - 20.34 6.53 8.86

DPS (ZARc) - 6.25 12.50 - - Oper Pft Mgn - 0.85 - 13.27 - 8.24 4.84 6.15

NAV PS (ZARc) 518.61 501.70 476.76 423.99 300.10 D:E 0.44 0.24 0.34 0.27 0.33

3 Yr Beta 0.10 0.20 0.19 0.46 - 0.50 Current Ratio 1.82 2.28 2.02 2.27 2.08

Price High 480 790 987 1 000 900

Div Cover - - - 13.44 6.33 8.00

Price Low 285 440 700 658 485

Price Prd End 435 485 790 870 850

RATIOS Hulisani Ltd.

Ret on SH Fnd 2.52 10.82 10.81 10.35 7.11 HUL

ISIN: ZAE000212072 SHORT: HULISANI CODE: HUL

Oper Pft Mgn 11.97 27.39 28.21 28.15 17.17 REG NO: 2015/363903/06 FOUNDED: 2015 LISTED: 2016

D:E 0.27 0.28 0.26 0.16 0.05 NATURE OF BUSINESS: Hulisani Ltd. was incorporated on 13 October

Current Ratio 2.15 1.42 0.84 1.76 2.37 2015 as an investment holding company focused on energy projects

Div Cover - 9.21 4.55 - - ranging from Coal and Gas to Solar PV, Concentrated Solar, Wind and

Hydro. Hulisani’s investment strategy is to pursue the acquisition of, or

investments in, direct or indirect minority stakes in companies operating

in the energy sector. Hulisani will invest in opportunities that meet

Hulisani’s investment criteria of (amongst others)– expected returns;

counterparty risk; inflation beating ability of cash flows; quality and

142