Page 93 - SHB 2020 Issue 1

P. 93

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – ALE

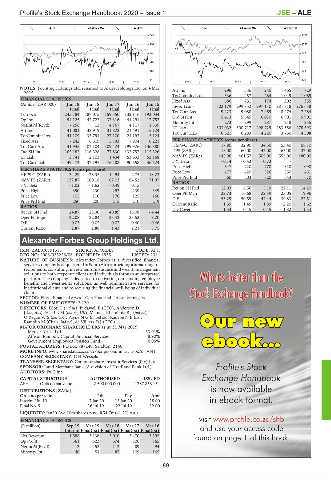

ALSH 40 Week MA ALARIS FINI 40 Week MA AFORBES

340 1168

294 1020

248 873

202 725

156 578

110 430

2015 | 2016 | 2017 | 2018 | 2019 2015 | 2016 | 2017 | 2018 | 2019

NOTES: Poynting Holdings Ltd. renamed to Alaris Holdings Ltd. on 4 May Att Inc 296 336 240 1 465 729

2015.

TotCompIncLoss 336 457 284 1 049 1 069

FINANCIAL STATISTICS Fixed Ass 686 731 174 202 355

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Inv & Loans 302 179 299 852 297 110 281 818 276 638

Final Final Final Final Final

Turnover 245 184 187 075 159 350 132 116 193 034 Tot Curr Ass 9 223 9 088 7 959 8 274 7 284

6 010

5 901

5 413

Ord SH Int

5 645

6 901

Op Inc 54 125 42 722 37 316 44 291 17 752 Minority Int 273 299 287 218 255

NetIntPd(Rcvd) - 256 12 4 167 4 117 1 539

Att Inc 41 081 32 919 31 822 21 491 - 5 124 LT Liab 303 032 300 717 298 729 283 556 278 593

6 283

4 220

Tot Curr Liab

3 760

4 508

6 621

TotCompIncLoss 41 109 35 791 27 100 21 192 - 5 124

Fixed Ass 7 242 6 619 5 793 7 904 6 221 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 141 945 107 104 109 424 199 926 136 880 HEPS-C (ZARc) 17.80 32.90 34.50 53.40 58.10

Ord SH Int 165 182 116 328 77 830 132 757 115 326 DPS (ZARc) 18.00 60.00 42.00 63.00 37.00

LT Liab 3 741 2 103 1 434 53 633 53 168 NAV PS (ZARc) 442.96 461.57 505.00 555.00 480.00

Tot Curr Liab 49 472 37 195 76 488 90 558 36 524 3 Yr Beta - 0.14 - 0.43 0.73 - -

Price High 647 720 770 810 1 090

PER SHARE STATISTICS (cents per share) Price Low 477 420 526 550 451

HEPS-C (ZARc) 34.29 28.35 14.94 2.75 18.23 Price Prd End 560 503 720 643 670

NAV PS (ZARc) 137.87 100.18 67.03 84.52 71.97

3 Yr Beta - 1.02 - 1.62 - 0.49 0.15 - RATIOS 12.03 6.56 5.19 22.11 14.20

Ret on SH Fnd

Price High 350 230 293 239 349

Oper Pft Mgn 22.73 16.68 22.39 23.05 19.96

Price Low 105 110 170 125 160 D:E 53.29 50.59 47.44 39.83 22.51

Price Prd End 250 200 215 210 219 Current Ratio 1.39 1.45 1.89 2.20 1.62

RATIOS Div Cover 1.34 0.45 0.45 1.82 1.54

Ret on SH Fnd 24.87 28.30 40.89 16.08 - 4.44

Oper Pft Mgn 22.08 22.84 23.42 33.52 9.20

D:E 0.03 0.02 0.02 0.40 0.46

Current Ratio 2.87 2.88 1.43 2.21 3.75

Alexander Forbes Group Holdings Ltd.

ALE

ISIN: ZAE000191516 SHORT: AFORBES CODE: AFH

REG NO: 2006/025226/06 FOUNDED: 1935 LISTED: 2014

NATURE OF BUSINESS: Alexander Forbes is a diversified financial

services company headquartered in South Africa providing a broad range of

retirements, consulting, investments, insurance and wealth management

solutions to both corporate clients and individuals through an integrated

platform. The company is dedicated to delivering outstanding employee

benefits and investments solutions, as well administrative services for

institutional clients and to securing the financial well-being of individual

clients.

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

NUMBER OF EMPLOYEES: 3 120

DIRECTORS: Dloti T (ind ne), Bydawell B (CFO), Anderson D

J (ne, Aus), Head R M (ind ne, UK), Memela-Khambula B J (ind ne),

O’Regan W S (ne, UK), Payne N G (ld ind ne), Radebe N B (ne),

Ramplin M (Chair, ind ne), de Villiers D J (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Mercer Africa Ltd. 33.01%

African Rainbow Capital Financial Services 8.90%

Government Employees Pension Fund 6.05%

POSTAL ADDRESS: PO Box 787240, Sandton, 2146

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AFH

COMPANY SECRETARY: C H Wessels

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Profile's Stock

AUDITORS: PwC Inc.

Exchange Handbook

CAPITAL STRUCTURE AUTHORISED ISSUED

AFH Ords no par value 2 500 000 000 1 287 858 154

DISTRIBUTIONS [ZARc] is now available

Ords no par value Ldt Pay Amt

Interim No 10 7 Jan 20 13 Jan 20 18.00 in ebook format.

Final No 9 16 Jul 19 22 Jul 19 12.00

LIQUIDITY: Jan20 Ave 10m shares p.w., R54.7m(41.2% p.a.)

FINANCIAL STATISTICS visit www.profile.co.za/shb

(R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 and use your access code

Interim Final(rst) Final(rst) Final(rst) Final(rst)

Net Revenue 1 588 3 136 3 010 3 470 3 395 found on page 1 of this book.

Op Profit 361 523 674 800 765

NetIntPd(Rcvd) - 12 - 52 - 112 - 89 - 94

Minority Int 46 54 87 109 145

89