Page 97 - SHB 2020 Issue 1

P. 97

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – ANG

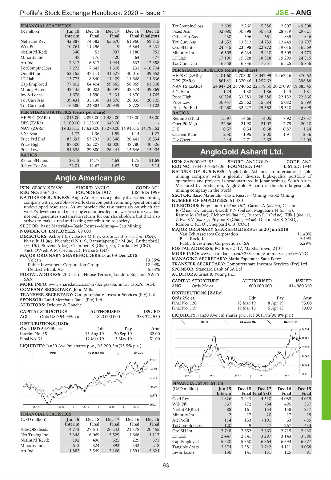

FINANCIAL STATISTICS TotCompIncLoss 2 609 2 260 5 886 2 807 - 9 808

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Fixed Ass 32 080 30 898 30 643 28 719 29 621

Interim Final Final Final Final(rst) Other Fin Ass 430 396 561 835 846

Net Sales Rev 42 887 74 582 65 670 61 960 59 815 Tot Curr Ass 14 652 13 312 14 733 12 449 13 797

Wrk Pft 10 761 11 296 9 5 864 5 231 Ord SH Int 24 645 23 598 22 972 19 016 16 569

NetIntPd(Rcd) 340 52 997 1 180 951 Minority Int 6 605 6 234 5 910 5 309 4 773

Minority Int 48 176 - 20 64 - 77 LT Liab 17 190 15 528 18 328 19 299 24 815

Att Inc 7 313 6 817 1 944 632 - 12 358 Tot Curr Liab 6 358 6 836 7 351 6 525 5 856

TotCompIncLoss 7 272 7 643 1 508 231 - 10 704 PER SHARE STATISTICS (cents per share)

Ord SH Int 52 155 47 111 41 527 40 016 39 652 HEPS-C (ZARc) 2 101.60 2 703.00 3 047.99 2 162.16 370.62

LT Liab 15 775 8 840 11 409 11 668 14 636 DPS (ZARc) 861.41 1 370.46 1 257.62 - 396.88

Cap Employed 77 802 64 404 59 865 58 969 61 808 NAV PS (ZARc) 24 847.24 26 740.62 22 179.30 20 270.97 19 885.45

Mining Assets 42 445 40 003 36 597 38 574 39 869 3 Yr Beta 1.24 1.38 1.86 1.43 1.81

Inv & Loans 1 678 1 590 3 434 4 870 4 765 Price High 40 828 33 583 28 586 22 132 22 666

Tot Curr Ass 39 431 35 138 31 876 26 035 20 705 Price Low 30 447 25 562 15 684 5 082 5 899

Tot Curr Liab 16 580 24 884 20 949 18 728 11 102

Price Prd End 40 260 32 227 25 562 19 510 6 899

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 2 815.00 2 893.00 1 482.00 713.00 - 48.00 Ret on SH Fnd 15.97 14.66 14.05 7.92 - 27.37

DPS (ZARc) 1 100.00 1 125.00 349.00 - - Oper Pft Mgn 22.66 21.98 21.07 7.79 - 20.10

NAV (ZARc) 19 338.15 17 620.00 15 270.00 14 916.15 14 795.52 D:E 0.57 0.54 0.68 0.87 1.24

3 Yr Beta 1.72 1.36 1.59 1.14 1.27 Current Ratio 2.30 1.95 2.00 1.91 2.36

Price Prd End 83 693 53 793 35 346 26 441 18 534 Div Cover 2.44 2.71 2.62 - - 14.04

Price High 87 500 55 207 42 000 48 780 40 526

Price Low 51 828 29 880 26 441 15 646 15 905 AngloGold Ashanti Ltd.

RATIOS

ANG

Ret on SH fund 28.12 14.77 4.69 1.75 - 31.69 ISIN: ZAE000043485 SHORT: ANGGOLD CODE: ANG

Ret on Tot Ass 22.01 12.62 - 1.67 5.88 5.14 REG NO: 1944/017354/06 FOUNDED: 1944 LISTED: 1944

NATURE OF BUSINESS: AngloGold Ashanti, an international gold

Anglo American plc mining company with a globally diverse, high-quality portfolio of

operations and projects, is headquartered in Johannesburg, South Africa.

ANG Measured by production, AngloGold Ashanti is the third-largest gold

ISIN: GB00B1XZS820 SHORT: AN GLO CODE: AGL mining company in the world.

REG NO: 3564138 FOUNDED: 1917 LISTED: 1999 SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

NATURE OF BUSINESS: Anglo American is a globally diversified mining

company with a portfolio of world class competitive mining operations and NUMBER OF EMPLOYEES: 51 480

undeveloped resources. As we provide the raw materials on which the DIRECTORS: Ferguson A (ind ne, UK), Garner A (ind ne), Gasant

world’s developed and maturing economies depend, we do so in a way that R (ld ind ne), January-Bardill P N (ind ne), Magubane N (ind ne),

not only generates sustainable returns for our shareholders but that also Ramos M (ind ne), Richter M (ind ne), Ruston R J (ind ne), Tilk J (ind ne),

strives to make a real and lasting contribution to society. Zilwa S V (ind ne), Pityana S (Chair, ind ne), Dushnisky K (CEO),

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining Ramon C (CFO), Sheppard C B (COO)

NUMBER OF EMPLOYEES: 69 000 MAJOR ORDINARY SHAREHOLDERS as at 20 Jun 2018 11.40%

Van Eck Assciates Corporation

DIRECTORS: Ashby I (ne), Bastos M (ne), Grote Dr B (snr ind ne, USA), BlackRock, Inc. 9.49%

Nyasulu H (ne), Nyembezi N (ne), Ramatlapeng Dr M (ne), Rutherford J

(ne, UK), Stevens A (ne), Chambers S (Chair, ne), Cutifani M (CEO, Public Investment Corporation of SA 6.29%

Aus), O’Neill A M (Technical), Pearce S (FD) POSTAL ADDRESS: PO Box 62117, Marshalltown, 2107

MAJOR ORDINARY SHAREHOLDERS as at 03 Dec 2018 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ANG

Volcan 19.35% MANAGING SECRETARY: Maria Esperanza Sanz Perez

Public Investment Corporation Group 12.94% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Deutsche Bank AG 5.84% SPONSOR: Standard Bank of SA Ltd.

POSTAL ADDRESS: 20 Carlton House Terrace, London, England, SW1Y AUDITORS: Ernst & Young Inc.

5AN CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AGL ANG Ords 25c ea 600 000 000 414 960 310

COMPANY SECRETARY: John Mills

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Rand Merchant Bank (Pty) Ltd. Ords 25c ea Ldt Pay Amt

AUDITORS: Deloitte & Touche Final No 120 18 Mar 19 8 Apr 19 95.00

Final No 119 19 Mar 18 6 Apr 18 70.00

CAPITAL STRUCTURE AUTHORISED ISSUED

AGL Ords USD 54.945c ea 1 820 000 000 1 383 372 550 LIQUIDITY: Jan20 Ave 8m shares p.w., R1 861.7m(98.8% p.a.)

GLDX 40 Week MA ANGGOLD

DISTRIBUTIONS [USDc]

Ords USD 54.945c ea Ldt Pay Amt 34614

Interim No 35 13 Aug 19 20 Sep 19 62.00

Final No 34 12 Mar 19 3 May 19 51.00 28991

LIQUIDITY: Jan20 Ave 9m shares p.w., R3 200.3m(33.5% p.a.) 23369

MINI 40 Week MA ANGLO

17746

41775

12124

34524

6501

2015 | 2016 | 2017 | 2018 | 2019

27274

FINANCIAL STATISTICS

20023

(USD million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final(rst) Final Final

12773

Gold Rev 1 826 3 943 4 510 4 085 4 015

5522 Wrk Pft 337 772 784 495 337

2015 | 2016 | 2017 | 2018 | 2019

NetIntPd(Rcd) 88 161 154 158 217

FINANCIAL STATISTICS Minority Int 2 17 20 17 15

(USD million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Att Profit 114 133 - 191 63 - 85

Interim Final Final Final Final TotCompIncLoss 120 9 - 17 267 - 433

SalesOfSubsids 14 772 27 610 26 243 21 378 20 455 Ord SH Int 2 748 2 652 2 663 2 715 2 430

Net Tradng Inc 3 348 6 069 5 529 1 666 - 4 112 LT Liab 2 447 2 841 3 297 3 143 3 596

NetIntPd(Rcvd) 192 496 525 229 371 Cap Employed 5 520 5 850 6 364 6 393 6 577

Minority Int 613 824 893 332 - 218 Tangible Assts 3 374 3 381 3 742 4 111 4 058

Att Inc 1 883 3 549 3 166 1 594 - 5 624 Inv & Loans 136 141 131 125 91

93