Page 117 - 2021 Issue 2

P. 117

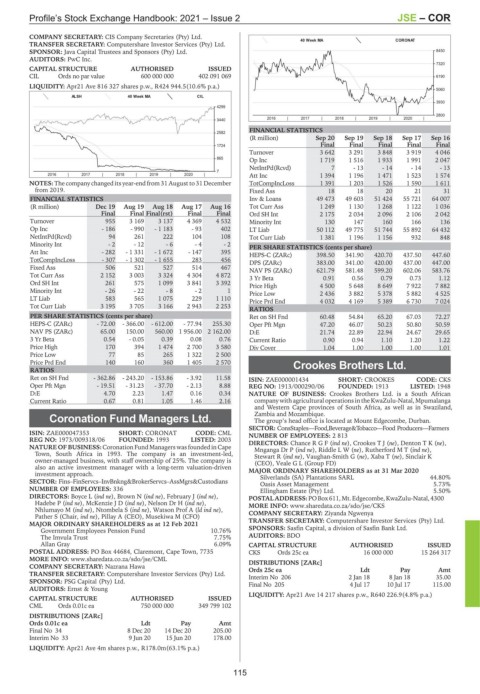

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – COR

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

40 Week MA CORONAT

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. 8450

AUDITORS: PwC Inc.

7320

CAPITAL STRUCTURE AUTHORISED ISSUED

CIL Ords no par value 600 000 000 402 091 069 6190

LIQUIDITY: Apr21 Ave 816 327 shares p.w., R424 944.5(10.6% p.a.)

5060

ALSH 40 Week MA CIL

3930

4299

2800

2016 | 2017 | 2018 | 2019 | 2020 |

3440

FINANCIAL STATISTICS

2582

(R million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16

1724 Final Final Final Final Final

Turnover 3 642 3 291 3 848 3 919 4 046

865

Op Inc 1 719 1 516 1 933 1 991 2 047

NetIntPd(Rcvd) 7 - 13 - 14 - 14 - 13

7

2016 | 2017 | 2018 | 2019 | 2020 | Att Inc 1 394 1 196 1 471 1 523 1 574

NOTES: The company changed its year-end from 31 August to 31 December TotCompIncLoss 1 391 1 203 1 526 1 590 1 611

from 2019. Fixed Ass 18 18 20 21 31

FINANCIAL STATISTICS Inv & Loans 49 473 49 603 51 424 55 721 64 007

(R million) Dec 19 Aug 19 Aug 18 Aug 17 Aug 16 Tot Curr Ass 1 249 1 130 1 268 1 122 1 036

Final Final Final(rst) Final Final Ord SH Int 2 175 2 034 2 096 2 106 2 042

Turnover 955 3 169 3 137 4 369 4 532 Minority Int 130 147 160 166 136

Op Inc - 186 - 990 - 1 183 - 93 402 LT Liab 50 112 49 775 51 744 55 892 64 432

NetIntPd(Rcvd) 94 261 222 104 108 Tot Curr Liab 1 381 1 196 1 156 932 848

Minority Int - 2 - 12 - 6 - 4 - 2 PER SHARE STATISTICS (cents per share)

Att Inc - 282 - 1 331 - 1 672 - 147 395 HEPS-C (ZARc) 398.50 341.90 420.70 437.50 447.60

TotCompIncLoss - 307 - 1 302 - 1 655 283 456 DPS (ZARc) 383.00 341.00 420.00 437.00 447.00

Fixed Ass 506 521 527 514 467 NAV PS (ZARc) 621.79 581.48 599.20 602.06 583.76

Tot Curr Ass 2 152 3 003 3 324 4 304 4 872 3 Yr Beta 0.91 0.56 0.79 0.73 1.12

Ord SH Int 261 575 1 099 3 841 3 392 Price High 4 500 5 648 8 649 7 922 7 882

Minority Int - 26 - 22 - 8 - 2 1 Price Low 2 436 3 882 5 378 5 882 4 525

LT Liab 583 565 1 075 229 1 110 Price Prd End 4 032 4 169 5 389 6 730 7 024

Tot Curr Liab 3 195 3 705 3 166 2 943 2 253

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 60.48 54.84 65.20 67.03 72.27

HEPS-C (ZARc) - 72.00 - 366.00 - 612.00 - 77.94 255.30 Oper Pft Mgn 47.20 46.07 50.23 50.80 50.59

NAV PS (ZARc) 65.00 150.00 560.00 1 956.00 2 162.00 D:E 21.74 22.89 22.94 24.67 29.65

3 Yr Beta 0.54 - 0.05 0.39 0.08 0.76 Current Ratio 0.90 0.94 1.10 1.20 1.22

Price High 170 394 1 474 2 700 3 580 Div Cover 1.04 1.00 1.00 1.00 1.01

Price Low 77 85 265 1 322 2 500

Price Prd End 140 160 360 1 405 2 570 Crookes Brothers Ltd.

RATIOS

CRO

Ret on SH Fnd - 362.86 - 243.20 - 153.86 - 3.92 11.58 ISIN: ZAE000001434 SHORT: CROOKES CODE: CKS

Oper Pft Mgn - 19.51 - 31.23 - 37.70 - 2.13 8.88 REG NO: 1913/000290/06 FOUNDED: 1913 LISTED: 1948

D:E 4.70 2.23 1.47 0.16 0.34 NATURE OF BUSINESS: Crookes Brothers Ltd. is a South African

Current Ratio 0.67 0.81 1.05 1.46 2.16 company with agricultural operationsin the KwaZulu-Natal,Mpumalanga

and Western Cape provinces of South Africa, as well as in Swaziland,

Zambia and Mozambique.

Coronation Fund Managers Ltd. The group’s head office is located at Mount Edgecombe, Durban.

COR SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers

ISIN: ZAE000047353 SHORT: CORONAT CODE: CML NUMBER OF EMPLOYEES: 2 813

REG NO: 1973/009318/06 FOUNDED: 1993 LISTED: 2003 DIRECTORS: ChanceRGF(ind ne), CrookesTJ(ne), DentonTK(ne),

NATURE OF BUSINESS: Coronation Fund Managers was founded in Cape Mnganga Dr P (ind ne), RiddleLW(ne), RutherfordMT(ind ne),

Town, South Africa in 1993. The company is an investment-led, Stewart R (ind ne), Vaughan-Smith G (ne), Xaba T (ne), Sinclair K

owner-managed business, with staff ownership of 25%. The company is (CEO), Veale G L (Group FD)

also an active investment manager with a long-term valuation-driven MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

investment approach.

SECTOR: Fins–FinServcs–InvBnkng&BrokerServcs–AssMgrs&Custodians Silverlands (SA) Plantations SARL 44.80%

5.73%

Oasis Asset Management

NUMBER OF EMPLOYEES: 336 Ellingham Estate (Pty) Ltd. 5.50%

DIRECTORS: Boyce L (ind ne), Brown N (ind ne), February J (ind ne), POSTAL ADDRESS:POBox611, Mt.Edgecombe, KwaZulu-Natal,4300

Hadebe P (ind ne), McKenzieJD(ind ne), Nelson Dr H (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/CKS

Nhlumayo M (ind ne), Ntombela S (ind ne), Watson Prof A (ld ind ne),

Pather S (Chair, ind ne), Pillay A (CEO), Musekiwa M (CFO) COMPANY SECRETARY: Ziyanda Ngwenya

MAJOR ORDINARY SHAREHOLDERS as at 12 Feb 2021 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Government Employees Pension Fund 10.76% SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

The Imvula Trust 7.75% AUDITORS: BDO

Allan Gray 6.09% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 44684, Claremont, Cape Town, 7735 CKS Ords 25c ea 16 000 000 15 264 317

MORE INFO: www.sharedata.co.za/sdo/jse/CML DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Nazrana Hawa Ords 25c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 206 2 Jan 18 8 Jan 18 35.00

SPONSOR: PSG Capital (Pty) Ltd. Final No 205 4 Jul 17 10 Jul 17 115.00

AUDITORS: Ernst & Young

LIQUIDITY: Apr21 Ave 14 217 shares p.w., R640 226.9(4.8% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

CML Ords 0.01c ea 750 000 000 349 799 102

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt

Final No 34 8 Dec 20 14 Dec 20 205.00

Interim No 33 9 Jun 20 15 Jun 20 178.00

LIQUIDITY: Apr21 Ave 4m shares p.w., R178.0m(63.1% p.a.)

115