Page 119 - 2021 Issue 2

P. 119

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – DAT

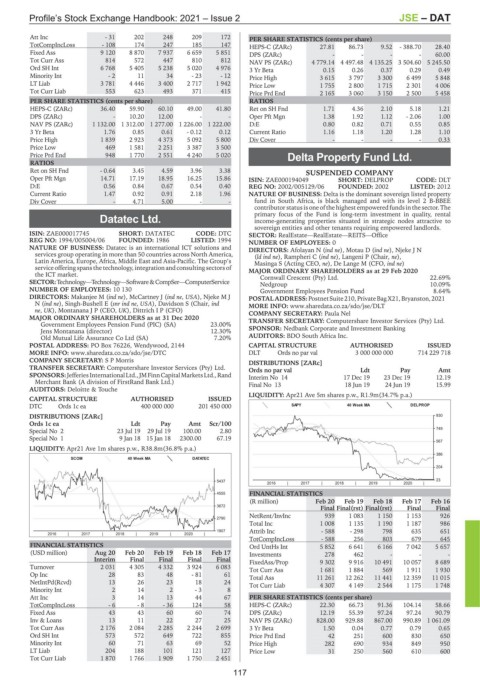

Att Inc - 31 202 248 209 172 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 108 174 247 185 147 HEPS-C (ZARc) 27.81 86.73 9.52 - 388.70 28.40

Fixed Ass 9 120 8 870 7 937 6 659 5 851 DPS (ZARc) - - - - 60.00

Tot Curr Ass 814 572 447 810 812 NAV PS (ZARc) 4 779.14 4 497.48 4 135.25 3 504.60 5 245.50

Ord SH Int 6 768 5 405 5 238 5 020 4 976 3 Yr Beta 0.15 0.26 0.37 0.29 0.49

Minority Int - 2 11 34 - 23 - 12 Price High 3 615 3 797 3 300 6 499 5 848

LT Liab 3 781 4 446 3 400 2 717 1 942 Price Low 1 755 2 800 1 715 2 301 4 006

Tot Curr Liab 553 623 493 371 415 Price Prd End 2 165 3 060 3 150 2 500 5 458

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 36.40 59.90 60.10 49.00 41.80 Ret on SH Fnd 1.71 4.36 2.10 5.18 1.21

DPS (ZARc) - 10.20 12.00 - - Oper Pft Mgn 1.38 1.92 1.12 - 2.06 1.00

NAV PS (ZARc) 1 132.00 1 312.00 1 277.00 1 226.00 1 222.00 D:E 0.80 0.82 0.71 0.55 0.85

3 Yr Beta 1.76 0.85 0.61 - 0.12 0.12 Current Ratio 1.16 1.18 1.20 1.28 1.10

Price High 1 839 2 923 4 373 5 092 5 800 Div Cover - - - - 0.33

Price Low 469 1 581 2 251 3 387 3 500

Price Prd End 948 1 770 2 551 4 240 5 020 Delta Property Fund Ltd.

RATIOS

DEL

Ret on SH Fnd - 0.64 3.45 4.59 3.96 3.38 SUSPENDED COMPANY

Oper Pft Mgn 14.71 17.19 18.95 16.25 15.86 ISIN: ZAE000194049 SHORT: DELPROP CODE: DLT

D:E 0.56 0.84 0.67 0.54 0.40 REG NO: 2002/005129/06 FOUNDED: 2002 LISTED: 2012

Current Ratio 1.47 0.92 0.91 2.18 1.96 NATURE OF BUSINESS: Delta is the dominant sovereign listed property

Div Cover - 4.71 5.00 - - fund in South Africa, is black managed and with its level 2 B-BBEE

contributor statusis one of the highest empowered fundsin the sector. The

primary focus of the Fund is long-term investment in quality, rental

Datatec Ltd. income-generating properties situated in strategic nodes attractive to

sovereign entities and other tenants requiring empowered landlords.

DAT

ISIN: ZAE000017745 SHORT: DATATEC CODE: DTC SECTOR: RealEstate—RealEstate—REITS—Office

REG NO: 1994/005004/06 FOUNDED: 1986 LISTED: 1994 NUMBER OF EMPLOYEES: 0

NATURE OF BUSINESS: Datatec is an international ICT solutions and DIRECTORS: Afolayan N (ind ne), Motau D (ind ne), Njeke J N

services group operating in more than 50 countries across North America, (ld ind ne), Rampheri C (ind ne), Langeni P (Chair, ne),

Latin America, Europe, Africa, Middle East and Asia-Pacific. The Group’s Masinga S (Acting CEO, ne), De Lange M (CFO, ind ne)

service offering spansthe technology, integration andconsulting sectors of MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

the ICT market.

SECTOR:Technology—Technology—Software&CompSer—ComputerService Cornwall Crescent (Pty) Ltd. 22.69%

10.09%

Nedgroup

NUMBER OF EMPLOYEES: 10 130 Government Employees Pension Fund 8.64%

DIRECTORS: Makanjee M (ind ne), McCartney J (ind ne, USA), Njeke M J POSTAL ADDRESS:PostnetSuite210, PrivateBagX21,Bryanston,2021

N(ind ne), Singh-Bushell E (snr ind ne, USA), Davidson S (Chair, ind MORE INFO: www.sharedata.co.za/sdo/jse/DLT

ne, UK), Montanana J P (CEO, UK), Dittrich I P (CFO) COMPANY SECRETARY: Paula Nel

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Government Employees Pension Fund (PIC) (SA) 23.00%

Jens Montanana (director) 12.30% SPONSOR: Nedbank Corporate and Investment Banking

Old Mutual Life Assurance Co Ltd (SA) 7.20% AUDITORS: BDO South Africa Inc.

POSTAL ADDRESS: PO Box 76226, Wendywood, 2144 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/DTC DLT Ords no par val 3 000 000 000 714 229 718

COMPANY SECRETARY: S P Morris DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par val Ldt Pay Amt

SPONSORS:JefferiesInternationalLtd.,JMFinnCapitalMarketsLtd.,Rand Interim No 14 17 Dec 19 23 Dec 19 12.19

Merchant Bank (A division of FirstRand Bank Ltd.) Final No 13 18 Jun 19 24 Jun 19 15.99

AUDITORS: Deloitte & Touche

LIQUIDITY: Apr21 Ave 5m shares p.w., R1.9m(34.7% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

DTC Ords 1c ea 400 000 000 201 450 000 SAPY 40 Week MA DELPROP

DISTRIBUTIONS [ZARc] 930

Ords 1c ea Ldt Pay Amt Scr/100

Special No 2 23 Jul 19 29 Jul 19 100.00 2.80 749

Special No 1 9 Jan 18 15 Jan 18 2300.00 67.19

567

LIQUIDITY: Apr21 Ave 1m shares p.w., R38.8m(36.8% p.a.)

386

SCOM 40 Week MA DATATEC

204

5437 23

2016 | 2017 | 2018 | 2019 | 2020 |

4555 FINANCIAL STATISTICS

(R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

3672

Final Final(rst) Final(rst) Final Final

NetRent/InvInc 939 1 083 1 150 1 153 926

2790

Total Inc 1 008 1 135 1 190 1 187 986

1907 Attrib Inc - 588 - 298 798 635 651

2016 | 2017 | 2018 | 2019 | 2020 |

TotCompIncLoss - 588 256 803 679 645

FINANCIAL STATISTICS Ord UntHs Int 5 852 6 641 6 166 7 042 5 657

(USD million) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17 Investments 278 462 - - -

Interim Final Final Final Final FixedAss/Prop 9 302 9 916 10 491 10 057 8 689

Turnover 2 031 4 305 4 332 3 924 6 083 Tot Curr Ass 1 681 1 884 569 1 911 1 930

Op Inc 28 83 48 - 81 61 Total Ass 11 261 12 262 11 441 12 359 11 015

NetIntPd(Rcvd) 13 26 23 18 24 Tot Curr Liab 4 307 4 149 2 544 1 175 1 748

Minority Int 2 14 2 - 3 8

Att Inc 3 14 13 44 67 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 6 - 8 - 36 124 58 HEPS-C (ZARc) 22.30 66.73 91.36 104.14 58.66

Fixed Ass 43 43 60 60 74 DPS (ZARc) 12.19 55.39 97.24 97.24 90.79

Inv & Loans 13 11 22 27 25 NAV PS (ZARc) 828.00 929.88 867.00 990.89 1 061.09

Tot Curr Ass 2 176 2 084 2 285 2 244 2 699 3 Yr Beta 1.50 0.04 0.77 0.79 0.65

Ord SH Int 573 572 649 722 855 Price Prd End 42 251 600 830 650

Minority Int 60 71 63 69 52 Price High 282 690 934 849 950

LT Liab 204 188 101 121 127 Price Low 31 250 560 610 600

Tot Curr Liab 1 870 1 766 1 909 1 750 2 451

117