Page 94 - SHB 2020 Issue 1

P. 94

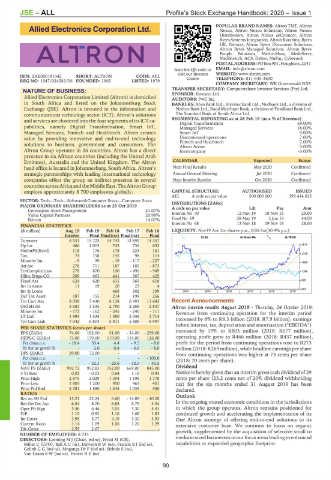

JSE – ALL Profile’s Stock Exchange Handbook: 2020 – Issue 1

POPULAR BRAND NAMES: Altron TMT, Altron

Allied Electronics Corporation Ltd. Nexus, Altron Nexus Solutions, Altron Nexus

Distributors, Altron Nexus @Connect, Altron

ALL

Bytes Systems Integration, Altron Karabina, Bytes

UK, Netstar, Altron Bytes Document Solutions,

Altron Bytes Managed Solutions, Altron Bytes

People Solutions, Med-e-Mass, MedeServe,

MediSwitch, ACS, Delter, NuPay, Cybertech

POSTAL ADDRESS: PO Box 981, Houghton, 2041

Scan the QR code to EMAIL: info@altron.com

visit our Investor WEBSITE: www.altron.com

ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL Centre TELE PHONE: 011-645-3600

REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979

COMPANY SECRETARY: WK Groenewald FCIS

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NATURE OF BUSINESS: SPONSOR: Investec Ltd.

Allied Elec tron ics Cor po ra tion Limited (Altron) is domiciled AUDITORS: PwC Inc.

in South Africa and listed on the Johannesburg Stock BANKERS: Absa Bank Ltd., Investec Bank Ltd., Nedbank Ltd., a division of

Exchange (JSE). Altron is invested in the in for ma tion and Nedcor Bank Ltd., Rand Merchant Bank, a division of FirstRand Bank Ltd.,

com mu ni ca tions tech nol ogy sector (ICT). Altron’s solutions The Standard Bank of South Africa Ltd.

and services are clustered into the four segments of its ICT ca - SEGMENTAL REPORTING as at 28 Feb 19 (as a % of Revenue)

59.00%

Digital Transformation

pa bil i ties, namely Digital Trans for ma tion, Smart IoT, Managed Services 18.00%

Managed Services, Fintech and Healthtech. Altron creates Smart IoT 9.00%

value by providing innovative and end-to-end technology Discontinued operations 7.00%

solutions to business, gov ernment and consumers. The Fintech and Healthtech 7.00%

3.00%

Altron Arrow

Altron Group operates in 26 countries. Altron has a direct Intercompany -3.00%

presence in six African countries (including the United Arab

Emirates), Australia and the United Kingdom. The Altron CALENDAR Expected Status

head office is located in Jo han nes burg, South Africa. Altron’s Next Final Results May 2020 Con firmed

strategic part ner ships with leading in ter na tional tech nol ogy Annual General Meeting Jul 2020 Con firmed

companies offers the group an indirect presence in several Next Interim Results Oct 2020 Con firmed

countries across Africa and the Middle East. The Altron Group

employs approximately 8 700 employees globally. CAPITAL STRUCTURE AUTHORISED ISSUED

AEL A ords no par value 500 000 000 399 414 023

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs

MAJOR ORDINARY SHAREHOLDERS as at 25 Oct 2019 DISTRIBUTIONS [ZARc]

Coronation Asset Management 21.07% A ords no par value Ldt Pay Amt

Value Capital Partners 20.98% Interim No 70 12 Nov 19 18 Nov 19 29.00

Biltron 14.07% Final No 69 28 May 19 3 Jun 19 44.00

Interim No 68 13 Nov 18 19 Nov 18 28.00

FINANCIAL STATISTICS

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 LIQUIDITY: Nov19 Ave 2m shares p.w., R50.7m(30.4% p.a.)

Interim Final Final(rst) Final(rst) Final

ELEE 40 Week MA ALTRON

Turnover 8 531 15 723 14 743 13 892 14 357

Op Inc 466 1 015 745 736 633 2810

NetIntPd(Rcvd) 118 176 178 223 161

Tax 74 158 145 98 114 2339

Minority Int - 9 39 - 19 - 117 - 227 1869

Att Inc 276 711 187 - 185 - 873

TotCompIncLoss 278 870 100 - 496 - 949 1398

Hline Erngs-CO 269 663 441 387 425

Fixed Ass 624 620 615 569 618 928

Inv in Assoc 11 19 20 23 4

Inv & Loans - - 468 302 199 2014 | 2015 | 2016 | 2017 | 2018 | 2019 457

Def Tax Asset 187 155 214 198 256

Tot Curr Ass 8 059 7 430 6 138 6 991 11 643 Recent Announcements

Ord SH Int 3 683 3 535 2 790 2 268 2 847 Altron interim results August 2019 - Thursday, 24 October 2019:

Minority Int - 172 - 162 - 245 - 240 - 111 Revenue from continuing operation for the interim period

LT Liab 1 993 1 424 1 580 2 048 2 714

Tot Curr Liab 7 042 6 804 5 811 5 808 8 997 increased by 8% to R8.5 billion (2018: R7.9 billion), earnings

before interest, tax, de pre ci a tion and am or ti sa tion (“EBITDA”)

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 74.00 192.00 51.00 - 54.00 - 259.00 increased by 19% to R803 million (2018: R677 million),

HEPS-C (ZARc) 73.00 179.00 119.00 114.00 126.00 operating profit grew to R466 million (2018: R437 million),

Pct chng p.a. - 18.4 50.4 4.4 - 9.5 - 8.0 profit for the period from con tin u ing op er a tions rose to R273

Tr 5yr av grwth % - 2.0 0.4 - 6.6 - 8.0 million (2018: R269 million), while headline earnings per share

DPS (ZARc) 29.00 72.00 - - - from con tin u ing op er a tions was higher at 73 cents per share

Pct chng p.a. - - - - - 100.0 (2018: 70 cents per share).

Tr 5yr av grwth % - - 32.3 - 25.6 - 32.5 - 35.5

NAV PS (ZARc) 992.72 952.83 752.00 669.00 845.00 Dividend

3 Yr Beta 0.02 - 0.03 0.64 1.16 0.93 Notice is hereby given that an interim gross cash dividend of 29

Price High 2 875 2 029 1 394 1 198 1 778 cents per share (23.2 cents net of 20% dividend with hold ing

Price Low 1 803 1 200 950 463 401 tax) for the six months ended 31 August 2019 has been

Price Prd End 2 381 1 880 1 245 1 035 550 declared.

RATIOS Outlook

Ret on SH Fnd 15.21 22.24 6.60 - 14.89 - 40.20

Ret On Tot Ass 6.54 8.70 6.85 5.79 3.54 In the ongoing muted economic con di tions in the ju ris dic tions

Oper Pft Mgn 5.46 6.46 5.05 5.30 4.41 in which the group operates, Altron remains positioned for

D:E 1.10 0.92 1.16 1.68 1.83 continued growth and ac cel er at ing the im ple men ta tion of its

Int Cover 3.95 5.77 4.19 3.30 3.93 One Altron strategy of offering end-to-end solutions to its

Current Ratio 1.14 1.09 1.06 1.20 1.29 extensive customer base. We continue to focus on organic

Div Cover 2.55 2.67 - - -

NUMBER OF EMPLOYEES: 8 733 growth, sup ple mented by the ac qui si tion of selective small to

DIRECTORS: Leeming M J (Chair, ind ne), Nyati M (CE), medium sized busi nesses in our focus areas leading to enhanced

Miller C (CFO), Ball A C (ne), Dawson B W (ne), Francis B J (ind ne), ca pa bil i ties or expanded geographic footprint.

Gelink G G (ind ne), Mnganga Dr P (ind ne), Sithole S (ne),

Van Graan S W (ind ne), Venter R E (ne)

90