Page 118 - 2021 Issue 2

P. 118

JSE – CSG Profile’s Stock Exchange Handbook: 2021 – Issue 2

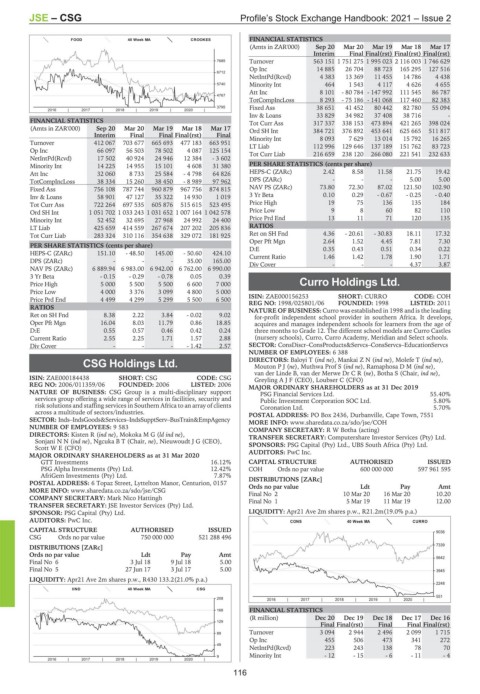

FOOD 40 Week MA CROOKES FINANCIAL STATISTICS

(Amts in ZAR'000) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

Interim Final Final(rst) Final(rst) Final(rst)

7685 Turnover 563 151 1 751 275 1 995 023 2 116 003 1 746 629

Op Inc 14 885 26 704 88 723 165 295 127 516

6712

NetIntPd(Rcvd) 4 383 13 369 11 455 14 786 4 438

5740 Minority Int 464 1 543 4 117 4 626 4 655

Att Inc 8 101 - 80 784 - 147 992 111 545 86 787

4767

TotCompIncLoss 8 293 - 75 186 - 141 068 117 460 82 383

3795 Fixed Ass 38 651 41 452 80 442 82 780 55 094

2016 | 2017 | 2018 | 2019 | 2020 |

Inv & Loans 33 829 34 982 37 408 38 716 -

FINANCIAL STATISTICS Tot Curr Ass 317 337 338 153 473 894 421 265 398 024

(Amts in ZAR'000) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Ord SH Int 384 721 376 892 453 641 625 665 511 817

Interim Final Final Final(rst) Final Minority Int 8 093 7 629 13 014 15 792 16 265

Turnover 412 067 703 677 665 693 477 183 663 951 LT Liab 112 996 129 646 137 189 151 762 83 723

Op Inc 66 097 56 503 78 502 4 087 125 154 Tot Curr Liab 216 659 238 120 266 080 221 541 232 633

NetIntPd(Rcvd) 17 502 40 924 24 946 12 384 - 3 602

Minority Int 14 225 14 955 15 101 4 608 31 380 PER SHARE STATISTICS (cents per share)

Att Inc 32 060 8 733 25 584 - 4 798 64 826 HEPS-C (ZARc) 2.42 8.58 11.58 21.75 19.42

TotCompIncLoss 38 334 15 260 38 450 - 8 989 97 962 DPS (ZARc) - - - 5.00 5.00

Fixed Ass 756 108 787 744 960 879 967 756 874 815 NAV PS (ZARc) 73.80 72.30 87.02 121.50 102.90

Inv & Loans 58 901 47 127 35 322 14 930 1 019 3 Yr Beta 0.10 0.29 - 0.67 - 0.25 - 0.40

Tot Curr Ass 722 264 697 535 605 876 515 615 523 495 Price High 19 75 136 135 184

Ord SH Int 1 051 702 1 033 243 1 031 652 1 007 164 1 042 578 Price Low 9 8 60 82 110

Minority Int 52 452 32 695 27 968 24 992 24 400 Price Prd End 13 11 71 120 135

LT Liab 425 659 414 559 267 674 207 202 205 836 RATIOS

Tot Curr Liab 283 324 310 116 354 638 329 072 181 925 Ret on SH Fnd 4.36 - 20.61 - 30.83 18.11 17.32

Oper Pft Mgn 2.64 1.52 4.45 7.81 7.30

PER SHARE STATISTICS (cents per share)

D:E 0.35 0.43 0.51 0.34 0.22

HEPS-C (ZARc) 151.10 - 48.50 145.00 - 50.60 424.10 Current Ratio 1.46 1.42 1.78 1.90 1.71

DPS (ZARc) - - - 35.00 165.00 Div Cover - - - 4.37 3.87

NAV PS (ZARc) 6 889.94 6 983.00 6 942.00 6 762.00 6 990.00

3 Yr Beta - 0.15 - 0.29 - 0.78 0.05 0.39

Price High 5 000 5 500 5 500 6 600 7 000 Curro Holdings Ltd.

Price Low 4 000 3 376 3 099 4 800 5 000 CUR

CODE: COH

Price Prd End 4 499 4 299 5 299 5 500 6 500 ISIN: ZAE000156253 SHORT: CURRO LISTED: 2011

FOUNDED: 1998

REG NO: 1998/025801/06

RATIOS NATURE OF BUSINESS: Curro was established in 1998 and is the leading

Ret on SH Fnd 8.38 2.22 3.84 - 0.02 9.02 for-profit independent school provider in southern Africa. It develops,

Oper Pft Mgn 16.04 8.03 11.79 0.86 18.85 acquires and manages independent schools for learners from the age of

D:E 0.55 0.57 0.46 0.42 0.24 three months to Grade 12. The different school models are Curro Castles

Current Ratio 2.55 2.25 1.71 1.57 2.88 (nursery schools), Curro, Curro Academy, Meridian and Select schools.

Div Cover - - - - 1.42 2.57 SECTOR: ConsDiscr–ConsProducts&Servcs–ConsServcs–EducationServcs

NUMBER OF EMPLOYEES: 6 388

CSG Holdings Ltd. DIRECTORS: Baloyi T (ind ne), MankaiZN(ind ne), Molefe T (ind ne),

MoutonPJ(ne), Muthwa Prof S (ind ne), RamaphosaDM(ind ne),

CSG van der Linde B, van der Merwe DrCR(ne), Botha S (Chair, ind ne),

ISIN: ZAE000184438 SHORT: CSG CODE: CSG GreylingAJF (CEO), Loubser C (CFO)

REG NO: 2006/011359/06 FOUNDED: 2006 LISTED: 2006 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

NATURE OF BUSINESS: CSG Group is a multi-disciplinary support PSG Financial Services Ltd. 55.40%

services group offering a wide range of services in facilities, security and Public Investment Corporation SOC Ltd. 5.80%

risk solutions and staffing services in Southern Africa to an array of clients Coronation Ltd. 5.70%

across a multitude of sectors/industries. POSTAL ADDRESS: PO Box 2436, Durbanville, Cape Town, 7551

SECTOR: Inds–IndsGoods&Services–IndsSupptServ–BusTrain&EmpAgency MORE INFO: www.sharedata.co.za/sdo/jse/COH

NUMBER OF EMPLOYEES: 9 583 COMPANY SECRETARY: R W Botha (acting)

DIRECTORS: Kisten R (ind ne), MokokaMG(ld ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SonjaniNN(ind ne), Ngcuka B T (Chair, ne), Nieuwoudt J G (CEO),

Scott W E (CFO) SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 AUDITORS: PwC Inc.

GTT Investments 16.12% CAPITAL STRUCTURE AUTHORISED ISSUED

PSG Alpha Investments (Pty) Ltd. 12.42% COH Ords no par value 600 000 000 597 961 595

AfriGem Investments (Pty) Ltd. 7.87% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: 6 Topaz Street, Lyttelton Manor, Centurion, 0157

Pay

Amt

Ldt

MORE INFO: www.sharedata.co.za/sdo/jse/CSG Ords no par value 10 Mar 20 16 Mar 20 10.20

Final No 2

COMPANY SECRETARY: Mark Nico Hattingh Final No 1 5 Mar 19 11 Mar 19 12.00

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. LIQUIDITY: Apr21 Ave 2m shares p.w., R21.2m(19.0% p.a.)

AUDITORS: PwC Inc. CONS 40 Week MA CURRO

CAPITAL STRUCTURE AUTHORISED ISSUED 9036

CSG Ords no par value 750 000 000 521 288 496

DISTRIBUTIONS [ZARc] 7339

Ords no par value Ldt Pay Amt

5642

Final No 6 3 Jul 18 9 Jul 18 5.00

Final No 5 27 Jun 17 3 Jul 17 5.00 3945

LIQUIDITY: Apr21 Ave 2m shares p.w., R430 133.2(21.0% p.a.)

2248

IIND 40 Week MA CSG

551

208 2016 | 2017 | 2018 | 2019 | 2020 |

168 FINANCIAL STATISTICS

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

129

Final Final(rst) Final Final Final(rst)

89 Turnover 3 094 2 944 2 496 2 099 1 715

Op Inc 455 506 473 341 272

49

NetIntPd(Rcvd) 223 243 138 78 70

9 Minority Int - 12 - 15 - 6 - 11 - 4

2016 | 2017 | 2018 | 2019 | 2020 |

116