Page 134 - 2021 Issue 2

P. 134

JSE – GEM Profile’s Stock Exchange Handbook: 2021 – Issue 2

NUMBER OF EMPLOYEES: 145 000

Gemfields Group Ltd. DIRECTORS: Carroll C (ind ne), Coates P (ne, Aus), Gilbert M (ind ne),

GEM Mack J (ind ne, USA), Madhavpeddi K (ind ne), Marcus Prof G (ind ne),

ISIN: GG00BG0KTL52 SHORT: GEMFIELDS CODE: GML Merrin P (ind ne), Hayward A (Chair, ind ne, UK),

REG NO: 47656 FOUNDED: 2007 LISTED: 2008 Glasenberg I (CEO, Swiss)

NATURE OF BUSINESS: Gemfields is a world-leading supplier of MAJOR ORDINARY SHAREHOLDERS as at 26 Feb 2021

responsibly sourced coloured gemstones. Gemfields is the operator and Qatar Holding LLC 9.17%

75% owner of both the Kagem emerald mine in Zambia (believed to be the Ivan Glasenberg 9.10%

world’s single largest producing emerald mine) and the Montepuez ruby BlackRock, Inc. 6.66%

mine in Mozambique (one of the most significant recently discovered ruby POSTAL ADDRESS: PO Box 777, Baar, Switzerland, CH-6341

deposits in the world). In addition, Gemfields also holds controlling MORE INFO: www.sharedata.co.za/sdo/jse/GLN

interests in various other gemstone mining and prospecting licenses in COMPANY SECRETARY: John Burton

Zambia, Mozambique, Ethiopia and Madagascar.

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Dia&Gem TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 1 103 SPONSOR: Absa

DIRECTORS: Malan C (ne), Mmela K (ind ne), Mondi L (ld ind ne), AUDITORS: Deloitte & Touche LLP

Reilly M (ind ne), Wiese DrCH(ne), Tolcher M (Chair, ind ne, UK), CAPITAL STRUCTURE AUTHORISED ISSUED

Gilbertson S (CEO), Lovett D (CFO, UK) GLN Ords USD0.01c ea 50 000 000 000 14 586 200 066

MAJOR ORDINARY SHAREHOLDERS as at 14 Jan 2021 DISTRIBUTIONS [USDc]

Fidelity International Ltd. 10.96%

Rational Expectations (Pty) Ltd. 8.41% Ords USD0.01c ea Ldt Pay Amt

Ophorst Van Marwijk Kooy Vermogensbeheer N.V 7.85% Share Premium No 12 31 Aug 21 21 Sep 21 6.00

POSTAL ADDRESS: PO Box 186, Royal Chambers, St. Julian's Avenue, Share Premium No 11 20 Apr 21 21 May 21 6.00

St. Peter Port, Guernsey, GY1 4HP LIQUIDITY: Apr21 Ave 17m shares p.w., R759.5m(6.0% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/GML

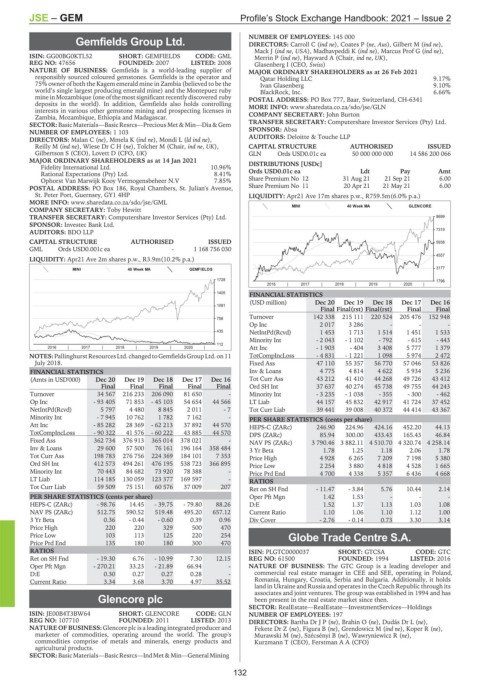

MINI 40 Week MA GLENCORE

COMPANY SECRETARY: Toby Hewitt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 8699

SPONSOR: Investec Bank Ltd.

7319

AUDITORS: BDO LLP

CAPITAL STRUCTURE AUTHORISED ISSUED 5938

GML Ords USD0.001c ea - 1 168 756 030

4557

LIQUIDITY: Apr21 Ave 2m shares p.w., R3.9m(10.2% p.a.)

MINI 40 Week MA GEMFIELDS 3177

1728 1796

2016 | 2017 | 2018 | 2019 | 2020 |

1405

FINANCIAL STATISTICS

(USD million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

1081

Final Final(rst) Final(rst) Final Final

Turnover 142 338 215 111 220 524 205 476 152 948

758

Op Inc 2 017 3 286 - - -

435 NetIntPd(Rcvd) 1 453 1 713 1 514 1 451 1 533

Minority Int - 2 043 - 1 102 - 792 - 615 - 443

112

2016 | 2017 | 2018 | 2019 | 2020 | Att Inc - 1 903 - 404 3 408 5 777 1 379

NOTES:PallinghurstResourcesLtd.changed toGemfieldsGroupLtd.on11 TotCompIncLoss - 4 831 - 1 221 1 098 5 974 2 472

July 2018. Fixed Ass 47 110 55 357 56 770 57 046 53 826

FINANCIAL STATISTICS Inv & Loans 4 775 4 814 4 622 5 934 5 236

(Amts in USD'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Tot Curr Ass 43 212 41 410 44 268 49 726 43 412

Final Final Final Final Final Ord SH Int 37 637 40 274 45 738 49 755 44 243

Turnover 34 567 216 233 206 090 81 650 - Minority Int - 3 235 - 1 038 - 355 - 300 - 462

Op Inc - 93 405 71 853 - 45 103 54 654 44 566 LT Liab 44 157 45 832 42 917 41 724 37 452

NetIntPd(Rcvd) 5 797 4 480 8 845 2 011 - 7 Tot Curr Liab 39 441 39 008 40 372 44 414 43 367

Minority Int - 7 945 10 762 1 782 7 162 - PER SHARE STATISTICS (cents per share)

Att Inc - 85 282 28 369 - 62 213 37 892 44 570 HEPS-C (ZARc) 246.90 224.96 424.16 452.20 44.13

TotCompIncLoss - 90 322 41 576 - 60 222 43 885 44 570 DPS (ZARc) 85.94 300.00 433.43 165.43 46.84

Fixed Ass 362 734 376 913 365 014 378 021 - NAV PS (ZARc) 3 790.46 3 882.11 4 510.70 4 320.74 4 258.14

Inv & Loans 29 600 57 500 76 161 196 164 358 484

3 Yr Beta 1.78 1.25 1.18 2.06 1.78

Tot Curr Ass 198 783 276 756 224 369 184 101 7 353 Price High 4 928 6 265 7 209 7 198 5 380

Ord SH Int 412 573 494 261 476 195 538 723 366 895 Price Low 2 254 3 880 4 818 4 528 1 665

Minority Int 70 443 84 682 73 920 78 388 - Price Prd End 4 700 4 338 5 357 6 436 4 668

LT Liab 114 185 130 059 123 377 169 597 - RATIOS

Tot Curr Liab 59 509 75 151 60 576 37 009 207

Ret on SH Fnd - 11.47 - 3.84 5.76 10.44 2.14

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 1.42 1.53 - - -

HEPS-C (ZARc) - 98.76 14.45 - 39.75 - 79.80 88.26 D:E 1.52 1.37 1.13 1.03 1.08

NAV PS (ZARc) 512.75 590.52 519.48 495.20 657.12 Current Ratio 1.10 1.06 1.10 1.12 1.00

3 Yr Beta 0.36 - 0.44 - 0.60 0.39 0.96 Div Cover - 2.76 - 0.14 0.73 3.30 3.14

Price High 220 220 329 500 470

Price Low 103 113 125 220 254 Globe Trade Centre S.A.

Price Prd End 135 180 180 300 470

GLO

RATIOS ISIN: PLGTC0000037 SHORT: GTCSA CODE: GTC

Ret on SH Fnd - 19.30 6.76 - 10.99 7.30 12.15 REG NO: 61500 FOUNDED: 1994 LISTED: 2016

Oper Pft Mgn - 270.21 33.23 - 21.89 66.94 - NATURE OF BUSINESS: The GTC Group is a leading developer and

D:E 0.30 0.27 0.27 0.28 - commercial real estate manager in CEE and SEE, operating in Poland,

Current Ratio 3.34 3.68 3.70 4.97 35.52 Romania, Hungary, Croatia, Serbia and Bulgaria. Additionally, it holds

land in Ukraine and Russia and operates in the Czech Republic through its

associates and joint ventures. The group was established in 1994 and has

Glencore plc been present in the real estate market since then.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

GLE

ISIN: JE00B4T3BW64 SHORT: GLENCORE CODE: GLN NUMBER OF EMPLOYEES: 197

REG NO: 107710 FOUNDED: 2011 LISTED: 2013 DIRECTORS: Bartha DrJP(ne), Brahin O (ne), Dudás Dr L (ne),

NATURE OF BUSINESS: Glencore plc is a leading integrated producer and Fekete Dr Z (ne), Figura B (ne), Grendowicz M (ind ne), Koper R (ne),

marketer of commodities, operating around the world. The group's Murawski M (ne), Szécsényi B (ne), Wawryniewicz R (ne),

commodities comprise of metals and minerals, energy products and Kurzmann T (CEO), Ferstman A A (CFO)

agricultural products.

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

132