Page 102 - SHB 2020 Issue 1

P. 102

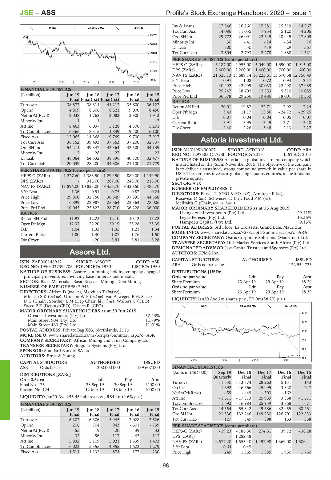

JSE – ASS Profile’s Stock Exchange Handbook: 2020 – Issue 1

Inv & Loans 17 546 16 260 15 581 15 319 14 867

PHAR 40 Week MA ASPEN

Tot Curr Ass 14 086 11 035 7 954 5 120 4 206

43878

Ord SH Int 29 772 26 091 22 649 18 945 17 809

Minority Int 30 - 41 - 24 - 34 16

36489

LT Liab 700 530 419 29 367

Tot Curr Liab 3 604 2 793 2 278 1 888 1 321

29101

PER SHARE STATISTICS (cents per share)

21712

HEPS-C (ZARc) 6 187.00 4 953.00 5 049.00 1 690.00 1 915.00

14324 DPS (ZARc) 2 400.00 2 200.00 1 400.00 700.00 600.00

NAV PS (ZARc) 21 325.13 18 689.14 16 223.61 13 570.58 12 756.49

6935 3 Yr Beta 0.97 1.08 0.72 0.94 2.17

2015 | 2016 | 2017 | 2018 | 2019

Price High 40 492 42 999 30 033 22 490 37 985

FINANCIAL STATISTICS Price Low 25 247 18 702 12 853 5 310 10 085

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Price Prd End 36 678 29 256 19 486 18 001 10 350

Final Final(rst) Final(rst) Final Final RATIOS

Turnover 38 872 38 314 41 213 35 600 36 127

Ret on SH Fnd 20.01 19.87 22.71 7.92 7.24

Op Inc 4 809 8 506 8 321 9 000 8 450 Oper Pft Mgn 3.43 11.17 15.86 - 24.72 - 29.25

NetIntPd(Rcvd) 2 038 1 762 2 082 2 900 1 912 D:E 0.07 0.04 0.04 0.05 0.07

Minority Int 1 1 - - - 2 Current Ratio 3.91 3.95 3.49 2.71 3.18

Att Inc 6 463 6 037 5 128 4 300 5 201 Div Cover 2.40 2.26 3.48 2.13 2.27

TotCompIncLoss 6 366 8 315 1 839 9 400 6 100

Fixed Ass 12 065 11 368 9 749 9 700 7 917

Tot Curr Ass 36 152 39 493 37 363 37 200 32 737 Astoria Investment Ltd.

AST

Ord SH Int 54 211 49 347 42 364 42 500 34 139 ISIN: MU0499N00007 SHORT: ASTORIA CODE: ARA

Minority Int 2 28 27 - 23 REG NO: 1297585 C1/GBL FOUNDED: 2015 LISTED: 2015

LT Liab 48 064 54 532 38 396 40 700 32 477 NATURE OF BUSINESS: Astoria is a global investment company which

Tot Curr Liab 20 039 28 200 34 806 21 100 21 779 inward listed on the JSE in November 2015. The objective of the company

PER SHARE STATISTICS (cents per share) is to deliver a sustained, strong compound growth in value per share in

HEPS-C (ZARc) 1 227.60 1 383.50 1 299.50 889.00 1 149.90 USD. The company invests in global, high quality equities, niche funds and

private equity.

DPS (ZARc) - 315.00 287.00 248.00 216.00 SECTOR: AltX

NAV PS (ZARc) 11 894.00 10 823.00 9 453.70 9 320.50 7 485.70 NUMBER OF EMPLOYEES: 0

3 Yr Beta 1.36 0.91 0.75 0.87 0.24 DIRECTORS: Purves T (CEO & FD, UK), Armitage P (ne),

Price High 29 800 32 750 38 849 37 895 44 868 Rosevear D (alt), Schweizer D (ne), Todd P M (ne),

Price Low 6 899 22 987 25 564 23 364 28 006 McIlraith C (Chair, ind ne, Mau)

Price Prd End 10 045 25 822 28 710 36 228 36 000 MAJOR ORDINARY SHAREHOLDERS as at 15 Aug 2019

RATIOS Livingstone Investments (Pty) Ltd. 29.41%

Ret on SH Fnd 11.92 12.23 12.10 10.12 15.22 Legae Peresec (Pty) Ltd. 15.36%

Oper Pft Mgn 12.37 22.20 20.19 25.28 23.39 Hampden Capital (Pty) Ltd. 9.15%

D:E 1.04 1.33 1.35 1.21 1.34 POSTAL ADDRESS: 3rd Floor, La Croisette, Grand Baie, Mauritius

Current Ratio 1.80 1.40 1.07 1.76 1.50 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ARA

COMPANY SECRETARY: Osiris Corporate Solutions (Mauritius) Ltd.

Div Cover - 4.20 3.91 3.81 5.28

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Assore Ltd. AUDITORS: KPMG Inc.

ASS CAPITAL STRUCTURE AUTHORISED ISSUED

ISIN: ZAE000146932 SHORT: ASSORE CODE: ASR

REG NO: 1950/037394/06 FOUNDED: 1950 LISTED: 1950 ARA Ords no par value - 122 954 726

NATURE OF BUSINESS: Assore is a mining holding company engaged DISTRIBUTIONS [USDc]

principally in ventures involving base minerals and metals. Ords no par value Ldt Pay Amt

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining Share Premium 23 Apr 19 29 Apr 19 88.39

NUMBER OF EMPLOYEES: 2 946 Ords no par value Ldt Pay Amt

DIRECTORS: Aitken D (ind ne), Mgoduso T (ind ne), Share Premium 23 Apr 19 29 Apr 19 88.39

Mhlarhi S K (ind ne), Urmson W F (ind ne), van Aswegen B H, Sacco

D G (Chair), Southey E M (Dep Chair, ld ind ne), Walters C (CEO), LIQUIDITY: Jan20 Ave 2m shares p.w., R7.9m(88.2% p.a.)

Sacco P E (Deputy CEO), Davies R (CFO) GENF 40 Week MA ASTORIA

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 1799

Oresteel Investments (Pty) Ltd. 52.43%

Main Street 904 (Pty) Ltd. 11.79% 1470

Main Street 460 (Pty) Ltd. 11.01%

POSTAL ADDRESS: Private Bag X03, Northlands, 2116 1141

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ASR

COMPANY SECRETARY: African Mining and Trust Company Ltd. 813

TRANSFER SECRETARY: Singular Systems (Pty) Ltd.

484

SPONSOR: Standard Bank of SA Ltd.

AUDITORS: Ernst & Young

| 2016 | 2017 | 2018 | 2019 155

CAPITAL STRUCTURE AUTHORISED ISSUED

ASR Ords 0.5c ea 200 000 000 139 607 000 FINANCIAL STATISTICS

(Amts in USD’000) Sep 19 Dec 18 Dec 17 Dec 16 Dec 15

DISTRIBUTIONS [ZARc] Quarterly Final Final Final Final

Ords 0.5c ea Ldt Pay Amt

Final No 125 23 Sep 19 30 Sep 19 1400.00 Turnover - 1 530 - 13 874 28 263 5 131 143

Interim No 124 12 Mar 19 18 Mar 19 1000.00 Op Inc - 1 692 - 16 666 25 995 3 320 - 217

NetIntPd(Rcvd) - 59 - 449 - 303 - 162 -

LIQUIDITY: Jan20 Ave 256 464 shares p.w., R84.4m(9.6% p.a.) Att Inc - 1 611 - 17 313 25 939 3 868 - 1 671

FINANCIAL STATISTICS TotCompIncLoss - 1 692 - 16 984 25 939 3 868 - 1 671

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Tot Curr Ass 14 554 55 342 19 686 32 955 88 461

Final Final Final Final Final Ord SH Int 21 336 132 246 149 230 126 701 122 833

Turnover 6 302 6 306 5 945 2 028 2 526 Tot Curr Liab 127 349 398 163 358

Op Inc 216 704 943 - 501 - 739 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 55 19 20 39 33 HEPS-C (ZARc) - 19.23 - 186.56 274.51 39.72 - 38.28

Minority Int 32 56 117 - 42 - 113 DPS (ZARc) - 1 282.48 - - -

Att Inc 5 932 5 119 5 021 1 539 1 403 NAV PS (ZARc) 2 577.20 1 553.40 1 497.98 1 369.00 1 506.41

TotCompIncLoss 6 023 5 355 4 955 1 623 1 279 3 Yr Beta - 0.64 0.45 - - -

Fixed Ass 1 511 1 133 874 177 230 Price High 249 1 365 1 385 1 950 1 750

98