Page 235 - Stock Exchange Handbook 2020 - Issue 3

P. 235

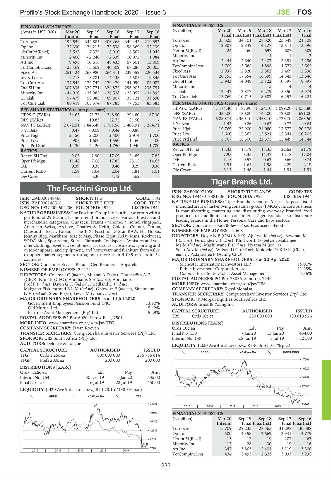

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – FOS

FINANCIAL STATISTICS

FINANCIAL STATISTICS

(Amts in USD’000) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 (R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final(rst) Final(rst) Final(rst) Final

Interim Final Final Final Final

Turnover 194 559 342 885 406 268 349 443 219 653 Turnover 35 323 34 101 28 520 23 549 21 108

Op Inc 22 330 24 213 72 538 98 369 32 139 Op Inc 2 807 2 849 4 127 3 811 3 596

NetIntPd(Rcvd) 3 535 7 375 8 910 6 567 11 045 NetIntPd(Rcvd) - 424 - 460 697 607 509

Minority Int 2 400 - 2 240 2 539 10 072 1 984 Minority Int - - 1 1 2

Att Inc 9 498 10 616 48 433 57 601 13 809 Att Inc 2 444 2 640 2 407 2 351 2 156

TotCompIncLoss - 25 469 - 5 609 40 309 67 286 20 005 TotCompIncLoss 3 709 3 588 1 896 1 577 2 562

Fixed Ass 251 124 263 980 264 311 232 559 220 534 Fixed Ass 2 937 2 820 2 862 2 469 2 336

Inv & Loans 9 713 8 781 4 438 4 505 9 846 Tot Curr Ass 20 755 17 554 16 599 14 343 13 646

Tot Curr Ass 137 542 172 747 179 479 141 099 84 087 Ord SH Int 15 943 14 049 13 122 10 397 9 897

Ord SH Int 307 836 322 771 324 872 296 903 236 751 Minority Int - - 5 4 4

Minority Int - 44 910 - 33 982 - 26 538 - 25 057 - 34 892 LT Liab 12 447 12 877 6 279 5 350 5 974

LT Liab 57 479 58 988 69 807 35 121 33 890 Tot Curr Liab 13 769 10 715 8 387 6 252 6 221

Tot Curr Liab 86 419 105 574 87 783 77 753 83 583 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 1 174.40 1 187.90 1 124.10 1 099.20 1 055.80

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 54.65 71.75 248.90 294.80 87.30 DPS (ZARc) 335.00 780.00 745.00 720.00 691.00

DPS (ZARc) - 10.83 52.75 81.50 - NAV PS (ZARc) 6 880.71 2 360.10 2 358.10 2 728.70 2 063.50

NAV PS (ZARc) 2 072.51 1 846.49 1 761.56 1 403.91 1 284.71 3 Yr Beta 1.43 0.26 0.62 0.77 0.64

3 Yr Beta 0.47 - 0.09 - 0.44 - 0.88 - Price High 19 769 22 900 24 080 17 577 20 178

Price High 2 150 2 200 2 400 2 974 1 700 Price Low 5 600 15 367 12 821 12 344 10 205

Price Low 905 1 600 1 550 1 160 400 Price Prd End 6 767 16 300 22 375 15 449 14 144

Price Prd End 1 130 2 120 1 750 1 940 1 700 RATIOS

Ret on SH Fnd 15.33 18.79 18.35 22.62 21.79

RATIOS Oper Pft Mgn 7.95 8.35 14.47 16.18 17.04

Ret on SH Fnd 9.05 2.90 17.09 24.89 7.82

Oper Pft Mgn 11.48 7.06 17.85 28.15 14.63 D:E 1.15 0.57 0.62 0.66 0.74

D:E 0.39 0.38 0.40 0.29 0.36 Current Ratio 1.51 1.64 1.98 2.29 2.19

Current Ratio 1.59 1.64 2.04 1.81 1.01 Div Cover 3.15 1.46 1.44 1.54 1.51

Div Cover - 5.30 4.72 3.62 -

Tiger Brands Ltd.

The Foschini Group Ltd. TIG

ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS

FOS

ISIN: ZAE000148466 SHORT: TFG CODE: TFG REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944

ISIN: ZAE000148516 SHORT: TFG PREF CODE: TFGP NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed

REG NO: 1937/009504/06 FOUNDED: 1924 LISTED: 1941 manufacturers of fast-moving consumer goods (FMCG). Its core business

NATURE OF BUSINESS: The Foschini Group Ltd. is a diverse group with a is manufacturing, marketing and distributing everyday branded food

portfolio of 29 leading fashion retail brands across various lifestyle and products to middle-income consumers. Tiger Brands also distribute

leading brands in the Home, Personal Care and Baby sectors.

merchandise categories. Our retail brands - @home, @homelivingspace,

American Swiss, Archive, Charles & Keith, Colette, Connor, Donna, SECTOR: Consumer—Food&Bev—Food Producers—Food

Duesouth, Exact, Fabiani, The FIX, Foschini, G-Star RAW, Hi, Hobbs, NUMBER OF EMPLOYEES: 17 608

Johnny Bigg, Markham, Mat & May, Phase Eight, Relay Jeans, Rockwear, DIRECTORS: Doyle N P (CEO & FD), Ajukwu M (ind ne), Bowman M

SODA Bloc, Sportscene, Sterns, Tarocash, Totalsports, Whistles and yd. - J(ind ne), Fernandez C (ind ne), Klintworth G (ind ne), Makanjee

offer clothing, jewellery, cellphones, accessories, cosmetics, sporting and MsM(ind ne), Mashilwane E (ind ne), Nyama M (ind ne),

outdoor apparel and equipment, and homeware and furniture from value Sello Adv M (ind ne), WilsonDG(ind ne), Mokhele DrKDK (Chair,

to upper market segments throughout more than 4 085 outlets in 32 ind ne), Padayachee P (Acting CFO)

countries. MAJOR ORDINARY SHAREHOLDERS as at 20 Apr 2020

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Apparels Silchester International Investors LLP 15.01%

NUMBER OF EMPLOYEES: 29 121 Public Investment Corporation Ltd. 11.28%

DIRECTORS: Coleman C (ind ne), MurrayAD(ne), Thunström A E Colonial First State Global Asset Management 7.36%

(CEO), Ntuli B (CFO), AbrahamsSE(ind ne), Abrahams POSTAL ADDRESS: PO Box 78056, Sandton, 2146

Prof F (ind ne), DavinGH(ind ne), Friedland D (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/TBS

Makgabo-FiskerstrandBLM(ind ne), Oblowitz E (ind ne), Simamane COMPANY SECRETARY: Kgosi Monaisa

NV(ind ne), Stein R (ne), Lewis M (Chair, ind ne) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 14 Jul 2020

Government Employees Pension Fund (PIC) 13.90% AUDITORS: Ernst & Young Inc.

Old Mutual Ltd. 5.42%

Fairtree Asset Management (Pty) Ltd. 5.29% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 6020, Parow East, 7501 TBS Ords 10c ea 250 000 000 189 818 926

MORE INFO: www.sharedata.co.za/sdo/jse/TFG DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: D van Rooyen Ords 10c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 150 7 Jan 20 13 Jan 20 434.00

SPONSOR: UBS South Africa (Pty) Ltd. Interim No 149 25 Jun 19 1 Jul 19 321.00

AUDITORS: Deloitte & Touche LIQUIDITY: Jul20 Ave 4m shares p.w., R846.3m(110.1% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

FOOD 40 Week MA TIGBRANDS

TFG Ords 1.25c ea 600 000 000 236 756 814

TFGP Prefs 200c ea 200 000 200 000 47001

DISTRIBUTIONS [ZARc] 40629

Ords 1.25c ea Ldt Pay Amt

Interim No 154 30 Dec 19 6 Jan 20 335.00 34257

Final No 153 16 Jul 19 22 Jul 19 450.00

27885

LIQUIDITY: Jul20 Ave 9m shares p.w., R1 078.1m(198.8% p.a.)

21513

GERE 40 Week MA TFG

23056 15141

2015 | 2016 | 2017 | 2018 | 2019 |

19600

FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

16145

Interim Final Final(rst) Final Final(rst)

Turnover 15 709 29 233 28 365 31 298 30 588

12689

Op Inc 500 4 358 2 669 3 941 3 779

9233 NetIntPd(Rcvd) - 15 - 12 19 207 162

Minority Int 12 28 30 19 16

5778 Att Inc 347 3 863 2 401 3 119 3 306

2015 | 2016 | 2017 | 2018 | 2019 |

TotCompIncLoss 434 3 493 2 323 3 033 3 235

233