Page 228 - Stock Exchange Handbook 2020 - Issue 3

P. 228

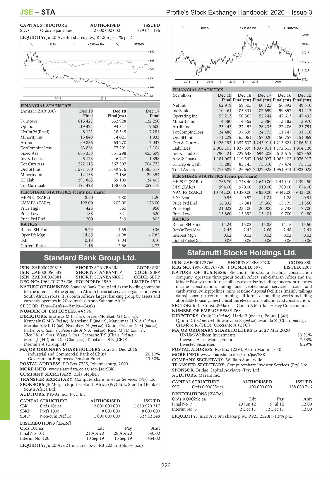

JSE – STA Profile’s Stock Exchange Handbook: 2020 – Issue 3

BANK 40 Week MA STANBANK

CAPITAL STRUCTURE AUTHORISED ISSUED

SDO Ords no par value 2 000 000 000 819 041 196

22507

LIQUIDITY: Jul20 Ave 3m shares p.w., R4.8m(16.1% p.a.)

ALSH 40 Week MA STADIO 19762

850

17017

698

14272

546 11527

394 8782

2015 | 2016 | 2017 | 2018 | 2019 |

242

FINANCIAL STATISTICS

(R million)

90 Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

2018 | 2019 |

Final Final(rst) Final(rst) Final(rst) Final(rst)

Net Int 62 919 59 505 60 125 56 892 49 310

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Dec 18 Dec 17 Inc Bank 110 461 105 331 102 699 99 857 91 113

Operating Inc 55 213 50 565 52 244 47 613 47 492

Final Final(rst) Final

Turnover 815 427 632 928 122 250 Minority Int 4 380 4 452 3 886 3 182 3 970

Op Inc 119 424 94 817 - 9 600 Attrib Inc 25 443 27 453 26 235 22 206 23 754

NetIntPd(Rcvd) - 8 121 - 18 545 - 7 284 TotCompIncLoss 24 488 37 699 24 775 11 147 31 110

Minority Int 13 848 14 021 1 933 Ord SH Int 171 229 165 061 157 020 150 757 151 069

Att Inc 69 836 63 270 - 7 037 Dep & Cur Acc 1 426 193 1 357 537 1 243 911 1 213 621 1 186 514

TotCompIncLoss 83 864 77 291 - 5 104 Liabilities 2 066 105 1 927 899 1 837 911 1 772 615 1 804 120

Fixed Ass 663 358 531 298 453 699 Inv & Trad Sec 790 121 729 638 694 208 613 619 607 352

Inv & Loans 5 173 6 727 1 898 Adv & Loans 1 181 067 1 119 547 1 048 027 1 065 405 1 076 917

Tot Curr Ass 222 115 367 507 704 772 ST Dep & Cash 75 288 85 145 75 310 77 474 75 112

Ord SH Int 1 571 160 1 649 916 1 385 317 Total Assets 2 275 589 2 126 962 2 027 928 1 951 974 1 983 028

Minority Int 12 138 47 186 29 354

PER SHARE STATISTICS (cents per share)

LT Liab 291 863 69 109 24 405 HEPS-C (ZARc) 1 766.70 1 748.40 1 640.00 1 440.10 1 394.50

Tot Curr Liab 191 498 138 035 259 176 DPS (ZARc) 994.00 970.00 910.00 780.00 674.00

NAV PS (ZARc) 10 742.00 10 380.00 9 830.00 9 442.00 9 433.00

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 8.50 7.80 - 1.20 3 Yr Beta 0.55 0.57 1.04 1.28 0.91

NAV PS (ZARc) 192.00 202.00 176.00 Price Prd End 16 832 17 881 19 566 15 175 11 350

Price High 425 860 950 Price High 21 022 23 100 20 000 15 748 17 700

Price Low 188 321 520 Price Low 15 860 15 392 13 401 9 700 9 480

Price Prd End 200 349 805

RATIOS

Ret on SH Fund 14.24 16.03 15.85 14.15 15.50

RATIOS

Ret on SH Fnd 5.29 4.55 - 0.36 RetOnTotalAss 2.43 2.45 2.66 2.48 2.41

Oper Pft Mgn 14.65 14.98 - 7.85 Interest Mgn 0.02 0.02 0.02 0.02 0.02

D:E 0.18 0.04 0.10 LiquidFnds:Dep 0.05 0.06 0.06 0.06 0.06

Current Ratio 1.16 2.66 2.72

Stefanutti Stocks Holdings Ltd.

Standard Bank Group Ltd. STE

ISIN: ZAE000123766 SHORT: STEFSTOCK CODE: SSK

STA

ISIN: ZAE000109815 SHORT: STANBANK CODE: SBK REG NO: 1996/003767/06 FOUNDED: 1971 LISTED: 2007

ISIN: ZAE000056339 SHORT: STANBANK-P CODE: SBPP NATURE OF BUSINESS: Stefanutti Stocks, a leading construction

ISIN: ZAE000038881 SHORT: STANBANK6.5 CODE: SBKP company, operates throughout South Africa, sub-Saharan Africa and the

REG NO: 1969/017128/06 FOUNDED: 1969 LISTED: 1970 Middle East with multi-disciplinary expertise including concrete structures,

NATURE OF BUSINESS: Standard Bank Group Ltd. is the holding company marine construction, piling and geotechnical services, roads and

for the interests of the group, an African financial services organisation with earthworks, bulk pipelines, mine residue disposal facilities (mainly tailings

South African roots. It is South Africa’s largest banking group by assets and dams), open pit contract mining, all forms of building works including

currently operates in 20 countries in sub-Saharan Africa. affordablehousing,mechanicalandelectricalinstallationandconstruction.

SECTOR: Fins—Banks—Banks—Banks SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction

NUMBER OF EMPLOYEES: 44 996 NUMBER OF EMPLOYEES: 9 768

DIRECTORS: Erasmus M (ind ne), Fraser-Moleketi G J (ind ne), DIRECTORS: Craig H (ind ne), Harie B (ind ne), Poluta J (alt),

Kennealy G M B (ind ne), Mabelane P (ind ne), Matyumza N N A (ind ne), Quinn D (ind ne, Ire), Silwanyana B (ind ne), Matlala Z (Chair, ind ne),

Moroka Adv K D (ne), Nyembezi N (ind ne), Oduor-Otieno Dr M (ind ne), Crawford R (CEO), Cocciante A (CFO)

Parker A C (ind ne), Peterside A N A (ind ne), Ruck M J D (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020

Vice J M (ind ne), Wang L (ne), Gcabashe T S (Chair, ind ne), UNUM-Welkom Investments 13.31%

Maree J ( H (Joint Dep Chair, ne), Tshabalala S K (CEO), Investec Asset Management 7.63%

Daehnke A (Group FD) Investec Securities 6.29%

POSTAL ADDRESS: PO Box 12394, Aston Manor, 1630

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Industrial and Commercial Bank of China 20.10% MORE INFO: www.sharedata.co.za/sdo/jse/SSK

Government Employees Pension Fund 13.30% COMPANY SECRETARY: William Somerville

POSTAL ADDRESS: PO Box 7725, Johannesburg, 2000 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/SBK SPONSOR: Bridge Capital Advisors (Pty) Ltd.

COMPANY SECRETARY: Zola Stephen AUDITORS: Mazars Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: JP Morgan Equities South Africa (Pty) Ltd., Standard Bank of CAPITAL STRUCTURE AUTHORISED ISSUED

South Africa Ltd. SSK Ords 0.00025c ea 400 000 000 188 080 746

AUDITORS: KPMG Inc., PwC Inc. DISTRIBUTIONS [ZARc]

Ords 0.00025c ea Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 7 29 Jun 12 9 Jul 12 12.00

SBK Ords 10c ea 2 000 000 000 1 619 929 317

SBKP Prefs 100c 8 000 000 8 000 000 Interim No 6 2 Dec 11 12 Dec 11 12.00

SBPP Non-cum Pref 1c 1 000 000 000 52 982 248 LIQUIDITY: Jul20 Ave 3m shares p.w., R925 252.8(71.9% p.a.)

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt

Final No 101 21 Apr 20 28 Apr 20 540.00

Interim No 100 10 Sep 19 16 Sep 19 454.00

LIQUIDITY: Jul20 Ave 21m shares p.w., R3 203.1m(66.3% p.a.)

226