Page 143 - 2021 Issue 2

P. 143

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – HOS

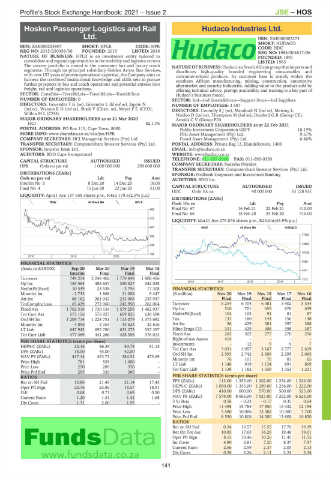

Hosken Passenger Logistics and Rail Hudaco Industries Ltd.

Ltd. HUD ISIN: ZAE000003273

HOS SHORT: HUDACO

ISIN: ZAE000255907 SHORT: HPLR CODE: HPR CODE: HDC

REG NO: 2015/250356/06 FOUNDED: 2015 LISTED: 2018 REG NO: 1985/004617/06

NATURE OF BUSINESS: HPLR is an investment entity tailored to FOUNDED: 1891

consolidate and expand opportunities in the mobility and logistics sectors. LISTED: 1985

The current portfolio is rooted in the commuter bus and luxury coach NATUREOF BUSINESS:HudacoisaSouthAfricangroupthatimportsand

segments. Through its principal subsidiary Golden Arrow Bus Services, distributes high-quality branded engineering consumables and

with over 157 years of proven operational expertise, the Company aims to consumer-related products. Its customer base is mainly within the

harness the combined institutional knowledge and skills sets to pursue southern African manufacturing, mining, construction, automotive

further prospects in bus and coach operations and potential entrées into aftermarket and security industries. Adding value to the product sold by

freight, rail and logistics operations. offering technical advice, prompt availability and training is a key part of

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Travel&Tour Hudaco’s business model.

NUMBER OF EMPLOYEES: 0 SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Ind Suppliers

DIRECTORS: GovenderTG(ne), Govender L (ld ind ne), Jappie N NUMBER OF EMPLOYEES: 3 587

(ind ne), WatsonRD(ind ne), Shaik Y (Chair, ne), Meyer F E (CEO), DIRECTORS: ConnellySJ(ne), Mandindi N (ind ne), Meiring L,

Wilkin M L (CFO) Naidoo D (ind ne), Thompson M (ind ne), Dunford G R (Group CE),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 Amoils C V (Group FD)

HCI 82.11% MAJOR ORDINARY SHAREHOLDERS as at 22 Feb 2021

POSTAL ADDRESS: PO Box 115, Cape Town, 8000 Public Investment Corporation GEPF 10.19%

MORE INFO: www.sharedata.co.za/sdo/jse/HPR PSG Asset Management (Pty) Ltd. 9.67%

COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd. Foord Asset Management (Pty) Ltd. 6.46%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: Private Bag 13, Elandsfontein, 1406

SPONSOR: Investec Bank Ltd. EMAIL: info@hudaco.co.za

AUDITORS: BDO Cape Incorporated WEBSITE: www.hudaco.co.za

TELEPHONE: 011-657-5000 FAX: 011-690-0350

CAPITAL STRUCTURE AUTHORISED ISSUED

HPR Ords no par val 1 000 000 000 290 000 000 COMPANY SECRETARY: Natasha Petrides

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] SPONSOR: Nedbank Corporate and Investment Banking

Ords no par val Ldt Pay Amt AUDITORS: BDO Inc.

Interim No 5 8 Dec 20 14 Dec 20 18.00

Final No 4 15 Jun 20 22 Jun 20 31.00 CAPITAL STRUCTURE AUTHORISED ISSUED

HDC Ords 10c ea 40 000 000 33 128 931

LIQUIDITY: Apr21 Ave 137 658 shares p.w., R452 179.6(2.5% p.a.)

DISTRIBUTIONS [ZARc]

TRAV 40 Week MA HPLR Ords 10c ea Ldt Pay Amt

685 Final No 67 16 Feb 21 22 Feb 21 410.00

Final No 66 18 Feb 20 24 Feb 20 410.00

573

LIQUIDITY: Mar21 Ave 279 876 shares p.w., R23.0m(43.9% p.a.)

461 INDE 40 Week MA HUDACO

17000

350

13863

238

10725

126

2018 | 2019 | 2020 |

7588

FINANCIAL STATISTICS

(Amts in ZAR'000) Sep 20 Mar 20 Mar 19 Mar 18

Interim Final Final Final 4451

Turnover 749 254 2 048 402 1 779 849 1 808 406 1313

Op Inc 155 564 488 657 330 527 342 038 2016 | 2017 | 2018 | 2019 |

NetIntPd(Rcvd) 10 549 24 538 - 3 796 17 308 FINANCIAL STATISTICS

Minority Int - 2 733 1 868 11 008 9 447 (R million) Nov 20 Nov 19 Nov 18 Nov 17 Nov 16

Att Inc 68 162 261 042 233 908 235 947 Final Final Final Final Final

TotCompIncLoss 65 429 272 060 242 950 262 064 Turnover 6 254 6 704 6 381 5 902 5 534

Fixed Ass 1 702 516 1 730 134 1 579 256 1 462 937 Op Inc 510 701 655 676 639

Tot Curr Ass 573 156 576 927 609 825 630 598 NetIntPd(Rcvd) 104 103 91 81 87

Ord SH Int 1 209 714 1 228 751 1 115 079 1 373 692 Tax 133 160 144 156 148

Minority Int - 4 896 - 2 163 43 623 32 616 Att Inc 36 429 381 397 388

LT Liab 647 942 695 780 633 272 557 397 Hline Erngs-CO 331 429 408 398 387

Tot Curr Liab 477 369 441 266 428 356 376 013 Fixed Ass 265 302 277 270 256

Right-of-use Assets 414 - - - -

PER SHARE STATISTICS (cents per share)

12

HEPS-C (ZARc) 23.16 86.39 80.78 81.15 Investments 3 031 - 3 057 3 167 9 2 777 9 2 619 7

Tot Curr Ass

DPS (ZARc) 18.00 45.00 42.00 - Ord SH Int 2 593 2 742 2 509 2 295 2 065

NAV PS (ZARc) 417.14 423.71 384.51 473.69 Minority Int 76 101 70 81 65

Price High 781 535 1 000 - LT Liab 1 148 919 1 124 891 869

Price Low 270 289 370 - Tot Curr Liab 1 138 1 182 1 339 1 353 1 231

Price Prd End 295 320 380 -

RATIOS PER SHARE STATISTICS (cents per share)

Ret on SH Fnd 10.86 21.43 21.14 17.45 EPS (ZARc) 113.00 1 355.00 1 202.00 1 254.00 1 226.00

Oper Pft Mgn 20.76 23.86 18.57 18.91 HEPS-C (ZARc) 1 050.00 1 355.00 1 289.00 1 256.00 1 222.00

D:E 0.68 0.71 0.69 0.50 DPS (ZARc) 410.00 600.00 570.00 560.00 525.00

Current Ratio 1.20 1.31 1.42 1.68 NAV PS (ZARc) 7 579.00 8 666.00 7 927.00 7 252.00 6 525.00

Div Cover 1.31 2.00 1.92 - 3 Yr Beta 0.58 - 0.23 - 0.17 0.35 0.64

Price High 11 498 15 785 17 850 15 432 12 194

Price Low 5 580 10 006 12 302 10 300 7 700

Price Prd End 8 550 10 808 14 200 13 600 10 850

RATIOS

Ret on SH Fnd 0.34 16.57 15.55 17.76 19.39

Ret On Tot Ass 10.85 17.63 16.26 19.48 19.01

Oper Pft Mgn 8.15 10.46 10.26 11.45 11.55

Int Cover 4.90 6.81 7.20 8.37 7.57

Current Ratio 2.66 2.59 2.37 2.05 2.13

Div Cover 0.28 2.26 2.11 2.24 2.34

141