Page 133 - 2021 Issue 2

P. 133

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – FOS

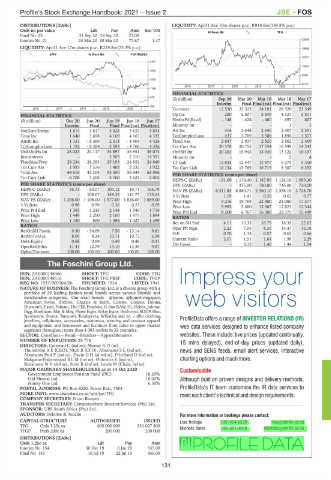

DISTRIBUTIONS [ZARc] LIQUIDITY: Apr21 Ave 10m shares p.w., R918.6m(159.8% p.a.)

Ords no par value Ldt Pay Amt Scr/100

40 Week MA TFG

Final No 22 21 Sep 20 28 Sep 20 23.00 -

Interim No 21 24 Mar 20 30 Mar 20 77.67 1.47 23056

LIQUIDITY: Apr21 Ave 17m shares p.w., R219.8m(73.3% p.a.) 19688

SAPY 40 Week MA FORTRESSA

16321

2161

12953

1840

9586

1520

6218

2016 | 2017 | 2018 | 2019 | 2020 |

1199

FINANCIAL STATISTICS

879

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

Interim Final Final(rst) Final(rst) Final(rst)

558

2016 | 2017 | 2018 | 2019 | 2020 | Turnover 12 530 35 323 34 101 28 520 23 549

FINANCIAL STATISTICS Op Inc 280 2 807 2 849 4 127 3 811

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 NetIntPd(Rcvd) - 148 - 424 - 460 697 607

Interim Final Final Final(rst) Final(rst) Minority Int - - - 1 1

NetRent/InvInc 1 614 3 617 3 628 3 633 3 894 Att Inc 416 2 444 2 640 2 407 2 351

Total Inc 1 640 3 698 4 169 4 165 4 332 TotCompIncLoss 437 3 709 3 588 1 896 1 577

Attrib Inc 1 131 - 8 369 2 618 - 4 904 4 426 Fixed Ass 2 847 2 937 2 820 2 862 2 469

TotCompIncLoss 1 192 - 8 288 2 593 - 4 706 4 326 Tot Curr Ass 20 378 20 755 17 554 16 599 14 343

Ord UntHs Int 25 023 24 117 34 897 36 951 45 074 Ord SH Int 20 263 15 943 14 049 13 122 10 397

Investments - - 2 505 2 310 14 591 Minority Int - - - 5 4

FixedAss/Prop 28 234 28 283 25 193 24 851 24 849 LT Liab 12 835 12 447 12 877 6 279 5 350

Tot Curr Ass 1 993 1 576 1 403 2 032 1 922 Tot Curr Liab 10 134 13 769 10 715 8 387 6 252

Total Ass 44 616 43 204 53 450 56 644 62 066 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 6 708 3 268 3 760 4 623 2 002

HEPS-C (ZARc) - 91.00 1 174.40 1 187.90 1 124.10 1 099.20

PER SHARE STATISTICS (cents per share) DPS (ZARc) - 335.00 780.00 745.00 720.00

HEPS-C (ZARc) 35.73 - 64.07 104.12 19.71 165.79 NAV PS (ZARc) 6 211.83 6 880.71 2 360.10 2 358.10 2 728.70

DPS (ZARc) - 100.67 148.35 141.77 135.63 3 Yr Beta 1.19 1.41 0.26 0.62 0.77

NAV PS (ZARc) 1 296.00 1 108.00 1 977.00 1 626.00 1 689.00 Price High 9 216 19 769 22 900 24 080 17 577

3 Yr Beta 0.98 0.99 0.36 0.27 0.29 Price Low 5 992 5 600 15 367 12 821 12 344

Price Prd End 1 365 1 245 2 144 1 540 1 716 Price Prd End 8 200 6 767 16 300 22 375 15 449

Price High 1 449 2 200 2 160 1 975 1 894 RATIOS

Price Low 1 130 800 1 496 1 427 1 499 Ret on SH Fnd 4.11 15.33 18.79 18.35 22.62

RATIOS Oper Pft Mgn 2.23 7.95 8.35 14.47 16.18

RetOnSH Funds 9.30 - 34.69 7.56 - 13.14 9.81 D:E 0.70 1.15 0.57 0.62 0.66

RetOnTotAss 8.09 8.24 10.71 10.73 6.98

Debt:Equity 0.68 0.69 0.49 0.49 0.31 Current Ratio 2.01 1.51 1.64 1.98 2.29

OperRetOnInv 11.43 12.79 13.10 13.38 9.87 Div Cover - 3.15 1.46 1.44 1.54

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

The Foschini Group Ltd.

FOS

ISIN: ZAE000148466 SHORT: TFG CODE: TFG

ISIN: ZAE000148516 SHORT: TFG PREF LISTED: 1941 Impress your

CODE: TFGP

REG NO: 1937/009504/06 FOUNDED: 1924

NATURE OF BUSINESS: The Foschini Group Ltd. is a diverse group with a

portfolio of 29 leading fashion retail brands across various lifestyle and

merchandise categories. Our retail brands - @home, @homelivingspace, web visitors

American Swiss, Archive, Charles & Keith, Colette, Connor, Donna,

Duesouth,Exact,Fabiani,The FIX, Foschini,G-StarRAW,Hi, Hobbs,Johnny

Bigg, Markham, Mat & May, Phase Eight, Relay Jeans, Rockwear, SODA Bloc,

Sportscene, Sterns, Tarocash, Totalsports, Whistles and yd. - offer clothing,

jewellery, cellphones, accessories, cosmetics, sporting and outdoor apparel ProfileData offers a range of INVESTOR RELATIONS (IR)

and equipment, and homeware and furniture from value to upper market web data services designed to enhance listed company

segments throughout more than 4 083 outlets in 32 countries.

SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers websites. These include: live prices (updated continually,

NUMBER OF EMPLOYEES: 29 776 15 mins delayed), end-of-day prices (updated daily),

DIRECTORS: Coleman C (ind ne), MurrayAD(ne),

Thunström A E (CEO), Ntuli B (CFO), AbrahamsSE(ind ne), news and SENS feeds, email alert services, interactive

Abrahams Prof F (ind ne), DavinGH(ld ind ne), Friedland D (ind ne),

Makgabo-FiskerstrandBLM(ind ne), Oblowitz E (ind ne), chartingoptionsandmuchmore.

SimamaneNV(ind ne), Stein R (ind ne), Lewis M (Chair, ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 14 Oct 2020 Customisable

Government Employees Pension Fund (PIC) 16.20%

Old Mutual Ltd. 10.02% Although built on proven designs and delivery methods,

Ninety One Ltd. 6.30%

POSTAL ADDRESS: PO Box 6020, Parow East, 7501 ProfileData’s IT team customise the IR data services to

MORE INFO: www.sharedata.co.za/sdo/jse/TFG meeteachclient’stechnicalanddesignrequirements.

COMPANY SECRETARY: D van Rooyen

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: UBS South Africa (Pty) Ltd.

AUDITORS: Deloitte & Touche For more information or bookings please contact:

CAPITAL STRUCTURE AUTHORISED ISSUED Lisa Trollope 082-454-9539 lisa@profile.co.za

TFG Ords 1.25c ea 600 000 000 331 027 300 Michelle Botes 082-601-4020 michelle@profile.co.za

TFGP Prefs 200c ea 200 000 200 000

DISTRIBUTIONS [ZARc]

Ords 1.25c ea Ldt Pay Amt

Interim No 154 30 Dec 19 6 Jan 20 335.00

Final No 153 16 Jul 19 22 Jul 19 450.00

131