Page 229 - Stock Exchange Handbook 2020 - Issue 3

P. 229

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – STE

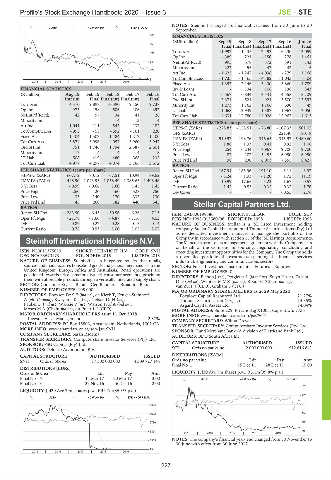

NOTES: Steinhoff changed its financial year-end from 30 June to 30

CONM 40 Week MA STEFSTOCK

September.

823

FINANCIAL STATISTICS

(EUR million)

660 Sep 19 Sep 18 Sep 17 Sep 16 Jun 16

Final Final(rst) Final(rst) Final(rst) Final

Turnover 11 992 11 435 12 493 16 130 13 059

497

Op Inc - 389 221 - 150 278 1 461

334 NetIntPd(Rcvd) 995 578 372 391 143

Minority Int - 222 55 42 42 5

171

Att Inc - 1 622 - 1 247 - 4 036 - 279 1 168

TotCompIncLoss - 1 735 - 1 165 - 4 182 - 1 043 - 104

8

2015 | 2016 | 2017 | 2018 | 2019 |

Fixed Ass 1 352 2 146 3 430 3 860 4 789

Inv & Loans - 134 106 198 843

FINANCIAL STATISTICS

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 Tot Curr Ass 6 567 6 834 4 441 4 558 8 109

Ord SH Int - 2 371 - 521 924 5 500 12 592

Interim Final Final(rst) Final(rst) Final

Turnover 4 470 9 898 10 390 9 150 9 737 Minority Int 1 273 1 162 1 166 590 49

Op Inc - 973 - 158 - 506 - 106 392 LT Liab 11 068 2 949 1 387 1 967 7 050

NetIntPd(Rcvd) 42 57 34 41 26 Tot Curr Liab 4 631 12 780 14 028 12 967 4 613

Minority Int - - - 4 - 13 4

Att Inc - 1 041 - 111 - 543 - 137 182 PER SHARE STATISTICS (cents per share) - 76.80 - 107.33 501.02

- 278.83

- 158.51

HEPS-C (ZARc)

TotCompIncLoss - 998 - 53 - 592 - 161 220 DPS (ZARc) - - - 221.40 180.18

Fixed Ass 1 404 1 502 1 484 1 212 1 100 NAV PS (ZARc) - 910.97 - 198.76 346.65 2 345.97 5 480.60

Tot Curr Ass 3 874 3 996 4 057 3 960 3 947 3 Yr Beta 1.86 1.33 0.41 0.92 1.06

Ord SH Int 751 1 746 1 794 2 387 2 601 Price High 254 6 244 7 967 9 700 9 700

Minority Int - 17 - 14 - 4 4 8 Price Low 87 107 5 455 6 950 6 950

LT Liab 508 419 480 366 232 Price Prd End 98 230 6 003 7 855 8 427

Tot Curr Liab 4 977 4 297 4 074 3 766 3 672

RATIOS

Ret on SH Fnd 167.94 - 185.96 - 191.10 - 3.11 8.97

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 607.72 - 70.12 67.51 10.94 89.62 Oper Pft Mgn - 3.24 1.93 - 1.20 1.72 11.19

NAV PS (ZARc) 448.90 1 043.95 1 058.49 1 385.65 1 498.48 D:E - 10.99 17.65 5.23 1.67 0.57

3 Yr Beta - 0.99 - 0.66 1.60 1.45 1.45 Current Ratio 1.42 0.53 0.32 0.35 1.76

Price High 260 420 460 528 750 Div Cover - - - - 0.55 2.76

Price Low 35 140 170 335 230

Price Prd End 45 260 182 440 345

Stellar Capital Partners Ltd.

RATIOS

STE

Ret on SH Fnd - 283.50 - 6.43 - 30.56 - 6.26 7.13 ISIN: ZAE000198586 SHORT: STELLAR CODE: SCP

Oper Pft Mgn - 21.78 - 1.60 - 4.87 - 1.16 4.03 REG NO: 1998/015580/06 FOUNDED: 1998 LISTED: 1998

D:E 0.89 0.27 0.28 0.15 0.14 NATURE OF BUSINESS: Stellar is a JSE listed investment holding

Current Ratio 0.78 0.93 1.00 1.05 1.07 company. Stellar Capital has appointed Thunder Securitisations (Pty) Ltd.

as its dedicated investment manager to manage the portfolio of the

Steinhoff International Holdings N.V. Company in accordance with section 15 of the JSE Listings Requirements.

The Manco, in terms of its management agreement with the Company, acts

STE on behalf of the Company in sourcing, negotiating, concluding and

ISIN: NL0011375019 SHORT: STEINHOFF N.V. CODE: SNH executing investment opportunities for the Company. The Company holds

REG NO: 63570173 FOUNDED: 2015 LISTED: 2015 a diversified portfolio of investments spanning the financial services,

NATURE OF BUSINESS: Steinhoff is an integrated retailer that retails, industrial, engineering and communications sectors.

sources and manufactures household goods and general merchandise in the SECTOR: Fins—Investment Instruments—Equities—Equities

United Kingdom, Europe, Africa and Australasia. Retail operations are NUMBER OF EMPLOYEES: 0

positioned towards price conscious (value) consumer segments, providing DIRECTORS: Bishop J (ne), Potgieter L (ld ind ne), Steyn H (ne), Tabata

them with affordable products through a vertically integrated supply chain. DD(ind ne), WentzelMVZ(ind ne), Roodt C (Chair, ind ne),

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets van Zyl P J (CEO), Graham S (CFO)

NUMBER OF EMPLOYEES: 105 000

DIRECTORS: Booysen DrSF(ind ne), de Klerk T, Kruger-Steinhoff MAJOR ORDINARY SHAREHOLDERS as at 29 May 2020 21.27%

Foxglove Capital Resourced Ltd.

A(alt, German), KweyamaKT(ne), Nelson Dr H (ne), Thunder Securitisation (Pty) Ltd. 14.35%

Pauker D (ind ne), Wakkie P (ne), Watson Prof A (ind ne), Asgard Capital Assets Ltd. 14.04%

Moses M A (Chair, ind ne), du Preez L J (CEO) POSTAL ADDRESS: Suite 229, Private Bag X1005, Cape Town, 7735

MAJOR ORDINARY SHAREHOLDERS as at 11 Oct 2018 MORE INFO: www.sharedata.co.za/sdo/jse/SCP

Investec Asset Management 2.87% COMPANY SECRETARY: Wilma Dreyer

POSTAL ADDRESS: PO Box 15803, Amsterdam, Netherlands, 1001 CA TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/SNH SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

COMPANY SECRETARY: Sarah Radema AUDITORS: BDO South Africa Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Deloitte Accountants B.V. SCP Ords no par value 2 000 000 000 912 616 841

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

SNH Ords of 50c ea 17 500 000 000 4 309 727 144 Ords no par value Ldt Pay Amt

Final No 1 15 Dec 11 28 Dec 11 15.00

DISTRIBUTIONS [EURc]

LIQUIDITY: Jul20 Ave 7m shares p.w., R5.1m(39.8% p.a.)

Ords of 50c ea Ldt Pay Amt

Final No 17 14 Mar 17 20 Mar 17 3.00 ALSH 40 Week MA STELLAR

Final No 16 29 Nov 16 6 Dec 16 12.00

325

LIQUIDITY: Jul20 Ave 29m shares p.w., R36.7m(35.3% p.a.)

270

ALSH 40 Week MA STEINHOFF N.V.

9508 215

7622 159

5736 104

3851 49

2015 | 2016 | 2017 | 2018 | 2019 |

NOTES: The company’s financial year- end changed from 30 November to

1965

30 June with effect from 30 June 2017.

79

2015 | 2016 | 2017 | 2018 | 2019 |

227