Page 232 - Stock Exchange Handbook 2020 - Issue 3

P. 232

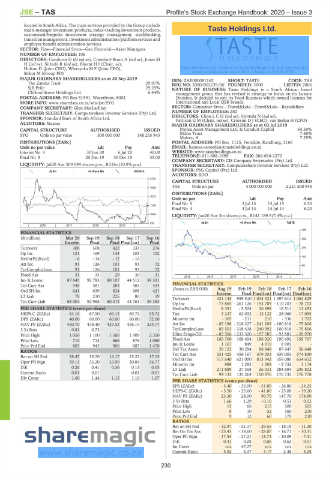

JSE – TAS Profile’s Stock Exchange Handbook: 2020 – Issue 3

located in South Africa. The main services provided by the Group include

multi-manager investment products, index-tracking investment products, Taste Holdings Ltd.

customised/bespoke investment strategy management, stockbroking, TAS

transition management, investment administration/platform services and

employee benefit administration services.

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

NUMBER OF EMPLOYEES: 106

DIRECTORS: Cavaleros G (ld ind ne), Crawford-Brunt A (ind ne), Jonas M

H(ind ne), Sithubi R (ind ne), Bhorat H I (Chair, ne),

Hufton D (Joint CEO), Wierzycka M F (Joint CEO), Taste Holdings Ltd. renamed to LuxeHoldings Ltd.and underwenta

Sirkot M (Group FD) share consolidation on a 100 to 1 basis on 22 July 2020.

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 ISIN: ZAE000081162 SHORT: TASTE CODE: TAS

The Zatoka Trust 29.97% REG NO: 2000/002239/06 FOUNDED: 2000 LISTED: 2006

SJB Peile 29.25% NATURE OF BUSINESS: Taste Holdings is a South African based

Clifford Street Holdings Ltd. 6.44% management group that has revised it strategy to focus on its Luxury

POSTAL ADDRESS: PO Box 51591, Waterfront, 8002 Division. It decided to exit its Food Business which owned licenses for

MORE INFO: www.sharedata.co.za/sdo/jse/SYG International and Local QSR brands.

COMPANY SECRETARY: Glen MacLachlan SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Rests&Bars

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. NUMBER OF EMPLOYEES: 280

SPONSOR: Standard Bank of South Africa Ltd. DIRECTORS: ChouLCH(ind ne), Siyotula N (ind ne),

Pattison G M (Chair, ind ne), Crosson D J (CEO), van Eeden H (CFO)

AUDITORS: Mazars

MAJOR ORDINARY SHAREHOLDERS as at 03 Jul 2019

Protea Asset Management LLC & Conduit Capital 64.50%

CAPITAL STRUCTURE AUTHORISED ISSUED Eldon Trust 7.46%

SYG Ords no par value 500 000 000 148 255 945

Maizey, A 7.29%

POSTAL ADDRESS: PO Box 1125, Ferndale, Randburg, 2160

DISTRIBUTIONS [ZARc]

EMAIL: hannes.vaneeden@tasteholdings.co.za

Ords no par value Ldt Pay Amt

Interim No 9 30 Jun 20 6 Jul 20 40.00 WEBSITE: www.tasteholdings.co.za

Final No 8 20 Dec 19 30 Dec 19 35.00 TELEPHONE: 011-608-1999 FAX: 086-696-1270

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

LIQUIDITY: Jul20 Ave 309 699 shares p.w., R3.0m(10.9% p.a.) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd.

ALSH 40 Week MA SYGNIA

AUDITORS: BDO

2220

CAPITAL STRUCTURE AUTHORISED ISSUED

1926 TAS Ords no par 4 000 000 000 2 221 500 948

DISTRIBUTIONS [ZARc]

1632

Ords no par Ldt Pay Amt

Final No 5 3 Jul 15 13 Jul 15 6.50

1338

Final No 4 4 Jul 14 14 Jul 14 6.20

1044

LIQUIDITY: Jun20 Ave 3m shares p.w., R141 189.9(7.4% p.a.)

750 ALSH 40 Week MA TASTE

| 2016 | 2017 | 2018 | 2019 |

489

FINANCIAL STATISTICS

(R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 392

Interim Final Final Final(rst) Final

Turnover 308 508 422 333 276 294

Op Inc 121 169 143 103 102

197

NetIntPd(Rcvd) - 6 - 14 - 12 - 16 -

Att Inc 91 126 101 93 72 99

TotCompIncLoss 91 126 101 93 72

Fixed Ass 31 33 29 30 31 2015 | 2016 | 2017 | 2018 | 2019 | 2

Inv & Loans 87 645 92 783 80 107 44 512 39 331

Tot Curr Ass 548 581 283 483 424 FINANCIAL STATISTICS

Ord SH Int 641 639 624 608 421 (Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

LT Liab 78 210 225 80 19 Turnover Interim 959 510 1 034 321 1 097 614 1 062 829

Final Final(rst) Final(rst) Final(rst)

421 145

Tot Curr Liab 88 004 92 988 80 013 44 761 39 383 Op Inc - 73 865 - 261 126 - 193 709 - 110 703 - 78 703

NetIntPd(Rcvd) 8 391 - 5 524 26 698 18 511 12 453

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 64.10 87.90 69.15 69.72 55.72 Tax 3 247 62 032 - 12 122 - 28 060 - 17 055

DPS (ZARc) 40.00 60.00 60.00 60.00 52.00 Minority Int - 305 - 211 210 - 336 1 705

NAV PS (ZARc) 450.70 438.40 427.52 458.15 324.77 Att Inc - 85 198 - 318 227 - 241 202 - 100 818 - 75 806

3 Yr Beta 0.81 0.73 - - - TotCompIncLoss - 85 503 - 318 438 - 240 992 - 100 818 - 75 806

Price High 1 050 1 100 1 500 1 909 2 350 Hline Erngs-CO - 85 566 - 233 320 - 197 585 - 93 881 - 59 970

Price Low 710 713 666 876 1 050 Fixed Ass 165 700 168 454 186 920 190 692 159 767

Price Prd End 805 945 906 887 1 470 Inv & Loans 1 107 849 4 919 8 905 -

Def Tax Asset 28 122 30 294 88 848 87 647 56 648

Tot Curr Ass 331 425 456 167 479 053 439 003 574 830

RATIOS

Ret on SH Fnd 28.47 19.70 16.17 15.22 17.15

Oper Pft Mgn 39.11 33.20 33.90 30.84 36.77 Ord SH Int 517 640 621 000 813 942 559 086 654 652

1 503

- 2 732

1 174

Minority Int

988

1 292

D:E 0.26 0.41 0.36 0.13 0.05 LT Liab 211 889 27 358 26 031 284 884 295 802

Current Ratio 0.01 0.01 - 0.01 0.01 Tot Curr Liab 94 133 135 264 150 976 176 732 176 778

Div Cover 1.60 1.44 1.15 1.16 1.07

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 5.40 - 35.00 - 51.00 - 26.80 - 24.25

HEPS-C (ZARc) - 5.50 - 25.60 - 41.80 - 25.00 - 19.20

NAV PS (ZARc) 23.30 28.00 90.70 147.70 174.90

3 Yr Beta 1.66 1.29 - 0.10 0.53 0.02

Price High 15 66 215 300 525

Price Low 8 10 52 160 210

Price Prd End 9 12 60 179 210

RATIOS

Ret on SH Fnd - 32.97 - 51.17 - 29.55 - 18.18 - 11.30

Ret On Tot Ass - 23.43 - 38.60 - 28.07 - 16.71 - 10.31

Oper Pft Mgn - 17.54 - 27.21 - 18.73 - 10.09 - 7.41

D:E 0.41 0.08 0.06 0.62 0.51

Int Cover n/a 47.27 n/a n/a n/a

Current Ratio 3.52 3.37 3.17 2.48 3.25

230