Page 234 - Stock Exchange Handbook 2020 - Issue 3

P. 234

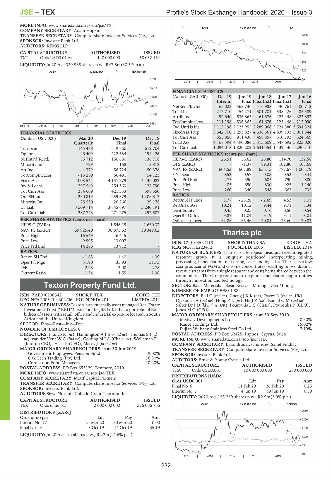

JSE – TEX Profile’s Stock Exchange Handbook: 2020 – Issue 3

MORE INFO: www.sharedata.co.za/sdo/jse/TXT

SAPY 40 Week MA TEX

COMPANY SECRETARY: Adam Hopkin

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 1235

SPONSOR: Investec Bank Ltd.

AUDITORS: KPMG LLP 1008

781

CAPITAL STRUCTURE AUTHORISED ISSUED

TXT Ords USD0.01 ea 140 000 000 58 032 164

553

LIQUIDITY: Jul20 Ave 339 988 shares p.w., R47.8m(30.5% p.a.)

326

ALSH 80 Day MA TEXTAINER

17500 99

2015 | 2016 | 2017 | 2018 | 2019 |

15914

FINANCIAL STATISTICS

14327 (Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final(rst) Final(rst) Final

12741 NetRent/InvInc 165 023 363 736 416 988 440 761 400 712

Total Inc 212 710 454 271 501 701 538 426 485 589

11155

Attrib Inc 92 640 - 536 863 - 61 676 123 448 323 892

TotCompIncLoss 111 198 - 536 863 - 61 676 123 448 212 090

9568

Dec 19 | Jan 20 | Feb | Mar | Apr | May | Jun | Jul

Ord UntHs Int 2 112 198 2 123 952 2 289 068 2 724 380 3 594 324

FixedAss/Prop 3 342 700 3 293 827 4 536 661 4 839 133 5 001 844

FINANCIAL STATISTICS

(Amts in USD’000) Mar 20 Dec 19 Dec 18 Tot Curr Ass 555 856 911 438 458 857 310 193 324 569

Total Ass 4 168 394 4 490 084 5 315 609 5 547 692 5 823 020

Quarterly Final Final

Turnover 145 478 619 760 612 704 Tot Curr Liab 1 094 018 1 820 202 2 641 554 1 439 436 296 110

Op Inc 46 409 222 684 194 426 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 35 712 150 680 136 718 HEPS-C (ZARc) 26.51 55.62 26.80 114.70 132.58

Minority Int - 729 - 168 3 872 DPS (ZARc) - 71.37 89.31 102.80 103.68

Att Inc - 4 379 56 724 50 378 NAV PS (ZARc) 604.53 607.89 655.15 777.67 1 005.79

TotCompIncLoss - 13 269 56 481 54 123 3 Yr Beta 0.52 0.57 0.08 0.53 0.41

Fixed Ass 4 008 541 4 157 279 4 136 082 Price Prd End 275 390 605 790 800

Inv & Loans 297 549 254 363 127 790 Price High 405 650 830 925 1 140

Tot Curr Ass 384 669 421 333 398 350 Price Low 260 340 548 663 735

Ord SH Int 1 230 819 1 259 379 1 206 813 RATIOS

Minority Int 25 530 26 266 29 178 RetOnSH Funds 8.77 - 25.28 - 2.69 4.53 9.01

LT Liab 3 509 714 3 645 697 3 240 191 RetOnTotAss 10.21 10.12 9.44 9.71 8.34

Tot Curr Liab 287 743 271 275 292 587 Debt:Equity 0.45 0.25 0.16 0.50 0.54

OperRetOnInv 9.87 11.04 9.19 9.11 8.01

OpInc:Turnover 61.86 65.46 70.81 73.60 70.03

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 1 546.15 1 630.37

NAV PS (ZARc) 39 925.40 30 875.62 30 349.62 Tharisa plc

Price High 16 549 16 415 -

THA

Price Low 9 995 13 007 - ISIN: CY0103562118 SHORT: THARISA CODE: THA

Price Prd End 14 266 13 912 - REG NO: HE223412 FOUNDED: 2006 LISTED: 2014

NATURE OF BUSINESS: Tharisa is a European headquartered integrated

RATIOS

Ret on SH Fnd - 1.63 4.40 4.39 resource group. It is uniquely positioned incorporating mining,

Oper Pft Mgn 31.90 35.93 31.73 processing, beneficiation, marketing, sales and logistics. Tharisa is a low

D:E 2.98 3.00 2.78 cost producer of PGM and chrome concentrates resulting in two distinct

Current Ratio 1.34 1.55 1.36 revenue streamsfromasingle resource andcostsbeing shared between the

commodities. The Group continues to explore beneficiation opportunities

through innovation and technology.

Texton Property Fund Ltd. SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

NUMBER OF EMPLOYEES: 1 889

TEX

ISIN: ZAE000190542 SHORT: TEX CODE: TEX DIRECTORS: Bell C (ind ne), ChengJKK(ne), Davey R (ind ne, UK),

REG NO: 2005/019302/06 FOUNDED: 2011 LISTED: 2011 Djakouris A (ind ne), HongZL(ne), HuJZ(ne), KamalOM(ind ne),

NATUREOF BUSINESS:TextonisaninternallyassetmanagedRealEstate Salter DrJD(ld ind ne, UK), Pouroulis L C (Chair), Pouroulis P (CEO),

Investment Trust (“REIT”) listed on the JSE Ltd. It has a portfolio of R5.4 Jones M G (CFO)

billion of assets with retail, office and industrial exposure located in South

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

Africa and the United Kingdom. Medway Developments Ltd. 40.60%

SECTOR: Fins—Rest—Inv—Div Rance Holdings Ltd. 15.02%

NUMBER OF EMPLOYEES: 0 Fujian Wuhang Stainless Steel Co Ltd. 7.19%

DIRECTORS: Franco R (ne), HanningtonAJ(snr ind ne), Thomas S (ind POSTAL ADDRESS: PO Box 62425, Paphos, Cyprus, 8064

ne), van der VentWC(ind ne), GoldingMJA (Chair, ne), Welleman P MORE INFO: www.sharedata.co.za/sdo/jse/THA

(Interim CEO), Hack P (CFO), Macey J (ld ind ne) COMPANY SECRETARY: Lysandros Lysandrides, Sanet Findlay

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Government Employees Pension Fund 19.00% SPONSOR: Investec Bank Ltd.

Oak Tech Trading (Pty) Ltd. 16.90% AUDITORS: Ernst & Young Cyprus Ltd.

Coronation Fund Managers 10.20%

POSTAL ADDRESS: PO Box 653129, Benmore, 2010 CAPITAL STRUCTURE AUTHORISED 270 000 000

ISSUED

THA

10 000 000 000

Ords USD0.001

MORE INFO: www.sharedata.co.za/sdo/jse/TEX

COMPANY SECRETARY: Motif Capital Partners DISTRIBUTIONS [USDc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords USD0.001 Ldt Pay Amt

SPONSOR: Investec Bank Ltd. Final No 6 11 Feb 20 26 Feb 20 0.25

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc. Interim No 5 4 Jun 19 19 Jun 19 0.50

LIQUIDITY: Jul20 Ave 153 269 shares p.w., R2.9m(3.0% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

TEX Ords of no par 2 000 000 000 376 066 766 ALSH 40 Week MA THARISA

2650

DISTRIBUTIONS [ZARc]

2200

Ords of no par Ldt Pay Amt

Interim No 17 24 Mar 20 30 Mar 20 0.00

Final No 16 8 Oct 19 14 Oct 19 35.19 1750

LIQUIDITY: Jul20 Ave 1m shares p.w., R2.2m(14.6% p.a.)

1300

850

400

2015 | 2016 | 2017 | 2018 | 2019 |

232